Overview

The US Fed delivered another 25bps rate cut on Wednesday, in-line with Street expectations. The knee-jerk reactions from the equity markets and the FX markets were muted, as the cut were pretty much already priced in. While the outlook of the future rate policy was mixed for now, how could the potential changes in macro policy setting alter capital flows and the possible impact on the cryptocurrency markets? Meanwhile, the prices of bitcoin dipped to below the 10,000 psychological levels on Thursday trading, at the same time, the discussions of the beginning of the “altcoin season” has been heating up, how traders and investors set the priority between bitcoin and altcoins?

Party’s Over…For Now

The US Federal Reserve has made the biggest news headline this week in the markets, as the policymakers slashed the interest rates by a quarter of a percentage point for the second time this year. While this was a widely expected move, markets were being skeptical about the Fed’s next move. Chairman Jerome Powell said “moderate” policy moves should be able to maintain the US expansion and stressed that the cut is a step to help the US economy strong. However, Powell also said, “weakness in global growth and trade policy have weighed on the economy.” The yes-and-no answer leaves the markets not much of a clue for the FOMC’s next move.

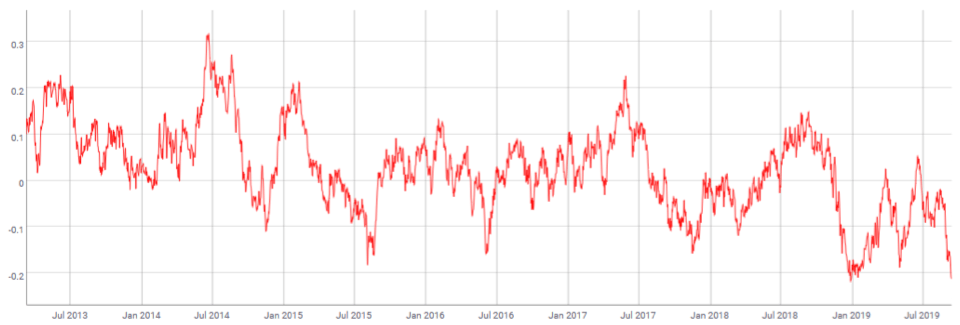

Figure 1: FOMC Participants’ Assessments of Appropriate Monetary Policy

Source: Bloomberg

The Fed certainly has the tools and rooms for policy maneuver in the future, the question is whether the Fed will and when to fire the shot. The latest dot plot (figure 1) shows that seven FOMC members expected one more cut this year, and five considered keep the rates unchanged, and another five supported the interest rates should go up. This means the FOMC members are extremely divided on how the interest rates should go.

In a note to clients, Calvin Tse, Head of North American G10 FX Strategy at Citigroup, said that “With the median dot in 2020 showing no change and hikes for 2021 and 2022, the Fed has softly signaled that this may be the end of their easing, and remained bullish on the dollar.”

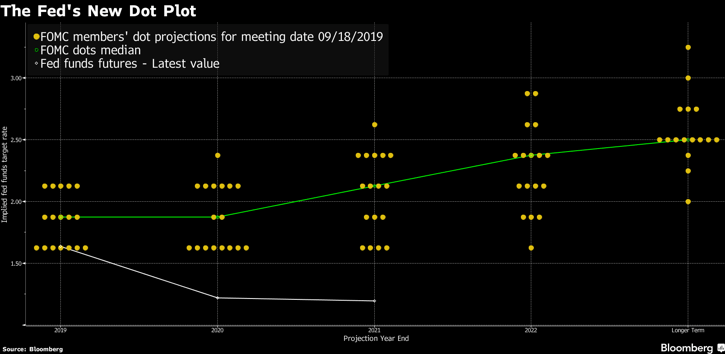

Figure 2: Citi Economic Surprise Index (US)

Source: Citi Economics

One of the gauges that paint a rosy US growth picture is the Citi Economic Surprise Index (figure 2), which tracks how the economic data have been progressing relative to the consensus forecasts of market economists. A positive reading of the Index indicates that economic data have been better than Street consensus. The Index just popped up into the positive region in September and it seems developing a trend to go further up. No wonder why the Fed seems has no urgency to cut the rates further.

Implications on Crypto

Changes in interest rates may not bring a direct impact to the cryptocurrency markets, but it certainly will alter the global capital flows, and this shift could potentially affect the crypto market in a macro way.

If we build on a dollar bull case, a strong dollar may not be the best for bitcoin. The dollar index generally had a negative correlation with bitcoin prices (figure 3), which means the DXY goes up, the prices of bitcoin goes down. This negative correlation currently at the highest level in nearly six years.

Figure 3: BTC-DXY 90-Day Correlation Since Late 2012

Source: Coinmetrics.io

While it seems too early to make any 2022 bitcoin prices forecast, the changes in global capital flows undoubtedly is something that HODL investors should put under their radar.

Bitcoin or Altcoin?

While the prices of bitcoin may be affected by the global capital flows over the long term, many investors have been asking whether if they should increase their altcoin exposure. The fact that altcoin has been gaining more attention in recent weeks, as the prices of major altcoins have surged dramatically, comments about the beginning of a new “altcoin season” have emerged throughout the internet.

We believe bitcoin should remain as the primary focus despite the continuation of the consolidation. When you look at the weekly chart of some of the major altcoins (figure 3), it’s not hard to discover that they were still in a downtrend and far away from a real trend reversal.

Figure 4: ETH/LTC/EOS USDT Weekly Chart

Source: OKEx; Tradingview

However, for day traders, altcoins could provide more short-term chances as they usually have greater volatility while bitcoin has been trading sideways. Overall, the altcoin rally is short-lived and could be mainly driven by the recent sluggish price actions of bitcoin, once market focus return to bitcoin, altcoins could face a new round of selling pressure. Though, a diversified portfolio could capture the best of both worlds.

This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involves significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

Recommended Content

Editors’ Picks

Crypto Today: Bitcoin is less than 10% away from all-time high as Ethereum ETF approval anticipation brews

Bitcoin trades around $68,000 early on Monday, less than 10% away from its all-time high of $73,777 on Binance. Ethereum ETF anticipation brews among traders and Ether investment products see inflow of over $45 million in the past week.

Ripple lawsuit settlement likely soon, says Brad Garlinghouse, XRP hovers around $0.60

Ripple (XRP) trades around a key psychological level of $0.60, early on Monday. The altcoin recently made headlines for its highest weekly gain of 2024, over 40%. XRP sustained nearly 21% of the gains from the last seven days.

Solana could cross $200 if these three conditions are met

Solana’s total value locked climbs 18% in July to $5.38 billion, as seen on DeFiLlama. Solana sustains over 20% gains in the past seven days, corrects nearly 3% on Monday. Active addresses and new address count in the Solana network have increased throughout July.

ALT, WLD, ENA, ID set for $200 million token unlocks next week

The crypto market is set to experience another wave of token unlocks next week, with Altlayer (ALT), Worldcoin (WLD), Ethena (ENA), and Space ID (ID) set for a combined token unlock worth about $200 million.

Bitcoin: Will BTC continue its bullish momentum?

Bitcoin (BTC) price increased by 5.5% this week until Friday after breaking above a descending trendline. Currently, it is trading slightly higher by 0.23% at $64,166.

-637048278207596424.png)