How to trade Polkadot price and yield 60% returns

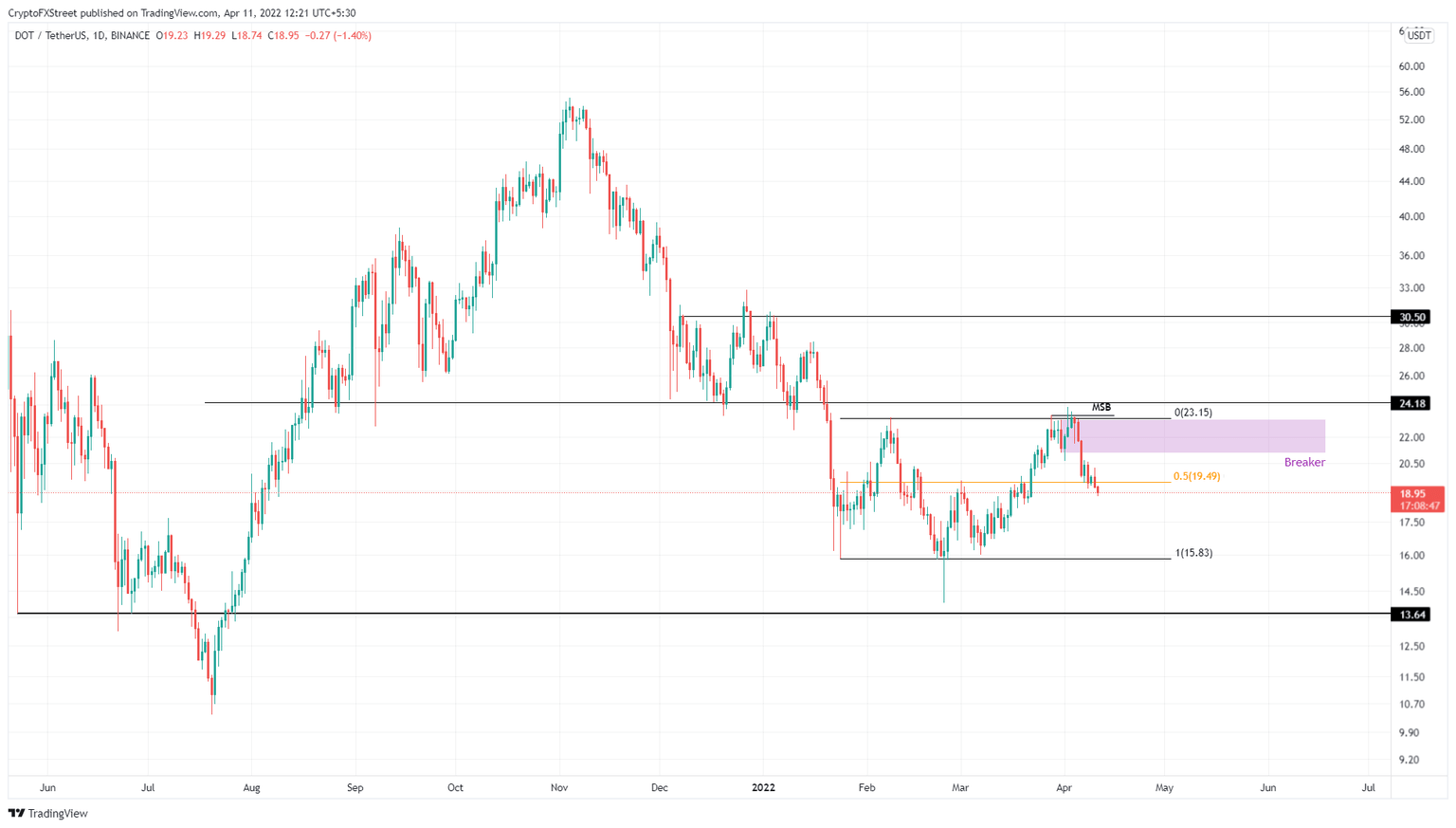

- Polkadot price is stuck in a range with its upside limited by three major hurdles.

- These significant resistance barriers extend from $21.08 to $24.18 with the last one at $30.50.

- A daily candlestick close below $15.83 will invalidate the bullish thesis for DOT.

Polkadot price has been ranging for more than two months. The recent uptrend provided bulls with an opportunity to overcome vital blockades and establish a stable support level. However, due to the buyers’ failures, these hurdles have multiplied.

Polkadot price faces an uphill battle

Polkadot price set a swing low at $15.83 on January 24 and rallied 46% to create a swing high at $23.19. This run-up became the range that DOT has stayed within since then. Despite the consolidation that has extended for more than two months, the altcoin has not managed to escape the range.

On April 2, Polkadot price wicked above the range high at $23.19, but closed below it, suggesting a lack of buying pressure. As a result, DOT has crashed 20% to where it currently trades - $18.88.

Moreover, DOT flipped a $21.08 to $23.06 demand zone formed on March 31 into a bearish breaker. According to this formation, a retest of the breaker after a down move is often rejected violently. Therefore, investors need to wait until DOT produces daily candlestick close above $23.06 to accumulate.

Doing so will push the altcoin back into another range, which extends from $24.18 to $30.50. Therefore, the upside for DOT is limited to $30.50, indicating a 60% upswing possibility.

DOT/USDT 1-day chart

While things are looking up for Polkadot price, a breakdown of the range low at $15.83 will create a lower low and invalidate the bullish thesis. In such a case, sidelined buyers could wait for a retest of $13.64 to reaccumulate.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.