How long will Bitcoin price delay its rally to $52,000

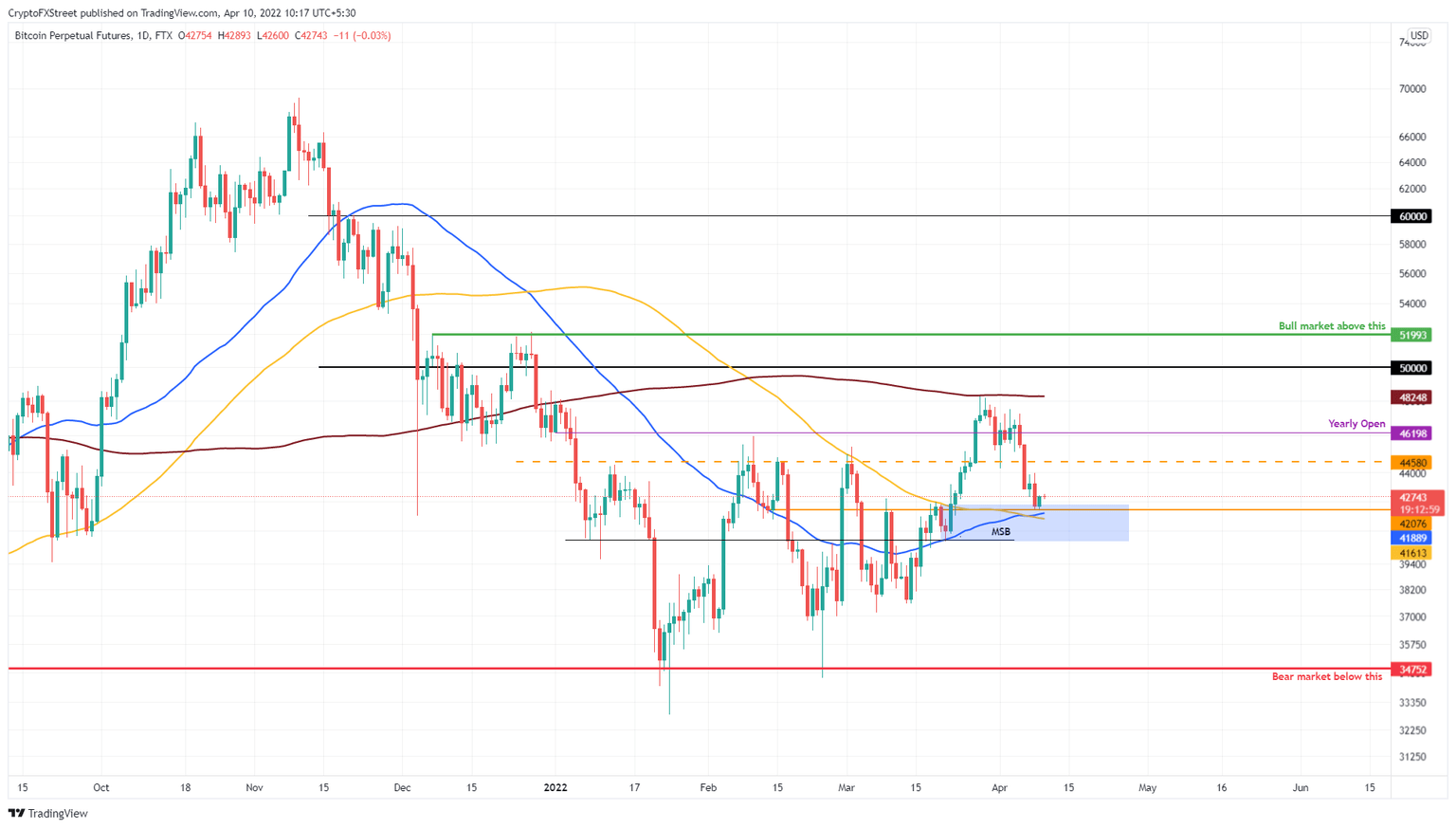

- Bitcoin price has slipped below the $44,671 support level and is currently grappling with the $42,076 barrier.

- A bounce off this foothold will likely trigger an ascent to $52,000.

- A daily candlestick close below $40,490 will invalidate the bullish thesis for BTC.

Bitcoin price has been trading devoid of its volatility for the past three days. This development occurs above a crucial support level, which indicates that a breakout will lead to a bullish move.

Bitcoin price contemplates directional bias favoring bulls

Bitcoin price crashed nearly 12% since its March 28 swing high at $48,238.Currently, BTC is grappling with a confluence of the $42,076 support level and the $40,490 to $42,316 demand zone.

Due to the 50-day and 100-day Simple Moving Averages (SMAs) inside this confluence, an upswing is a high probability outcome. The resulting rally is likely to propel Bitcoin price to $44,580; quickly cleaning this hurdle will open the bulls' path to test their strength by overcoming the 200-day SMA at $48,248.

If the buying pressure is strong enough to overcome this significant barrier, there is a good chance Bitcoin price will eye a retest of the $50,000 psychological level. Such a development will also open up the avenue for further gains by tagging the $52,000 ceiling.

This run-up to the level mentioned above would constitute a 21% upswing and is likely where the upside for the big crypto is capped at.

BTC/USDT 1-day chart

While the fundamentals for Bitcoin price show a highly optimistic outlook, the technicals are not following it. So, a daily candlestick close below $40,490 will invalidate the bullish thesis for Bitcoin price and open the path for further descent to $34,752.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.