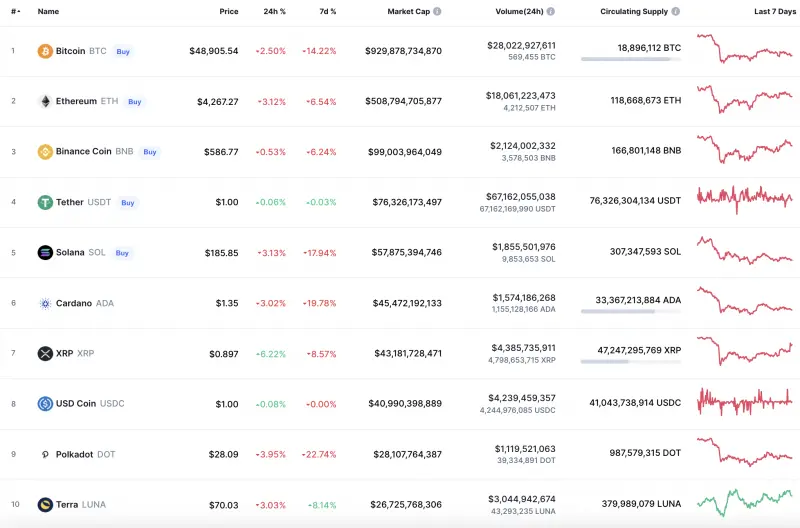

Bears remain more powerful than bulls as almost all of the coins from the top 10 list are in the red zone.

Top coins by CoinMarketCap

BTC/USD

Trading volumes were very low yesterday morning. The Bitcoin price dropped below the psychological level of $50,000, setting the daily low at $48,656.

This decline has awakened consumer demand, and purchase volumes increased to the average level. The BTC price was able to recover to the two-hour EMA55; however, the resistance of this moving average was not overcome.

BTC/USD chart by TradingView

As of this morning, the pair has again rolled back below the $50,000 mark. During the day, the pullback may continue to the $47,745 level. If the bears are able to push it, then one can expect a decline to the support of $46,000.

The negative scenario may not work if the bulls pick up the price in the area of $49,500 and try to gain a foothold above the average price level.

Bitcoin is trading at $48,655 at press time.

ETH/USD

Sellers tried to push through the support of the two-hour EMA55 yesterday. During the day, the Ethereum (ETH) price pierced the moving average and marked the daily low at $4,226.

ETH/USD chart by TradingView

In the evening, the pair recovered above the level of $4,400 and, tonight, buyers came close to the level of $4,500 but could not test it.

In the morning, the ETH price returned to the area of average prices. Today, one might again hope for the support of the two-hour EMA55. If the bears are unable to push through the EMA55 moving average, then there is a chance to see recovery above $4,500.

Ethereum is trading at $4,220 at press time.

XRP/USD

Buyers were unable to break through the resistance of the two-hour EMA55 in the morning yesterday. In the afternoon, their attempt was more successful. Toward evening, the XRP price fixed a local maximum at the point of $0.885.

XRP/USD chart by TradingView

If the pair consolidates above the moving average EMA55, then by the end of the week, the recovery can continue to the level of $0.960.

XRP is trading at $0.8851 at press time.

BNB/USD

The rate of Binance Coin (BNB) is almost unchanged since yesterday. The price has gone down by only 0.53%.

BNB/USD chart by TradingView

Despite the fall, BNB is located in the zone of the most liquidity around $580, far away from the support at $540. At the moment, neither bulls nor bears are controlling the situation on the market, which is also confirmed by the low trading volume. If sellers break the purple support line and fix below it, the fall may continue to the vital level of $500.

BNB is trading at $575.90 at press time.

ADA/USD

Cardano (ADA) is looking worse than BNB as the altcoin has declined by 3%.

ADA/USD chart by TradingView

From the technical point of view, the price drop may continue if ADA fixes below the nearest support level at $1.284. If that happens, the decline may get ADA to the crucial level at $1.072.

ADA is trading at $1.321 at press time.

Any financial and market information given on U.Today is written for informational purposes only. Conduct your own research by contacting financial experts before making any investment decisions.

Recommended Content

Editors’ Picks

Is Altcoin Season here as Bitcoin reaches a new all-time high?

Bitcoin reaches a new all-time high of $98,384 on Thursday, with altcoins following the suit. Reports highlight that the recent surge in altcoins was fueled by the victory of crypto-friendly candidate Donal Trump in the US presidential election.

Shanghai court confirms legal recognition of crypto ownership

A Shanghai court has confirmed that owning digital assets, including Bitcoin, is legal under Chinese law. Judge Sun Jie of the Shanghai Songjiang People’s Court shared this opinion through the WeChat account of the Shanghai High People’s Court.

BTC hits an all-time high above $97,850, inches away from the $100K mark

Bitcoin hit a new all-time high of $97,852 on Thursday, and the technical outlook suggests a possible continuation of the rally to $100,000. BTC futures have surged past the $100,000 price mark on Deribit, and Lookonchain data shows whales are accumulating.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: New high of $100K or correction to $78K?

Bitcoin surged to a new all-time high of $93,265 in the first half of the week, followed by a slight decline in the latter half. Reports highlight that Bitcoin’s current level is still not overvalued and could target levels above $100,000 in the coming weeks.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.