- Ethereum miner revenue has dropped to $498 million, an alarmingly low level, in June.

- A decline in Ethereum price and the fear of being out of business after the Merge lead to steep decline in miner revenue.

- The Gray Glacier upgrade delayed the difficulty bomb, giving miners another 100 days before the migration to Proof-of-Stake.

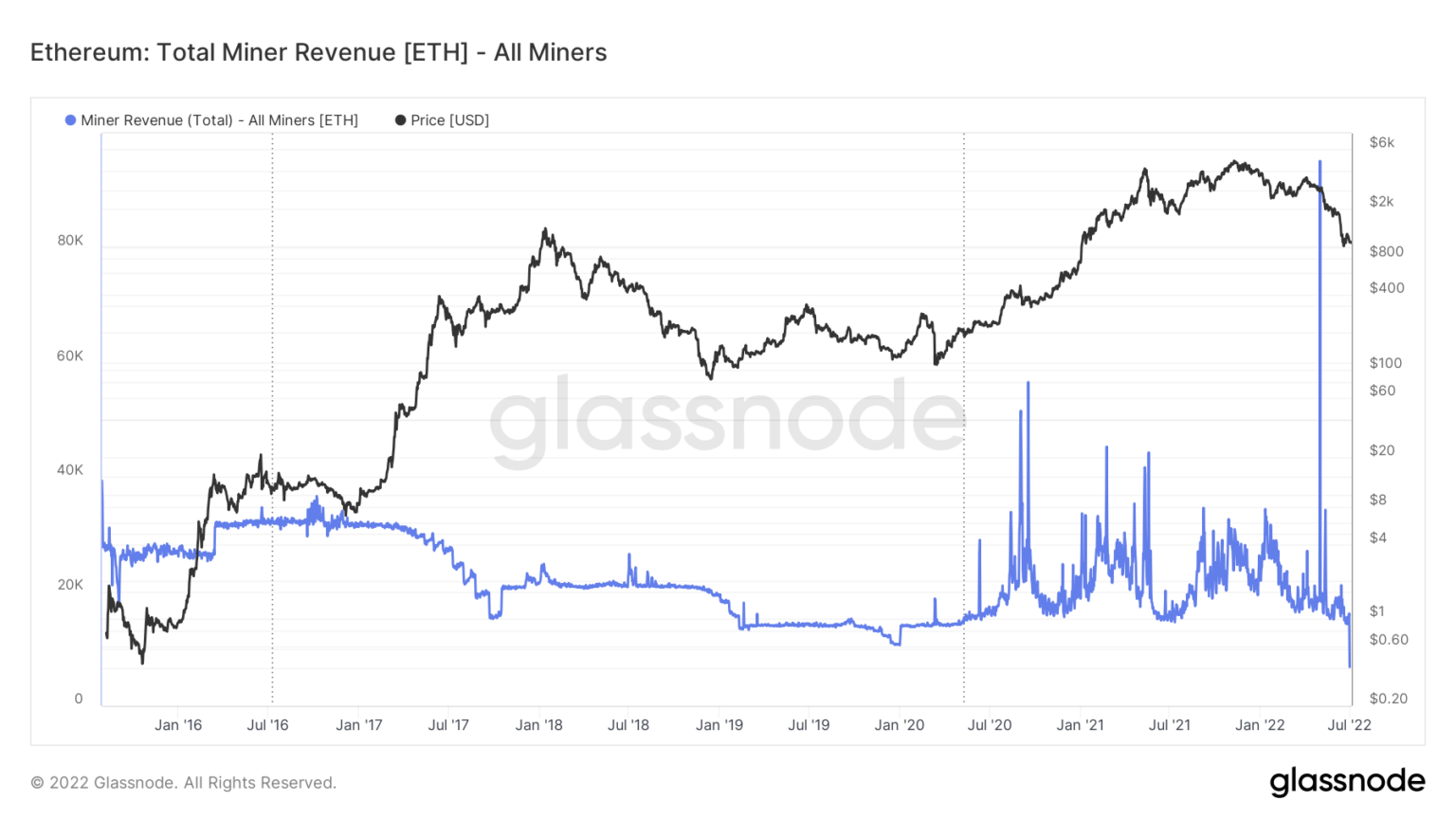

The Ethereum Merge, the much anticipated transition from Proof-of-Work to Proof-of-Stake, has negatively impacted miners on the altcoin’s network. Miner revenue was slashed to an alarmingly low level in June. Experts revealed that it is likely miners on the Ethereum network have operated under losses for the last two months.

Also read: One of the most iconic American rappers is bullish on Ethereum despite recent price slump

Gray Glacier upgrade gives miners relief for another 100 days

The Ethereum network underwent a scheduled upgrade at block 15,050,000, to change the parameters of the Difficulty Bomb. The Gray Glacier upgrade went live on June 30 and pushed the Difficulty Bomb back by roughly 100 days.

Tim Beiko, a leading Ethereum developer, tweeted:

Gray Glacier Upgrade Announcement

— Tim Beiko | timbeiko.eth (@TimBeiko) June 16, 2022

At block 15,050,000, the Ethereum network will undergo the Gray Glacier fork to push back the difficulty bomb, *hopefully* for the last time ever

If you run a node or validator, make sure to upgrade !https://t.co/wmPqzQSgL7

The Difficulty Bomb is a mechanism that increases the difficulty level of the puzzles in the Proof-of-Work mining algorithm that results in longer block times and less Ethereum reward for miners. The upgrade affects only the Ethereum mainnet and was not deployed on any testnet.

EIP-5133 was introduced in the Gray Glacier upgrade to delay Ethereum’s Difficulty Bomb to mid-September 2022.

Ethereum miner revenue plummets to alarmingly low levels

Despite the delay in the Difficulty Bomb, miners on the Ethereum network have seen a steep decline in their revenue, month-on-month. While the transition to Proof-of-Stake has been pushed back to September 2022, declining Ethereum prices and lower profitability for miners has sinked revenue to alarmingly low levels.

In the recent crypto bloodbath, Ethereum price dropped at an alarming rate. Ethereum price decline negatively impacts miner profitability.

Ethereum: Total Miner Revenue

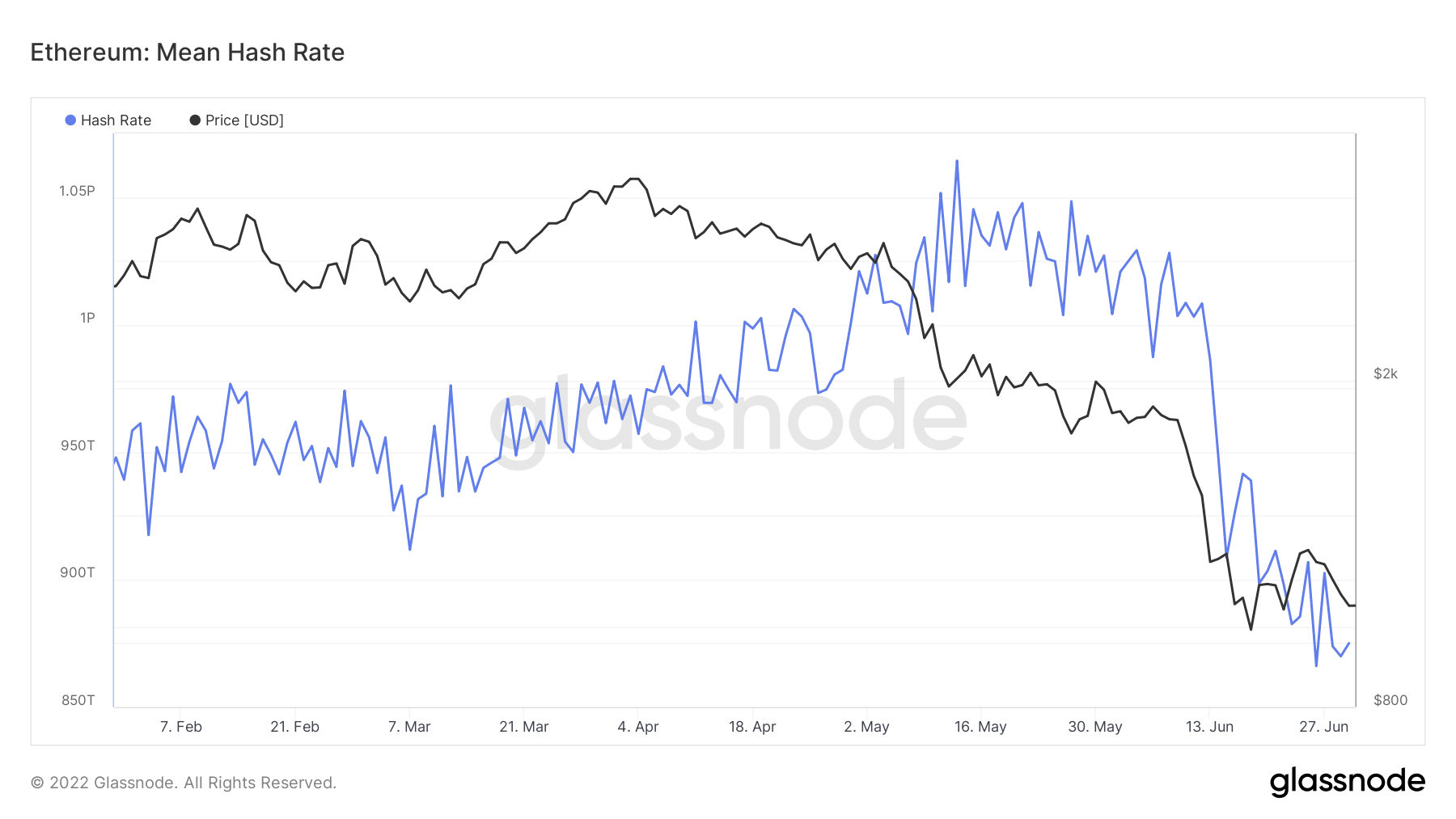

As profitability plummets, miners pull out of the Ethereum network and disconnect, resulting in a lower hash rate.

Ethereum: Mean Hash Rate

Based on data from The Block Research, miners’ revenue on the Ethereum Network shrunk by 45.5% from May to June. Ethereum miners made a mere $528 million in revenue in the month of June 2022. Of this revenue, $498.8 million was from block subsidies, transaction fees from the Ethereum network was significantly lower than in May and April.

Ethereum miners spent $15 billion on graphics cards

Bitpro Consulting disclosed that Ethereum miners have spent as much as $15 billion on gaming graphics cards for mining on the altcoin’s network. These cards cost as much as $2,000 in the retail market, and implies that miners' objective is to recoup the initial investment through mining revenue.

As Ethereum price declined in the bear market, miners have seen a steep drop in revenues, finding it challenging to recover their operating costs. Interestingly, the shift from Proof-of-Work to Proof-of-Stake has been a looming threat to miners’ operations.

Aydin Kilic, Chief Operating Officer at industrial Ethereum miner Hive, puts the odds of the Merge happening in 2022 between 1 to 10%. Regardless, there is a rise in the number of small miners pooling their resources to continue operations on the Ethereum network. Post the Merge, miners plan to shift focus to Raven, Grin, Dash, Monero and ZCoin.

Though mining in these altcoins is not as profitable as Ethereum, it is a plan for miners to fall back on and recover their cost of operation and initial equipment.

Ethereum Merge end of the road for miners?

Ethereum’s transition to Proof-of-Stake seems like the end of the road for miners on the altcoin’s network. However, it is important to note that the timing of the Merge is key and Ethereum miners have limited time to recoup their losses and exact operating costs out of the altcoin, before pulling the plug.

Ethereum Merge will therefore force the $19 billion mining industry to find new cryptocurrencies to mine. It is likely that mining altcoins with small market capitalization may not be economically viable for Ethereum miners. The total market cap of GPU-mineable coins, excluding Ethereum, is less than 2% of the altcoin’s market capitalization.

Based on a report from Messari, large-scale miners plan to pivot towards a data-center oriented business and focus on high-performance computing. Miners can pool their resources and contribute to Web3 protocols like Render Network and Livepeer. There is a concern of increased selling pressure on Ethereum as miners leave.

Analysts believe Ethereum price could hit previous cycle ATH

Crypto trader and investor @PostyXBT believes Ethereum price could hit its previous cycle all-time high of $1,450 if the altcoin crosses bounces to $1,300 level. The analyst believes Ethereum price is likely to plummet after hitting the previous cycle high until “there is more action from the bulls.”

ETH-USD price chart

Three altcoins to watch this week

Analysts at FXStreet evaluated altcoin price charts and identified three key assets to watch out for gains. For more information and important price levels, checkout this video:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Monero Price Forecast: XMR soars over 19% amid rising demand for privacy coins

Monero (XMR) price is extending its gains by 19% at the time of writing on Monday, following a 9.33% rally the previous week. On-chain metrics support this price surge, with XMR’s open interest reaching its highest level since December 20.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC and ETH stabilize while XRP shows strength

Bitcoin and Ethereum prices are stabilizing at around $93,500 and $1,770 at the time of writing on Monday, following a rally of over 10% and 12% the previous week. Ripple price also rallied 8.3% and closed above its key resistance level last week, indicating an uptrend ahead.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.