How great are the coins' chances to set new peaks?

Despite the drop on the weekend, the cryptocurrency market has recovered and kept its rise steady. Most of the top 10 coins are located in the green zone.

Top 10 coins by CoinMarketCap

BTC/USD

Monday has begun with the bounceback of the main crypto from the liquidity level at $56,000 that had confirmed bulls' power.

BTC/USD chart by TradingView

On the daily chart, Bitcoin (BTC) is looking bullish despite short-term corrections. The buyers are accumulating strength before the continued rise based on the trading volume.

As the more likely scenario, the growth may last to the unclosed gap in the area of $60,500.

Bitcoin is trading at $57,920 at press time.

ETH/USD

Ethereum (ETH) has broken the vital mark at $3,000 and keeps rising. The growth over the last day is 8.34%.

ETH/USD chart by TradingView

The breakout was accompanied by an increasing trading volume, which means that buyers may have begun fixing their positions by now. Even though the long-term trend remains bullish, and $3,000 may not be the peak, there are chances to see a retest of the mirror level at $2,950 soon.

Ethereum is trading at $3,164 at press time.

ADA/USD

Compared to Ethereum (ETH), the rate of Cardano (ADA) has not increased much. The price change is only +1% since yesterday.

ADA/USD chart by TradingView

From the technical point of view, Cardano (ADA) is not ready to grow now as the accumulation has not ended yet. The coin is trading within a narrow range, which means that the price change might occur soon. In this regard, the bullish scenario with the target at $1.54 is the more likely scenario for the upcoming days.

Cardano is trading at $1.35 at press time.

BNB/USD

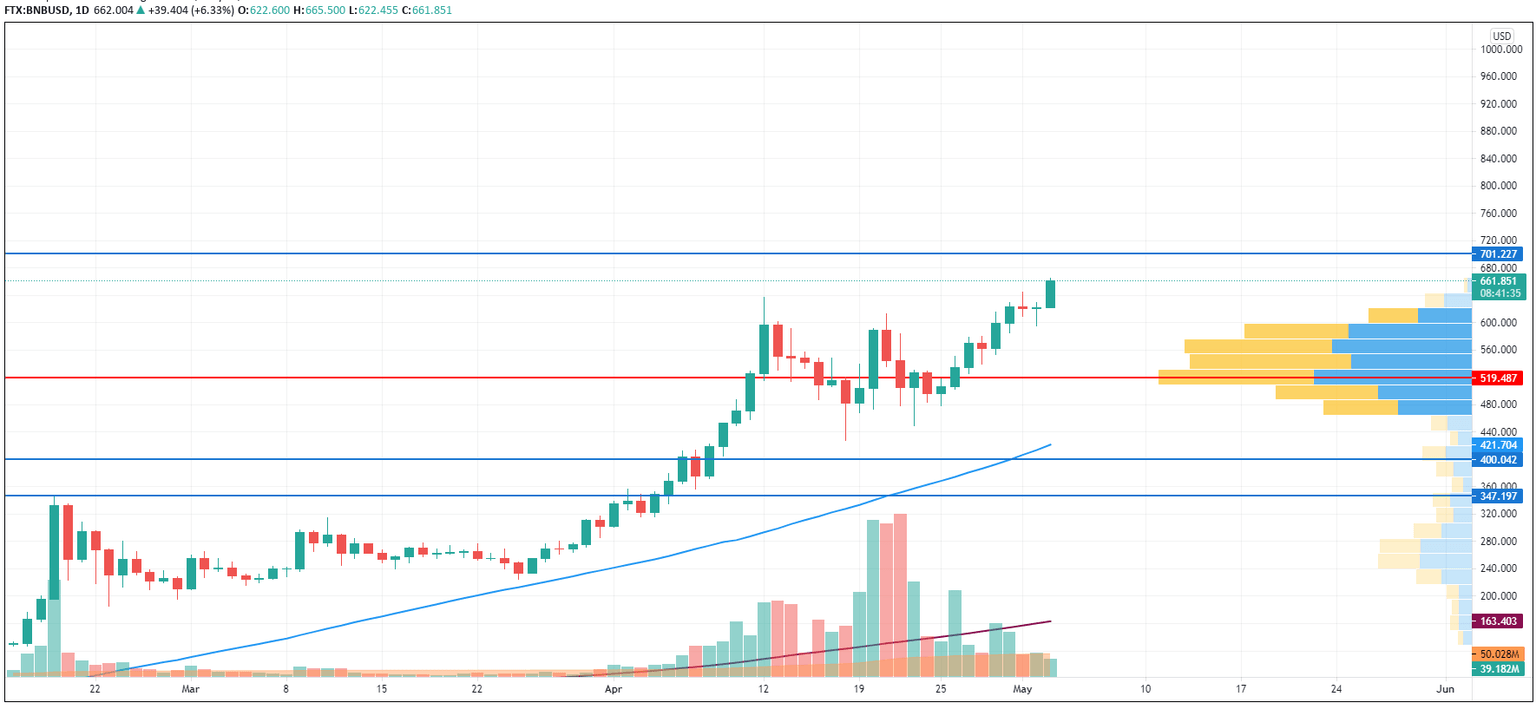

Unlike Cardano (ADA), Binance Coin (BNB) has already accumulated enough power for growth.

BNB/USD chart by TradingView

Binance Coin (BNB) is on its way to the vital $700 mark. However, there might be a slight correction from there as there is not enough power to keep the rise going. If that happens, a drop is possible to the area of the most liquidity at $600.

BNB is trading at $661 at press time.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.