How these supply walls are preventing Algorand from moving higher

- Algorand price has hit a wall at the $0.93 value area.

- A major resistance level in the 2022 Volume Profile prevents further upside movement.

- Trade opportunities on the long and short sides of the market have developed.

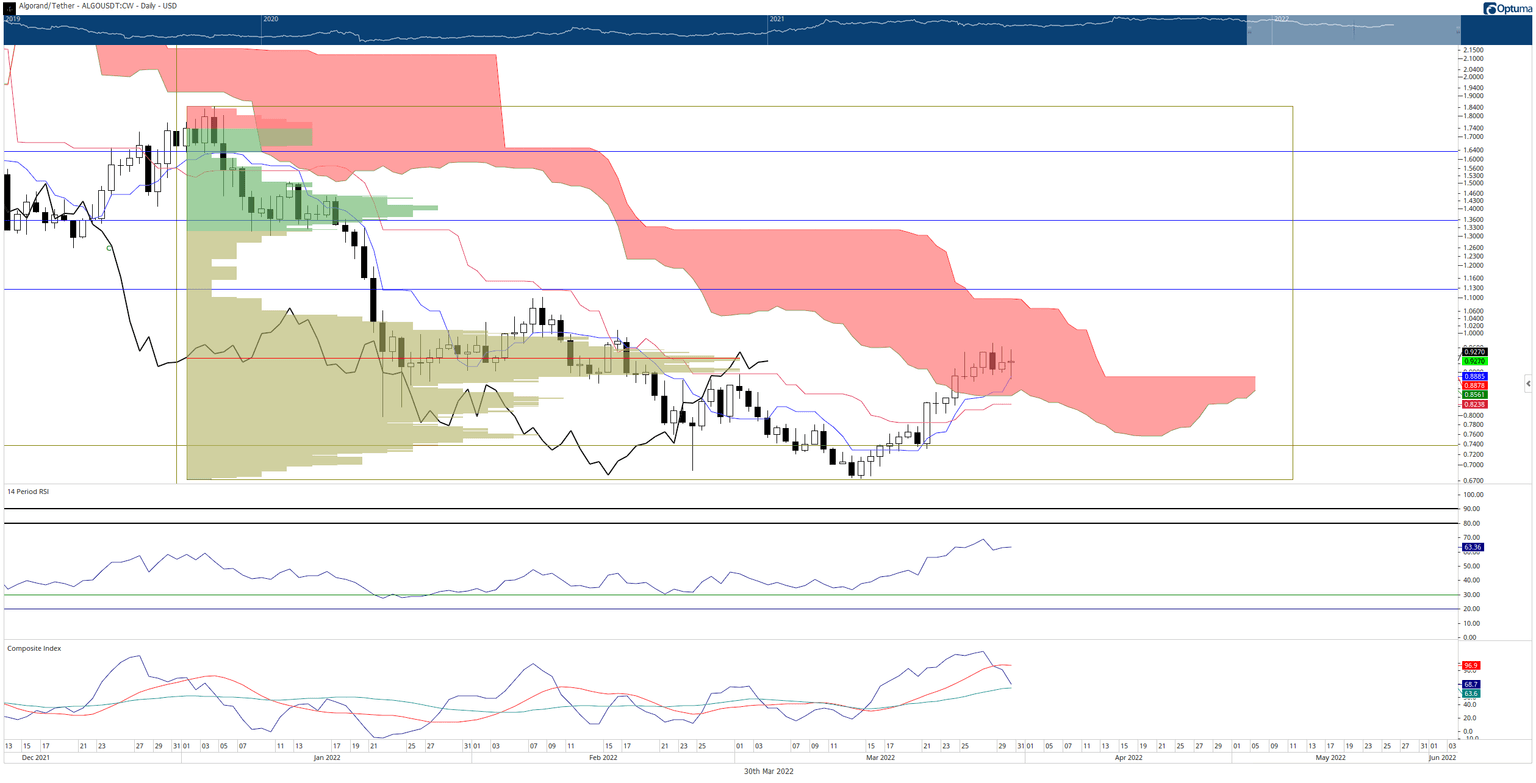

Algorand price has spent the past six days banging against the 2022 Volume Point Of Control door at $0.93. While ALGO did close above $0.93 on Sunday and has since traded above that level during the intraday sessions, bulls have been unable or unwilling to complete a close above $0.93.

Algorand price consolidation may be a precursor to the next major breakout

Algorand price action continues to constrict against the 2022 Volume Point Of Control but has not sold off. Bulls likely anticipate a breakout above the Volume Point Of Control would likely trigger a rapid and violent drive higher towards the next high volume node near the 50% Fibonacci retracement at $1.36. Likewise, bears look for weakness and failure to pursue higher highs to sell or short Algorand to new 2022 lows.

ALGO/USDT Daily Ichimoku Kinko Hyo Chart

As a result of this price action, two Point and Figure trade setups have developed for bulls and bears.

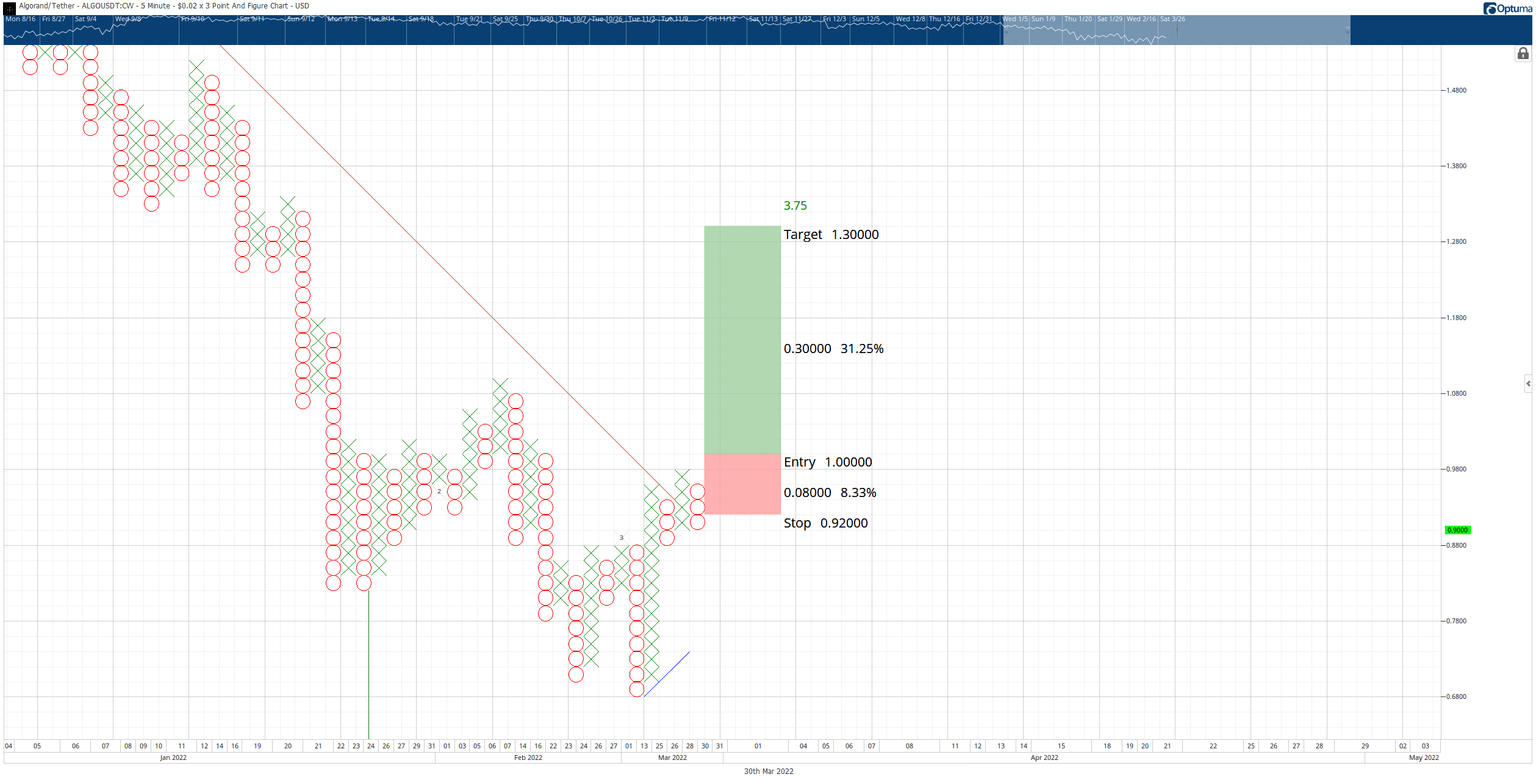

The hypothetical long trade setup for Algorand price is a buy stop order at $1.00, a stop loss at $0.92, and a profit target at $1.30. The trade represents a 3.75:1 reward for the risk. The trade setup is based on a Point and Figure pattern known as the Ascending Triple Top breakout. Essentially, the Ascending Triple Top breakout is a failed rising wedge pattern.

$0.02/3-box Reversal Point and Figure Chart

A two to three-box trailing stop would help protect any implied profit made post entry. The trade setup is invalidated if the short entry below is triggered first.

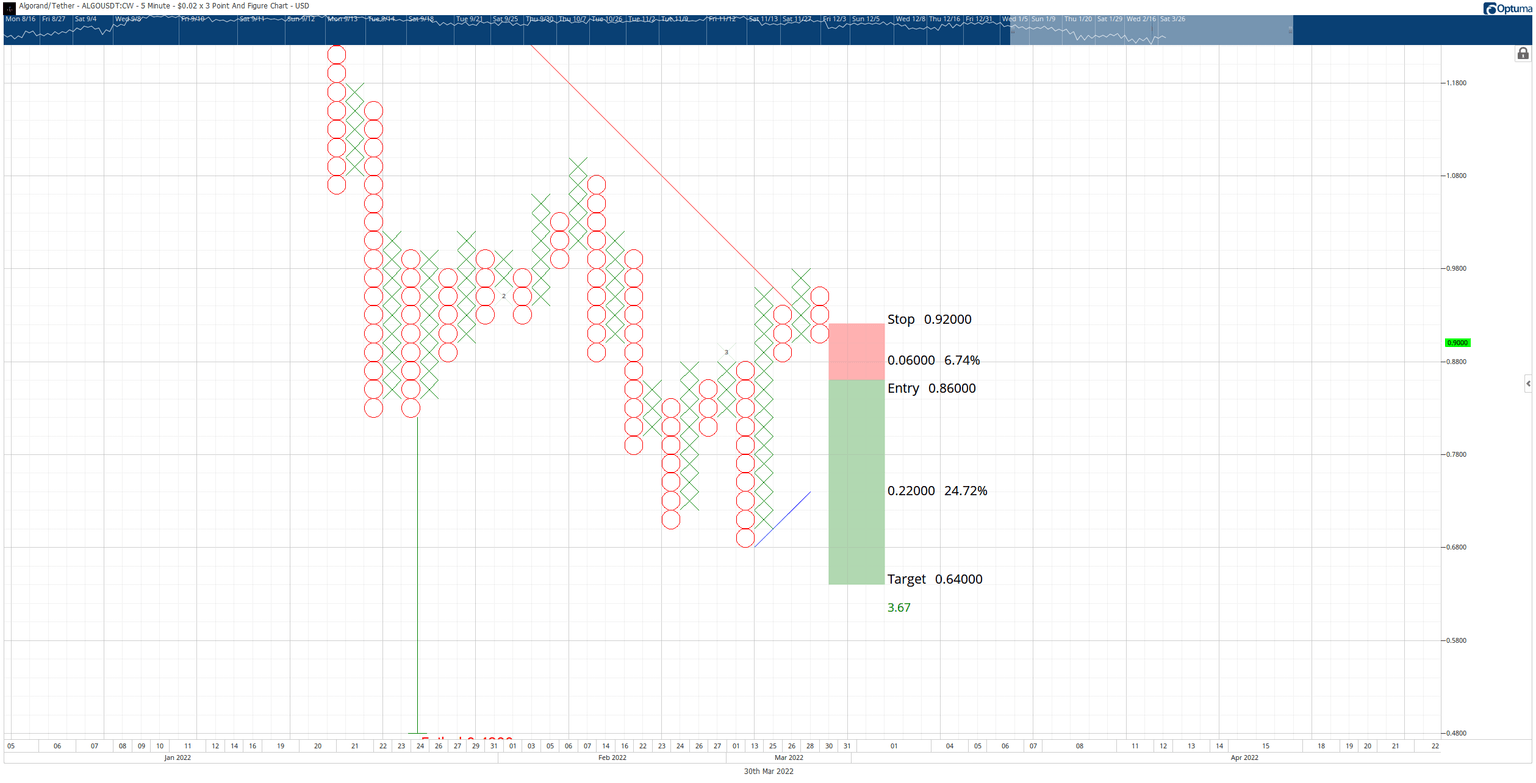

On the short side of the trade for Algorand price, the theoretical short setup is a sell stop order at $0.86, a stop loss at $0.92, and a profit target at $0.64. This short idea is a 3.67:1 reward for the risk, with a three-box stop versus the standard four-box stop loss due to the proximity of the entry to the bull market trend line. If the short entry is triggered, it confirms a Point and Figure pattern known as a Bull Trap.

$0.02/3-box Reversal Point and Figure Chart

The trade is invalidated if a reversal column of Xs prints before the short entry is hit. A tight, two-box trailing stop would help protect against any whipsaw in price action that could develop on a swift drop.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.