How high could Ethereum price go with Triple Halving

- Ethereum core developers announced a tentative Merge date of September 15.

- Ethereum supply is expected to fall dramatically following Merge through a mass ‘burn’ in effect equal to a ‘triple halving’

- ETH price is likely to hit $5,000, say analysts, as a result of triple halving post the Merge.

Ethereum Merge is going live sooner than the community expected. Core developers of the Ethereum Foundation announced a tentative Merge date as September 15. Ethereum’s successful transition to proof-of-stake is expected to lead to a drop in ETH supply of – according to some estimates – between 80-90% as a result of a mass burn following Merge, in effect causing what amounts to a ‘triple halving’. This is expected to push the ETH price substantially higher.

Also read: Ethereum price explodes, eyes $2,000 after successful Goerli testnet

Ethereum Merge set to go live on September 15

Ethereum’s Merge, the transition from proof-of-work to proof-of-stake is the most highly anticipated event in the altcoin’s history. The transition to proof-of-stake is expected to reduce Ethereum’s power consumption by nearly 99.5%. At the same time, miners will be rendered obsolete for the new Ethereum chain, where validators will approve transactions on the network instead.

The Ethereum triple halving narrative has gained relevance as the Merge draws closer. The Triple Halving narrative considers Ethereum locked in the ETH2 deposit contract as the biggest driver of ETH’s price rally. The ETH2 deposit contract has 13.29 million Ether, worth nearly $25.15 billion. Nikhil Shamapant, the author of the Triple Halving narrative argues that Etheruem holding is likely to go viral more than Bitcoin holding. Investors would prefer Ethereum to Bitcoin for its energy efficiency and bullish potential.

The author believes burn implementation through EIP-1559, Ethereum’s Merge and widespread adoption of ETH are catalysts for the Triple Halving. Ethereum is therefore an ultra-sound store of value with explosive growth in the number of active accounts and increasing transaction volume.

Ethereum’s transition to proof-of-stake will push adoption higher

While Bitcoin’s narrative has dominated the crypto space since the 2017 bull run, Ethereum’s transition to proof-of-stake could push ETH’s adoption higher. The triple halving narrative has set an Ethereum price target of $150,000, at its peak. This implies a $16 trillion market cap and is unlikely sustainable past the short-term.

Ethereum illiquidity is expected to drive up the price and therefore demand among new traders and institutional investors.

Analysts predict Ethereum price rally to $5,000

TechDev, a leading crypto analyst, identified a series of parallel channels on Ethereum. The analyst predicted the next bounce from inside the channel could hit the channel’s upper limit at $5,000.

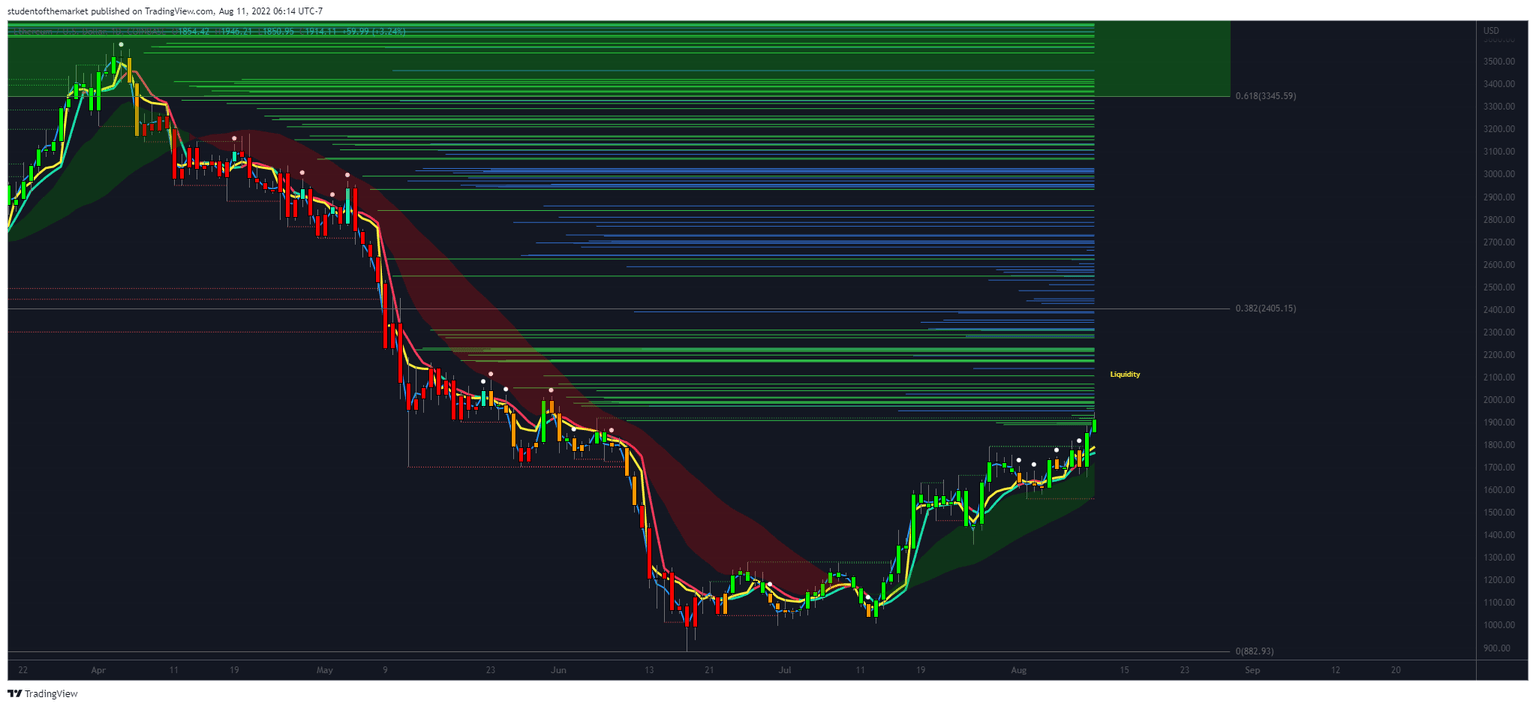

ETH-USD 1-week price chart

Decentrader, a leading crypto analyst and trader has set a short-term target of $2,400 for Ethereum price. The analyst argues that the liquidator and SFP indicator which identifies short order stops in an asset’s price trend, is showing a high volume of stops – of 10x and 3x – above the current price, which if triggered could lead to a substantial short squeeze, driving prices higher.

Ethereum price chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.