Crypto experienced one of its worst days in years on Aug. 5. Few saw it coming, but traders’ addiction to leverage has been quietly amplifying marketwide risks for months. If leveraged trading was the kindling, the Japanese yen’s abrupt uptrend was the match. Thankfully, the fire may burn out as quickly as it started.

Surging costs on yen-denominated loans caused the crash. Now, markets are set for a healthy rebound as traders finally pare back leverage and exposure to the yen. If broader markets stabilize — and they probably will — crypto may soon make a comeback.

Bargain-bin borrowing

It’s no secret crypto doesn’t trade on fundamentals. Prices are mainly driven by short-term institutional traders, who profit off crypto’s volatility. To boost returns, traders double down on positions with leverage, or borrowed funds — often in staggering amounts. Shortly before the crash, open interest, a measure of net borrowing, stood at almost $40 billion.

All that borrowed money has to come from somewhere. Lately, that place has been Japan. In 2022, interest rates on United States Treasury bills rose above zero for the first time in years and kept climbing. In Japan, rates stayed rock-bottom. Trading firms cashed in — taking out huge Japanese loans to cheaply finance trades in other markets.

It seemed like good timing. By 2023, the crypto’s bull market was in full swing. Leveraged trades — which can amplify gains or losses by 2x or more — paid off handsomely. Meanwhile, traders’ yen-denominated financing was nearly free.

This was the essence of the so-called yen carry trade, and it wasn’t unique to crypto. By 2024, yen-denominated loans to foreign borrowers reached some $2 trillion, up more than 50% from two years prior, according to a report from ING Bank.

An end to 17-year-old policy in Japan

Everything changed on July 31, when the Bank of Japan raised rates on short-term government bonds from 0% to 0.25%. (That came after a hike in March, when the bank raised the rate — for the first in 17 years — from -0.1%.) That seemingly innocuous move set off a cascade of events that eventually caused Bitcoin (BTC $55,514) and Ethereum (ETH $2,500) prices to plunge around 18% and 26%, respectively.

Even traditional markets were badly shaken, with the S&P 500 — an index of US stocks — down more than 5% on the day.

The catalyst wasn’t so much Japan’s rate hike as what followed: the surging value of the yen in foreign exchange markets. (Currencies often gain value when domestic interest rates rise.) From July 31, the USD/JPY exchange rate dropped from around 153 yen per dollar to 145. Suddenly, those yen-denominated loans became significantly more expensive.

Whether because of margin calls from lenders or general caution, traders started dumping positions by the billions. Jump Trading’s sale of more than $370 million in ETH between July 24 and Aug 4 caused a stir, but they didn’t trigger the downturn. At most, Jump amplified what was already destined to be a historic selloff.

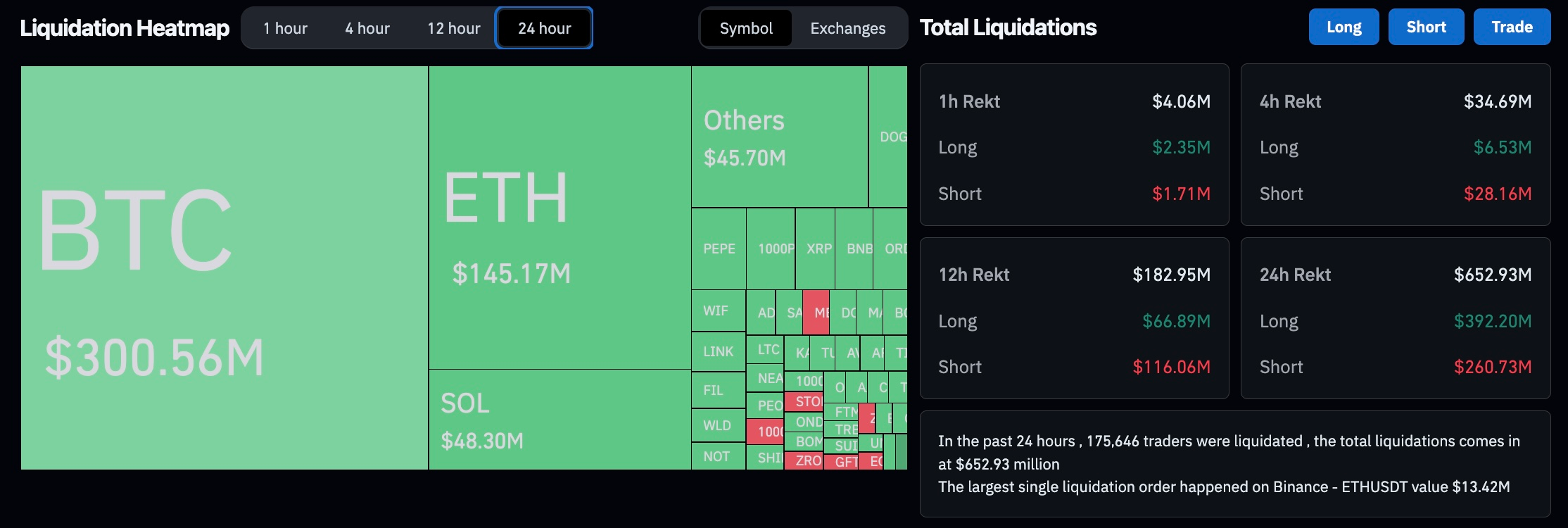

Liquidation data for the 24 hours between the evenings of Aug. 4-5, 2024. Source: CoinGlass

In fact, more than $1 billion in leveraged trading positions — representing hundreds of thousands of trades — were liquidated between Aug. 4-5, according to CoinGlass.

Coming back stronger?

With some sicknesses, a fever is the cure. Hopefully, that’s what is happening with the markets. Traders were shaken out of high-risk leveraged positions and have finally pared back huge yen-denominated loan obligations. In crypto, net open interest now stands at $27 billion — almost $13 billion less than before the crash.

Meanwhile, USD/JPY may not have room left to fall, according to ING.

If all else fails, there’s always rate cuts. Japan’s own stock market dropped some 12% on Aug. 5 — its worst one-day drop since 1987. That may force Japan’s central bank to intervene, softening the blow for borrowers. The US may be in for relief too, after a July report showed a sharp rise in unemployment.

In Japan, "If there was a shot at intervention working — this is the time," David Aspell, a senior portfolio manager at Mount Lucas Management, told Cointelegraph. “Given the recent data from the US, it looks like the Fed will be cutting much more aggressively than was thought a few months ago.”

If that scenario plays out, then crypto might be set for a late-summer rebound. Of course, crypto markets are as unpredictable as they come. If there’s one lesson in all this, it’s to think twice before aping into another leveraged trade.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Whale grabs 16,000 ETH as Ethereum Foundation vows support for L1, RWA and stablecoins

Ethereum Foundation's Co-Executive Director Tomasz K. Stańczak highlights simplified roadmap scaling blobs and improving L1 performance. Ethereum whale scoops 16,000 ETH, emphasizing growing interest in the token as the price recovers.

Bitcoin retests key resistance at $85K, breakout to $90K or rejection to $78K?

Bitcoin (BTC) price edges higher and approaches its key resistance at $85,000 on Monday, with a breakout indicating a bullish trend ahead. Metaplanet announced Monday that it purchased an additional 319 BTC, bringing its total holdings to 4,525 BTC.

XRP price teases breakout, bulls defend $2 support

Ripple (XRP) price grinds higher and trades at $2.15 during the early European session on Monday. The token sustained a bullish outlook throughout the weekend supported by bullish sentiment from the 90-day tariff suspension in the United States.

Senator Elizabeth Warren launches fresh offensive on crypto

Senators Elizabeth Warren, Mazie K. Hirono, and Dick Durbin want the DoJ’s decision to terminate crypto investigations reversed. The Senators raise concerns over the DoJ’s shift in priorities, terming it a “grave mistake.”

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.