The price of any asset is always impacted by a combination of factors. Unlike traditional financial assets, Bitcoin has historically had its own set of factors affecting its price. Do things look any different now? Let's find out.

Basic factors: Supply and demand

Bitcoin price is heavily dependent on supply and demand fluctuations, just like other assets. However, contrary to traditional assets, a BTC's supply is always known and its hard cap is set at 21 million coins.

The demand for Bitcoin always sits at the top of the crypto world's agenda (that's why adoption of BTC is so talked about). Higher demand will lead to an increase in its price, especially when institutional investors get involved.

For example, when companies and institutions began buying and holding Bitcoin in early 2021, its price rose significantly as demand outpaced the rate at which new coins were created, resulting in a decrease in the total available supply of the cryptocurrency.

Its price will drop, however, if there are more people who want to sell it.

Institutional adoption

News developments influence investor perception about Bitcoin in a major way, prompting them to want the crypto asset or get rid of it.

In spite of extreme volatility in BTC price, the year 2021 stands out for its unprecedented adoption by both institutions and corporations.

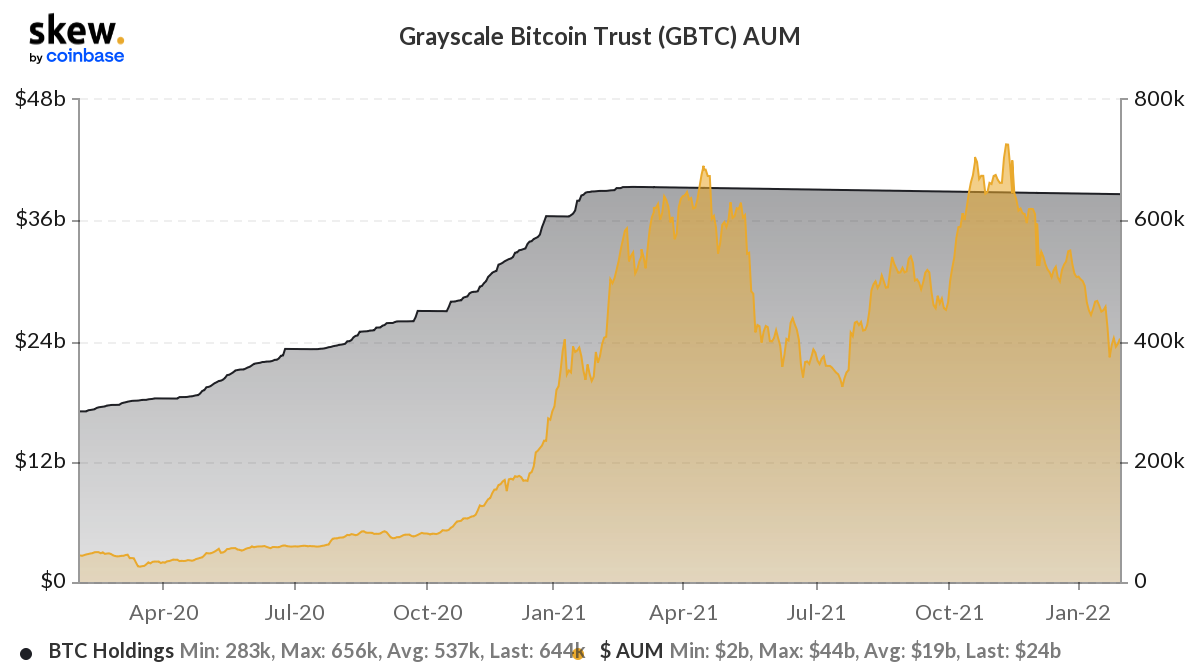

For example, Grayscale Bitcoin Trust, the firm's largest holding, had an average AUM of $31 billion and an average Bitcoin holding of 650K in 2021.

Source: analytics.skew.com

Crypto regulation

Bitcoin's price is also affected by regulatory developments. Changes in regulation can encourage or discourage investment in BTC or its use, which in turn leads to an increase or decrease in its price.

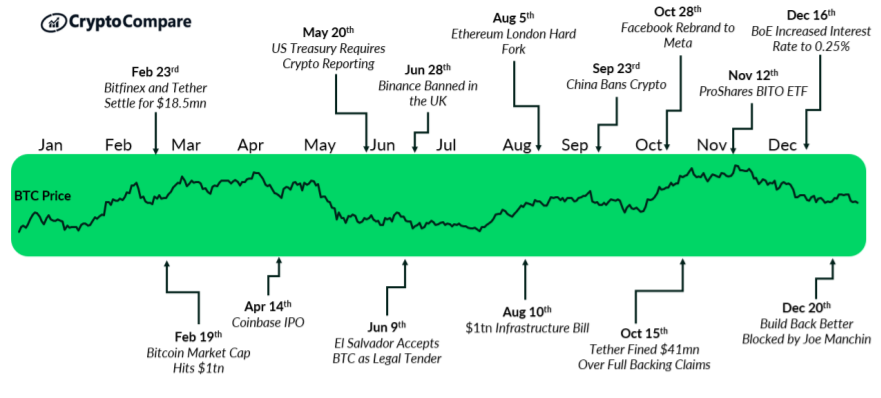

Here’s how the regulatory events in 2021 affected the BTC price:

Source: 2022 CryptoCompare Outlook report

News indirectly related to Bitcoin

Let’s consider an example of how indirect news events, such as reports about a political situation in a country somewhere in the world, can substantially impact the price of BTC.

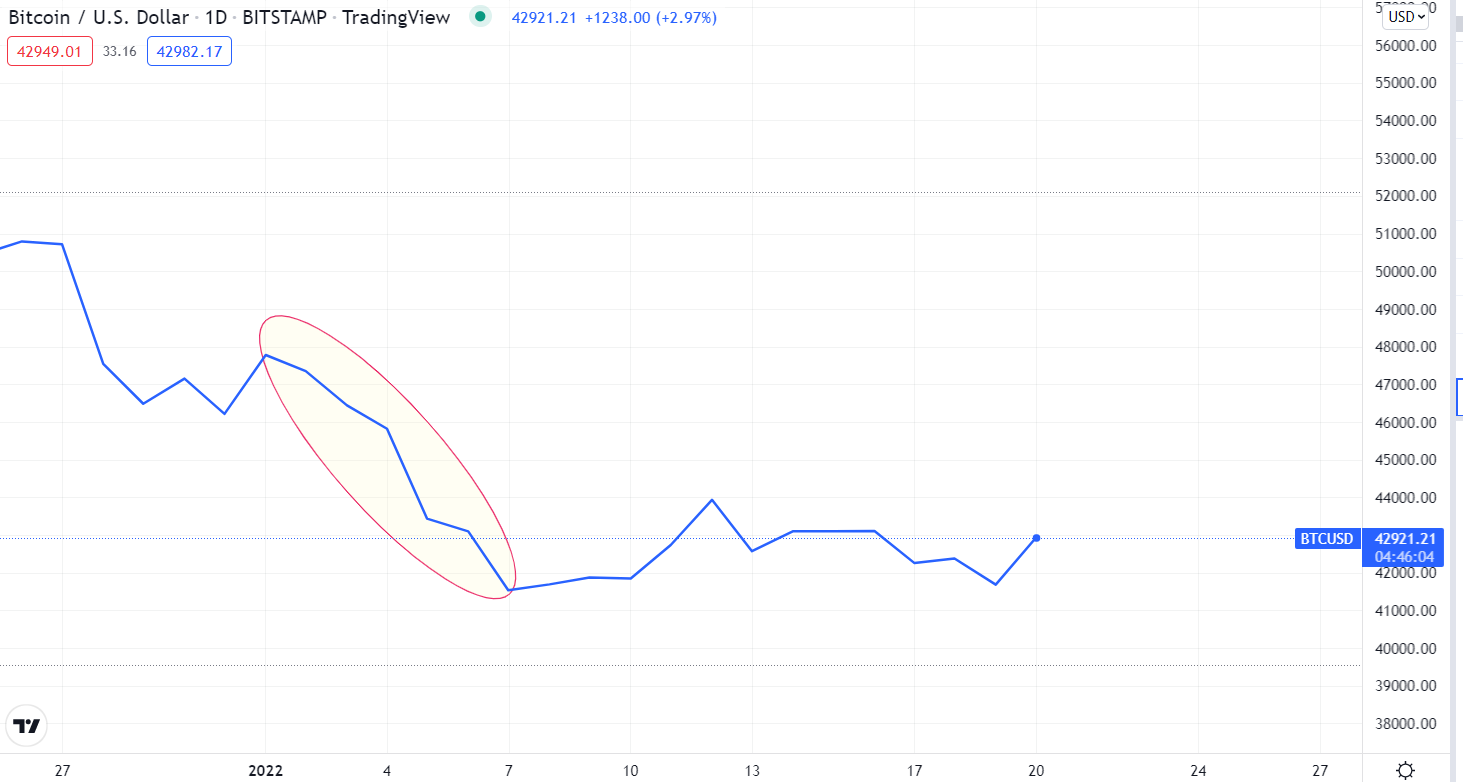

The week-long uprising started in Kazakhstan on January 2, 2022. Most people don't realize the significance of this event for the crypto market. Kazakhstan is, however, the world's No. 2 Bitcoin miner. It accounts for about 18% of the global hashrate, and is only outdone by the United States.

So, it took about 24 hours for the crypto market to react, and the BTC price plunged by a combined 13.1% from January 2 to 8, 2022.

Source: TradingView

BTC increasingly resembles traditional asset

In theory, traditional-market-related news such as reports on the macroeconomic environment or monetary policy of central banks should not affect cryptocurrencies owing to their decentralized nature. However, the current trend suggests otherwise.

Global news sentiment has a big impact on equity returns around the world, according to World Bank research. This effect is not reversible in the short run, suggesting an underlying source of sentiment-driven asset price fluctuations.

Below is the Daily News Sentiment Chart by the Federal Reserve Bank of San Francisco, which gives an overall measure of economic sentiment by analyzing news articles related to economics.

Although Bitcoin is not a traditional asset class, general news sentiment obviously influences its value.

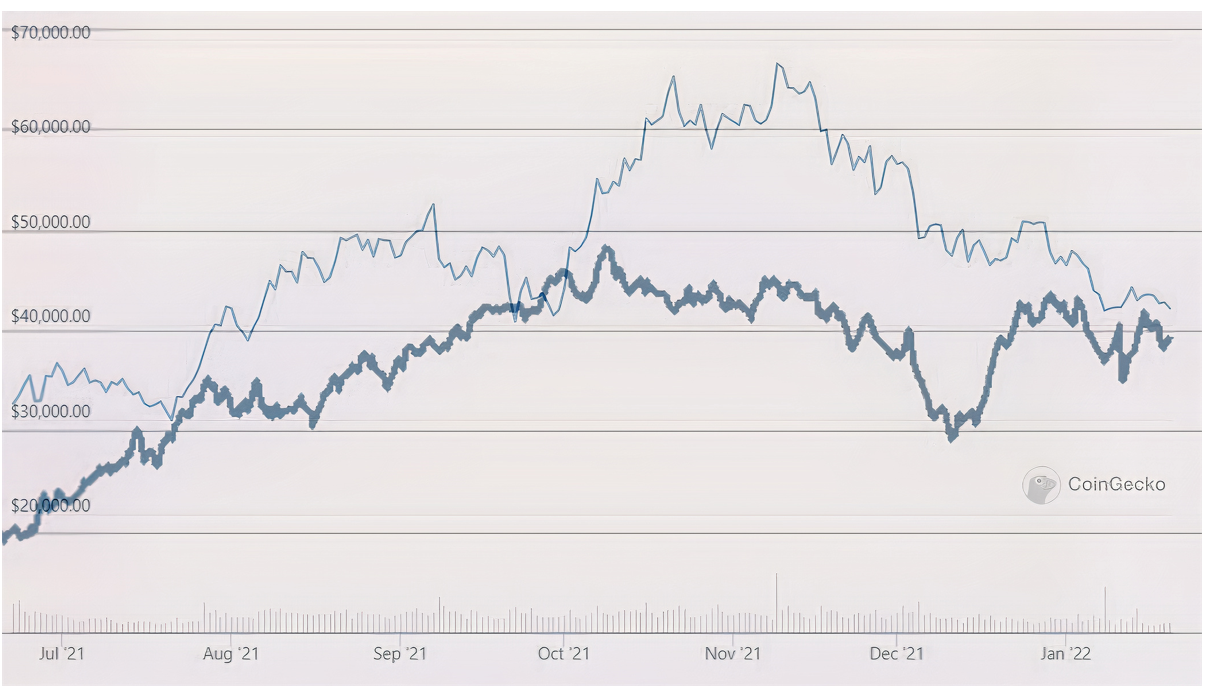

Here's how Bitcoin's price chart looks when combined with the news sentiment index for the same period:

Recent data on Bitcoin and major stock indices correlation also prove this.

Historically, crypto-assets didn’t show a strong correlation with major stock indices. In the latest data from Coinmetrics, however, the daily correlation between Bitcoin and the S&P 500 jumped to 0.47 on January 28, 2022, indicating a close correlation.

Source: Coinmetrics.io

Bottom line

As the crypto market matures, new trends are emerging that we haven't observed before. Initially a fringe asset, Bitcoin is now increasingly acting like a traditional asset, sensitive to the same market forces. In addition to news on crypto regulations and institutional adoption, Bitcoin price is affected by changes in general economic conditions and world events that impact traditional markets.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

VanEck sees Bitcoin reaching $61 trillion market cap, Marathon buys $100 million BTC

Bitcoin declined by 1% on Thursday following asset manager VanEck's forecast that the top digital asset will reach a $61 trillion market capitalization by 2050.

Ethereum Classic price sets for a rally following retest of key support

ETC edges higher by 2.3% and trades around $22.60 at the time of writing on Friday after testing a key support area the day before. On-chain data showing increased account growth suggests a bullish move ahead. Ethereum Classic price faced rejection by the daily resistance level of $25.13 earlier this week.

Celebrity meme coins lose their shine

Celebrity meme coins report by Jupiter Slorg on Thursday shows that these tokens have been in deep waters since early July after experiencing heavy growth in June. In a recent analysis, Jupiter Slorg revealed that celebrity meme coins are down by an average of 94% from their all-time highs.

Ripple gains 5%, Mark Cuban says Kamala Harris’ nomination could affect SEC lawsuit

Ripple (XRP) made a comeback above key psychological resistance early on Wednesday. Crypto traders are optimistic after the Ethereum Exchange Traded Fund (ETF) launch. Entrepreneur and investor Mark Cuban recently shared his comments on how Kamala Harris’ nomination to the Presidential elections could influence crypto regulation.

Bitcoin: Will BTC manage to recover from recent market turmoil?

Bitcoin recovers to $67,000 on Friday after finding support around $63,500 a day before. Still, BTC losses over 1.50% on the week as Mt. Gox persists in transferring Bitcoin to exchanges.