If the Ethereum price does this, it's out of here

- Ethereum price has rallied 35% in just a few days.

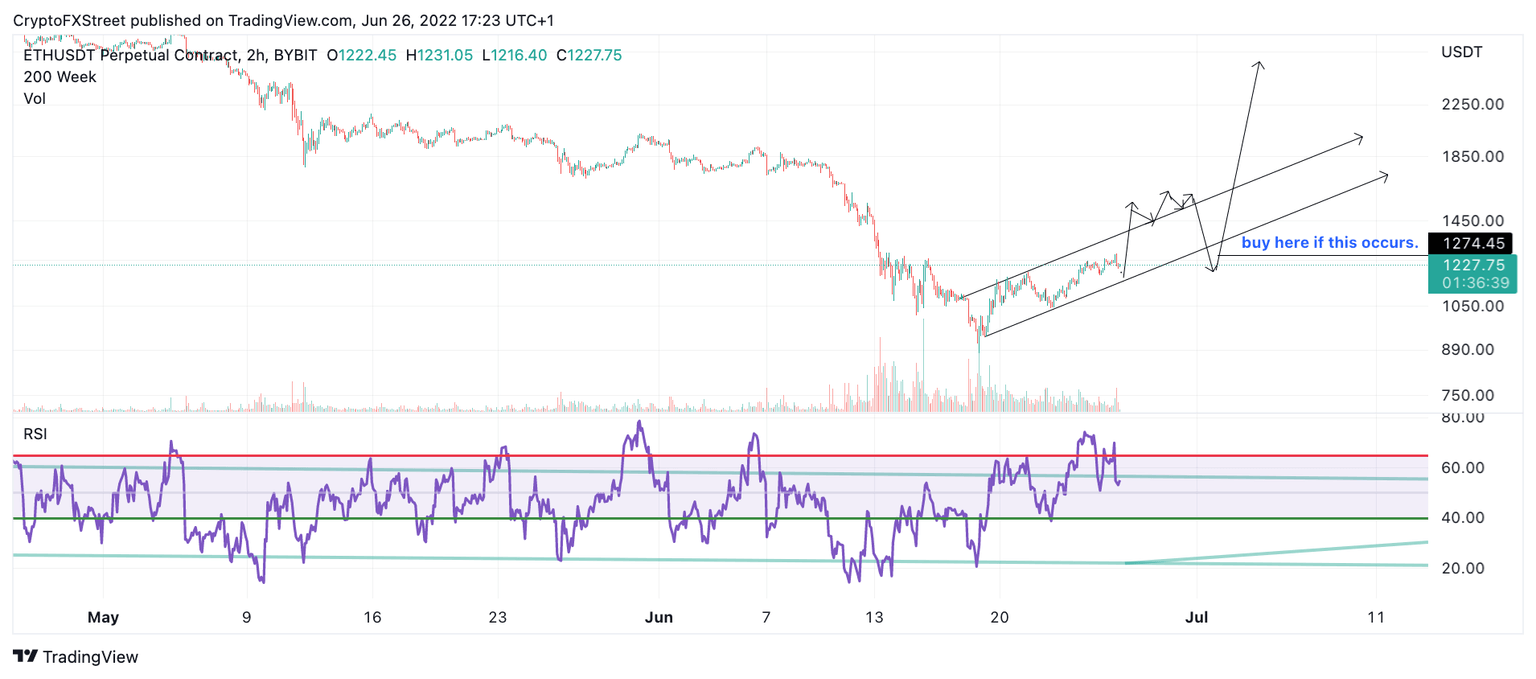

- Ethereum price has printed two impulse waves subtly confined within a parallel channel.

- Invalidation of the bullish thesis is a breach below the June 18 swing low at $877.80 with contingencies. (read below)

Ethereum price could become a very favorable digital asset for day traders in the coming days. Still, the final confirmation for more upside potential has not yet occurred.

Ethereum price could get explosive

Ethereum price shows bullish signals forecasting a recovery rally towards $2,500 for the summer. The bulls have been rallying all weekend as the smart contract token has risen 35% since the unexpected sell-off that occurred on June 18. The Ethereum price is now believed to have hurdled 80% of stage 1 of the summertime bull-run everyone is hoping for.

Ethereum price currently trades at $1,223 as the bulls have produced two impulsive waves confined within a parallel channel. If the bull market is genuine, an additional spike above the trend channel's upper bounds could create the final wave with targets between $1,400 and $1,750. When the rally loses momentum, a three-wave pullback will occur, re-routing towards targets between $1,400 and $1,200.

ETH/USDT Perpetual Contract 2-Hour Chart

Invalidation of the bullish idea is a breach below $877.80 with one caveat. Investors must allow the current rally to finish and witness a three-wave pullback before placing an entry. If the technicals unfold in this manner, investors will have plenty of opportunities to join the uptrend move targeting $2,000 and possibly $2,500, resulting in a 100% increase from the current Ethereum price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.