How Polygon zkEVM growth could act as a catalyst for MATIC price

- Polygon’s zkEVM supports over $5 million in assets across 20 cryptocurrencies.

- The ecosystem made massive strides, and $2.1 million worth of assets are locked in decentralized exchanges and collateralized lending.

- MATIC price could begin its recovery from the recent decline in its price with the growth of zkEVM acting as a catalyst.

Polygon network’s zkEVM rollout has witnessed an increase in Total Value Locked. There is a spike in on-chain activity on the MATIC network, and experts expect this to fuel a recovery in the asset’s price.

Also read: Ethereum battles intense selling pressure from spike in ETH deposits to crypto exchanges

Polygon zkEVM could catalyze MATIC recovery

Based on data shared by Polygon in a recent tweet, there are over $5 million in assets on the network. zkEVM currently supports nearly 20 tokens, and the bulk of the assets is in Ethereum and USD Coin. $2.1 million worth of assets is locked across decentralized exchanges and collateralized lending.

The TVL of zkEVM has recorded consistent growth, hitting $2.25 million since April 3, 2023, as seen in the chart below:

TVL in Polygon’s zkEVM

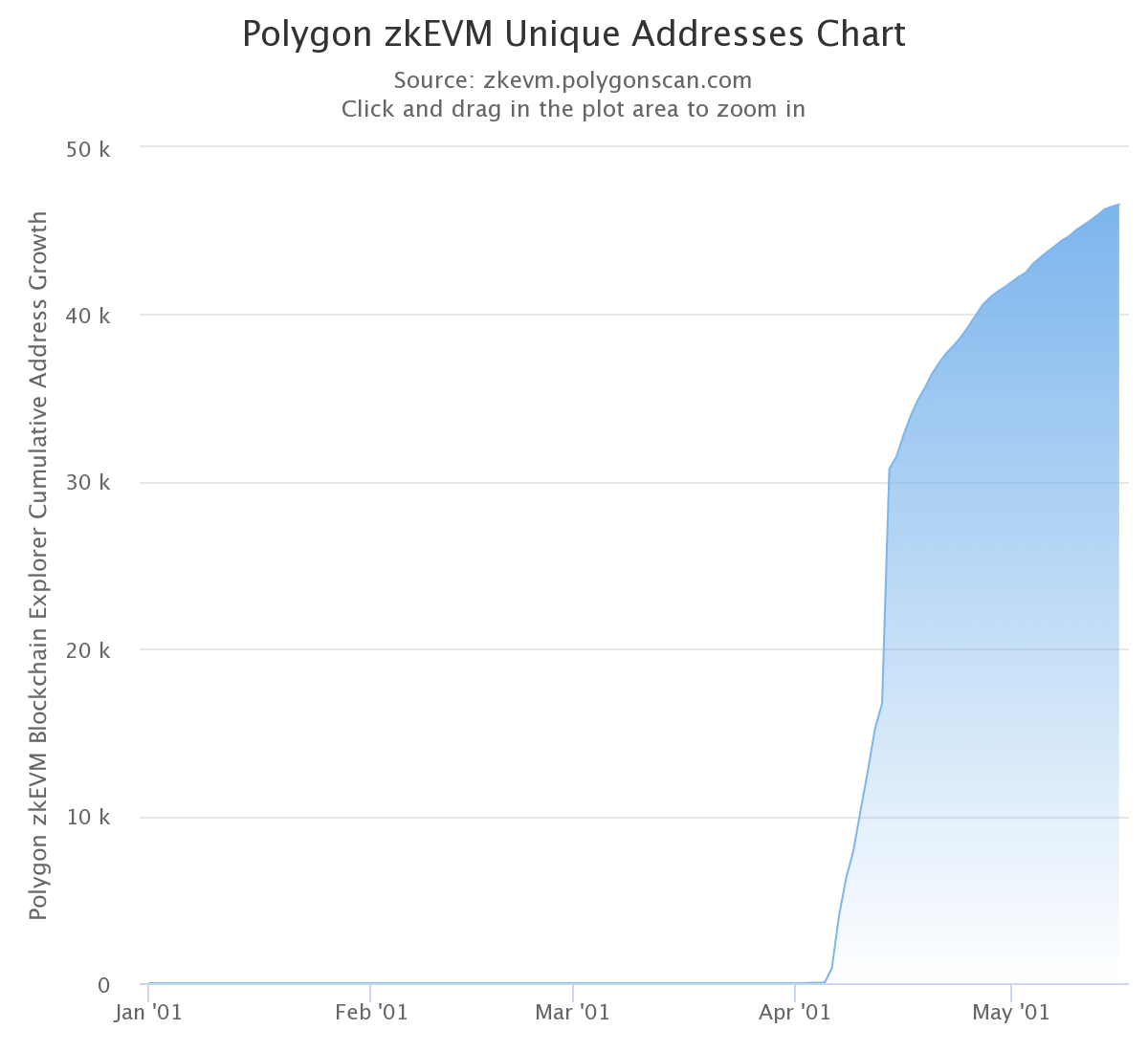

Interestingly, there is a spike in on-chain activity; the unique wallets and daily active addresses count on Polygon zkEVM continue its upward trend.

Polygon zkEVM unique addresses chart

The rapid climb in on-chain activity in zkEVM could likely be a bullish catalyst for the blockchain’s native token MATIC.

MATIC price could recover from its 12% pullback in April

MATIC, the native token of Ethereum’s scaling solution, yielded double-digit losses for holders over the past thirty days. With the emergence of bullish catalysts in Polygon’s ecosystem, the Layer 2 scaling token could begin its recovery.

MATIC price is currently in an uptrend that started in mid-June 2022. MATIC price is currently below the three long-term Exponential Moving Averages 10, 50 and 200-day. Key resistances at $1.18, and $1.39, previously supported the token in its 2022 price rally.

MATIC/USD 1D price chart

If the MATIC price declines below the 23.6% Fibonacci level at $0.93, the bullish thesis could be invalidated. The immediate support for MATIC is $0.86.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.