How will the upcoming Ethereum Merge affect linked tokens?

After long years of preparation, Ethereum will soon become a token operating fully on the Proof-of-stake (PoS) blockchain. So far, no delays are expected for the Merge, which is scheduled for 19 September. In addition to ETH, many other tokens are gaining in utility and price through the upcoming transition, which will enable them to be more widely and quickly adopted.

Ethereum's plan is to replace ETH miners with validators, a kind of 'node' of the proof-of-stake system. They will be responsible for storing data, processing transactions and adding more chain blocks. Each validator is expected to hold a min. 32 ETH - at the current price, this is approximately $60600.

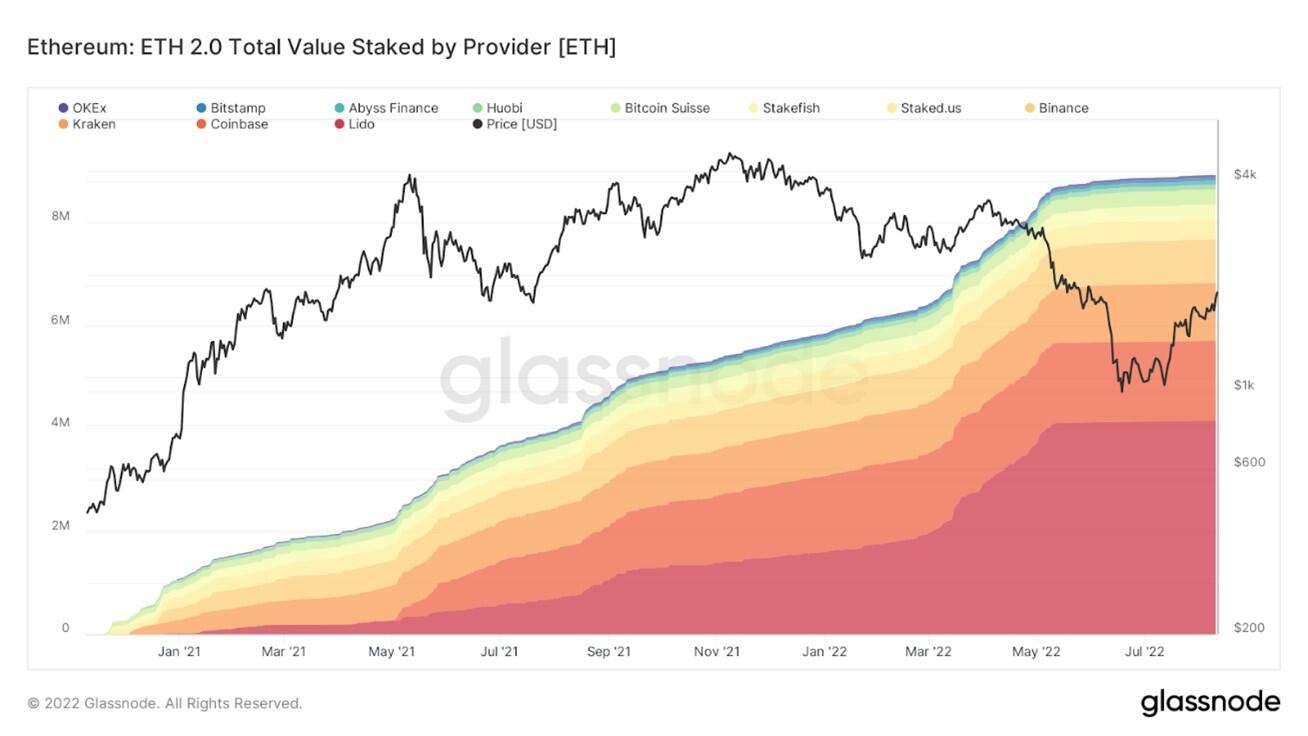

An important part of this network is to be the Lido DAO, which is the main project offering staking services within Merge. So far, Lido has funded ETH 2.0 with approximately 4.15 million ETH. Since the local bottom on 18 June 2022. LDO has gained almost 530%.

Accounting for almost half of the staking on ETH, the Lido is an important part of the chain with great growth potential if the trend in this service adoption continues. However, currently after surging 500%, the price may be too high, and a great deal of caution is advised for bulls.

Despite the transformation, Ethereum Classic (ETC) is still an important part of the crypto scene. The token was created as a result of a split of the Ethereum blockchain in 2016 and has most of the functionality of the current ETH, but is slower in handling transfers and less flexible in creating DApps. However, it still plays a significant role and is considered by traditionalists to be a combination of the best features of Bitcoin and ETH.

The token, through its reliance on mining, provides a natural refuge for miners who will be excluded by the Ethereum blockchain change. This is probably why it has gained more than 215% in recent weeks since its local low on 14 July.

The influx of miners is bound to have an impact on the increased supply of ETC in short to medium term, which typically drives the price down. However, with a maximum of 210.7 million coins to be mined, ETC is deflationary in nature, and the market seems to be pricing that increased mining will translate into a faster increase in the token's price due to limited future supply. ETC, like BTC, has mainly been used as a store of value.

Merge will have an impact on the entire crypto world. It surpasses the ETH split of 2016 by its scale and points to new areas such as proof-of-stake, energy efficiency and lower commissions. The transformation in addition to the above-mentioned LDO, ETC affects most ETH-related projects giving some new significance.

Author

Daniel Kostecki

Conotoxia

Daniel Kostecki is a graduate of Economics at the University of Szczecin in Poland. Privately connected to the financial markets since 2007 and professionally since 2010.