- Algorand price is set to complete a bearish triangle, breaking the monthly S1 support.

- ALGO could be dumped towards $0.30, but expect a significant shift in sentiment as bulls scope up price action.

- A bear trap is thus looming and could see a violent squeeze towards $0.50, pumping up the price by 60%.

Algorand (ALGO) is set to take a step back but then rally a long way with the final removal of a bearish element. After the completion of a bearish triangle, bulls will have the opportunity to jump into price action at significantly discounted prices and then ramp up price by 60% in what will be the largest bear trap and short squeeze in ALGO’s history. If bulls can play their cards right, even an upswing towards $0.60 is possible.

ALGO is set for a short squeeze with bulls likely to crowd the scene

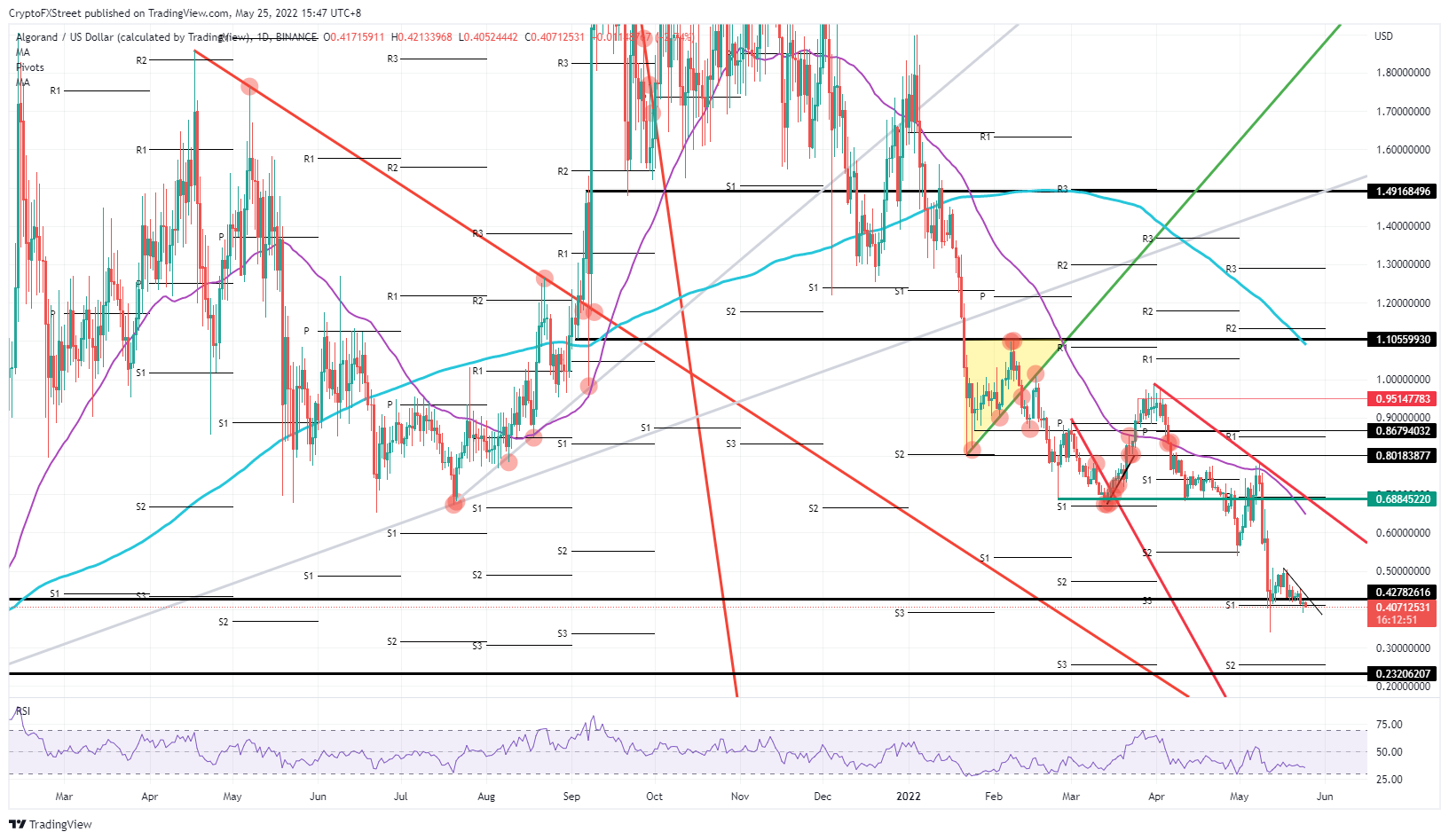

Algorand (ALGO) price is set to complete a bearish triangle – with the descending black trendline from $0.50 as the hypotenuse and the baseline as the monthly S1 around $0.41. This should result in an initial break lower for Algorand price , roughly towards $0.30, with the Relative Strength Index (RSI) breaking back into the oversold area. However, with bears lacking an incentive to rally further, bulls should have a free lunch to get in on the price action, sparking a quick turnaround towards $0.50, from there, breaking back above the bearish triangle and catching bears in a bear trap, that will squeeze them out.

ALGO price will – once it hits $0.30 or even $0.23 – rebound and form a very violent breakout that will slice like a knife through butter back up through $0.30. The critical element here is for traders that are not part of the price action not to chase the move but instead wait for consolidation at $0.50 and enter there for a rally towards $0.65. At that level there is a quadruple technical resistance from the 55-day Simple Moving Average (SMA), the red descending trend line, the monthly pivot and a historic pivotal level from February 24.

ALGO/USD daily chart

At risk is another correction of roughly 45% towards $0.23, which is the last line of defence before a move down below $0.20 and the monthly S2 support level. Although this level is already mentioned in the above paragraph, it would need a quick rebound off that level, in just a matter of minutes. In a case ALGO consolidates at $0.23 and trades at that level for several days, even starts to form a squeeze to the downside, expect then more losses to come.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

SEC Crypto Task Force plans to establish digital asset regulatory sandbox

The Securities & Exchange Commission's (SEC) Crypto Task Force met with El Salvador's National Commission on Digital Assets (CNAD) representatives to discuss cross-border regulation and a proposed cross-border sandbox project.

DeFi Dev Corp buys additional 65,305 SOL amid broader institutional interest: Solana price slides below $150

Solana (SOL) price faces growing overhead pressure and slides below $150 to trade at $148 at the time of writing on Thursday. The sudden pullback follows the crypto market's edging higher on improving investor sentiment, which saw SOL climb to $154 on Wednesday.

Uniswap Price Forecast: UNI whale moves 9 million tokens to Coinbase Prime

Uniswap (UNI) price hovers around $5.92 at the time of writing on Thursday, having rallied 12.8% so far this week. According to Wu Blockchain, data shows that the address potentially related to the Uniswap team, investor, or advisor transferred 9 million UNI to the Coinbase Prime Deposit on Thursday.

Tron DAO announces $70B USDT supply: Here's how TRX price could react

TRON’s USDT circulation just surpassed $70 billion, signaling rising network utility as TRX price approaches a technically significant breakout. On Wednesday, TRON DAO confirmed that the circulating supply of Tether (USDT) on its blockchain has surpassed $70 billion.

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.