How to approach the fourth Bitcoin halving as an investor - all you need to know

- Investors are bracing for a potential rally as the fourth Bitcoin halving is less than 32 hours away.

- Bitcoin's recent dip may be a good buying opportunity to participate in the potential upside from the halving.

- Investors must exercise caution, considering Middle East crisis tension, historical price trends and new market players.

Bitcoin's (BTC) recent dip presents an opportunity for investors to buy the dip as the fourth Bitcoin halving will occur tomorrow. However, investors must exercise amid tension in the Middle East, historical price movement and new market players.

Also read: Bitcoin halving is a few days away. Here's what key crypto community members are saying

Investors should buy the dip

Bitcoin is about to witness its fourth halving event in less than 32 hours. After months of anticipation, Bitcoin's block reward will drop from 6.25 BTC to 3.125 BTC. As the largest cryptocurrency becomes scarce, investors are expecting its price to rally to new highs, similar to previous halving events. While Bitcoin halving events don't always lead to a quick price rise, they have propelled the digital currency to record impressive gains in the long term.

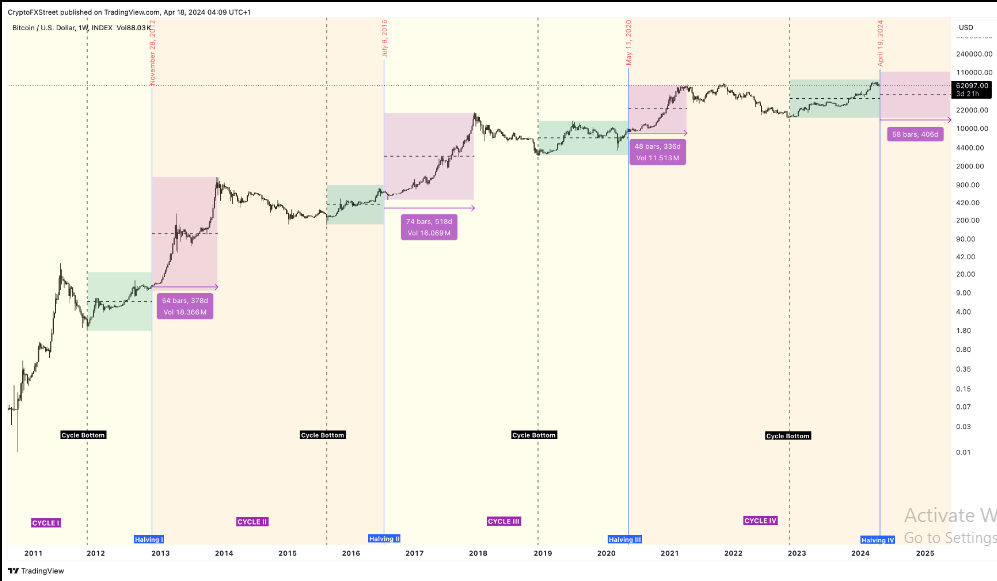

The chart below shows how BTC has always rallied to new all-time highs (ATH) on average 410 days after each halving event. While historical data doesn't guarantee future price movements, the recent market dip presents a good buying opportunity to build a stake in Bitcoin. Investors may consider buying the current dip or employ dollar cost averaging to yield maximum interest.

BTC/USDT 1-week chart

Read more: With Bitcoin miners bracing for effect of fourth halving, here's what to expect

Bitcoin’s rise to a new ATH faces hurdles

Although the long-term outlook for Bitcoin is bullish, investors must exercise caution as a series of factors make its short-term prospects "remain unclear and could potentially trigger a crash," says FXStreet analyst Akash Girimath.

There's a strong inverse correlation between Bitcoin and the US Dollar Index, which has gained strength following tension in the Middle East after Iran launched drone strikes on Israel. If a crisis persists, Bitcoin could take a hit and crash to cover the weekly inefficiency, extending from $59,111 to $53,120, emphasized Akash.

Additionally, price movements in the current bull run bring back echoes of the 2021 cycle. The rally of late 2020 into the first four months of 2021 saw BTC forming an all-time high of around $65,000 in April 2021 before a market correction that dropped its price to about $30,000. BTC peaked in late Q3 into Q4 2021 to set a new ATH at $69,000.

Also read: Why crypto may see a recovery right before or shortly after Bitcoin halving

BTC/USDT Perpetual Contract 1-week chart

Bitcoin has exhibited similar price movements in the past five months. This scenario could see BTC crash beyond $60,000 and potentially dip to $45,000 to cover inefficiencies. After that, BTC could begin another fresh rally to set up a new ATH. This is typical of previous halving events, where Bitcoin would lag a few months post-halving before gaining momentum.

However, it's important to note that new key market players - Bitcoin ETF issuers and retailers - could alter BTC's market dynamics. Bitcoin reached its all-time high before halving for the first time this year. The move, propelled by the launch of Bitcoin ETFs, has seen Glassnode analysts predicting that the halving effect is already priced in. Although some crypto community members said it would rather multiply the effect of the fourth Bitcoin halving.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi