If buyers do not defend this level, Dogecoin price could crash 20%

- Dogecoin price has undone its 18% rally seen this week as markets sell-off.

- DOGE is facing a make-or-break momentum at the $0.072 support level.

- Investors should be aware of a potential 20% crash that could sweep the liquidity resting below $0.057.

Dogecoin price has undone its gains that were accrued earlier this week This development comes as the crypto markets undergo a massive sell-off with Bitcoin at its helm. As a result, DOGE has arrived at a stable support level, where buyers could choose to defend the level and trigger an uptrend, but the likelihood of this outlook is not guaranteed.

Dogecoin price at inflection point

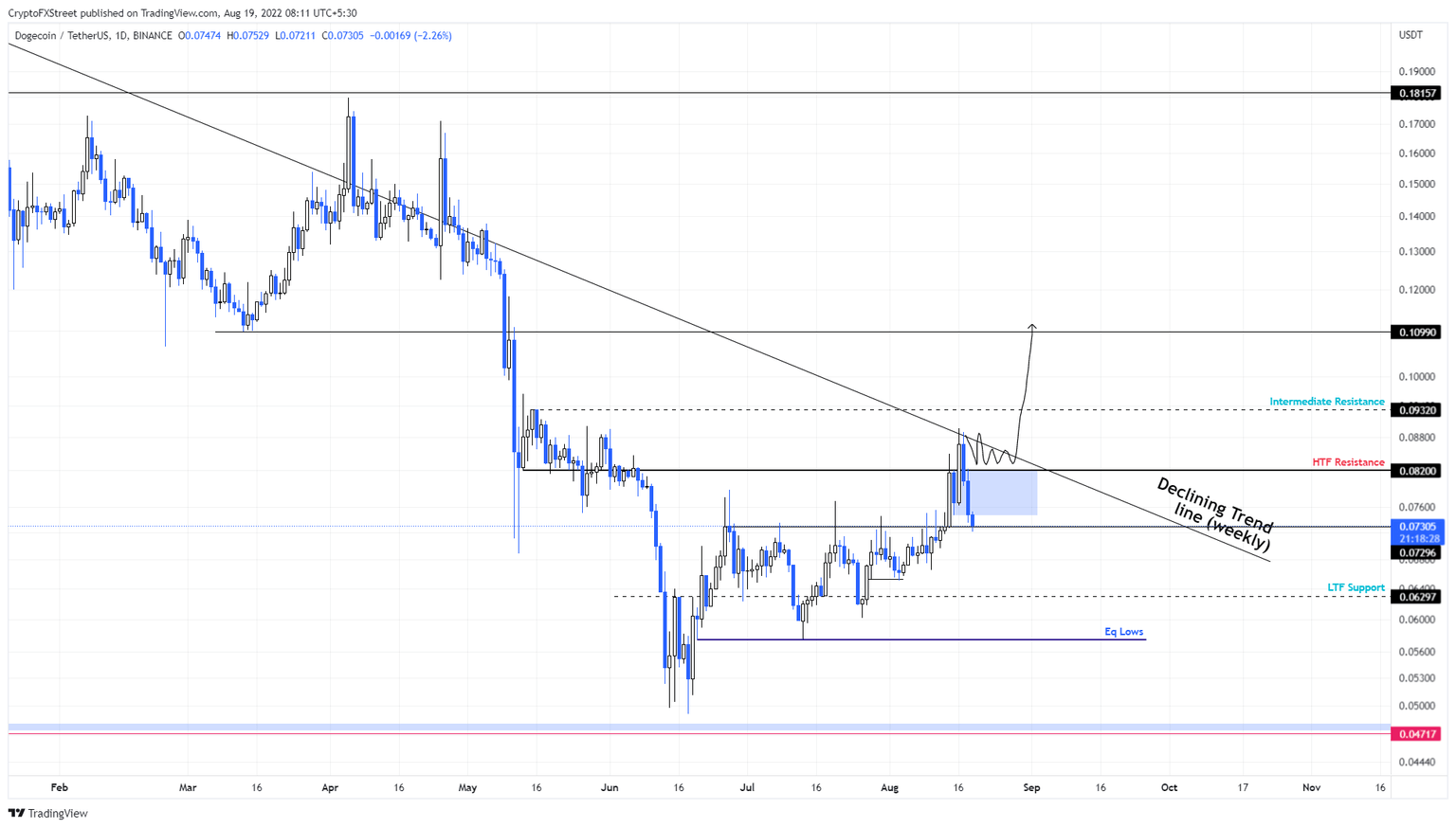

Dogecoin price saw a sudden spike in buying pressure, resulting in a 12% rally on August 12. This move contended with a declining trend line serving as a resistance level for more than 400 days.

The obvious reaction was a rejection that has pushed DOGE to undo its 12% gains. As a result of this correction, Dogecoin price is currently retesting the $0.072 support level. As explained previously, this area will serve as a good level for buyers that missed the previous rally.

However, these investors need to factor in that the ongoing market crash will take a beat. In such a case, DOGE is likely to produce at least a 12% upswing that retests the $0.082 hurdle. Due to the current market conditions, a rejection here could lead to a swift breakdown of the $0.072 support floor and a revisit of the $0.062 barrier.

The best case scenario, for long-term buyers or swing traders, would include a sweep of the equal lows formed at $0.057. This liquidity run is likely to trigger a shift in the trend that will allow investors to ride a quick run-up to either $0.062 or $0.072, in a highly bullish case.

DOGE/USDT 1-day chart

While a downtrend seems more than likely for Dogecoin price, there are opportunities to short the market if the $0.072 support floor breaks. Although unlikely, a daily candlestick close above $0.093 would invalidate the bearish thesis as it does not just break out from the 400+ day declining trend but also flip significant hurdles in the process.

In such a case, investors could expect DOGE to ascend higher and retest the $0.109 hurdle.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.