Horizen price skyrockets 40% on Coinbase Pro listing

- Coinbase Pro has revealed that it will list Horizen on its exchange on September 15.

- ZEN price surged over 40% after the announcement was made.

- Horizon is gaining momentum, although it still is over 35% down from its all-time high.

Coinbase Pro has announced that it will support the trading of Horizen (ZEN) on the leading cryptocurrency exchange on September 15. Trading of the altcoin will commence on September 16 if liquidity conditions are fulfilled.

Coinbase Pro to support ZEN trading

Coinbase Pro has begun accepting inbound transfers of Horizen to the platform. Once the sufficient supply of ZEN has been reached on the exchange, trading is expected to be launched.

Order books for Horizen will be launching in three phases, starting with post-only, limit-only and full trading. The crypto exchange will support trading pairs denominated in USD, BTC and USDT.

The Horizen blockchain enables privacy-preserving decentralized applications. The network aims to solve scaling and security issues found in networks such as Ethereum.

ZEN was conceived as a hard fork from privacy coin Zcash. The network uses zero-knowledge proofs to make its native currency untraceable and unwatchable for its users. The blockchain believes that any interaction between users should be private.

Horizon is also building privacy solutions for smart contracts as it aims to become a decentralized platform for decentralized application development, as well as private messaging and publishing.

Horizen price captures investor interest

Horizen price has climbed a whopping 43% on September 15, as Coinbase Pro disclosed that it would support the trading of the crypto asset. ZEN appears to be retracing slightly as buying pressure has eased. Should the altcoin be able to find a strong foothold, it could continue to trend higher.

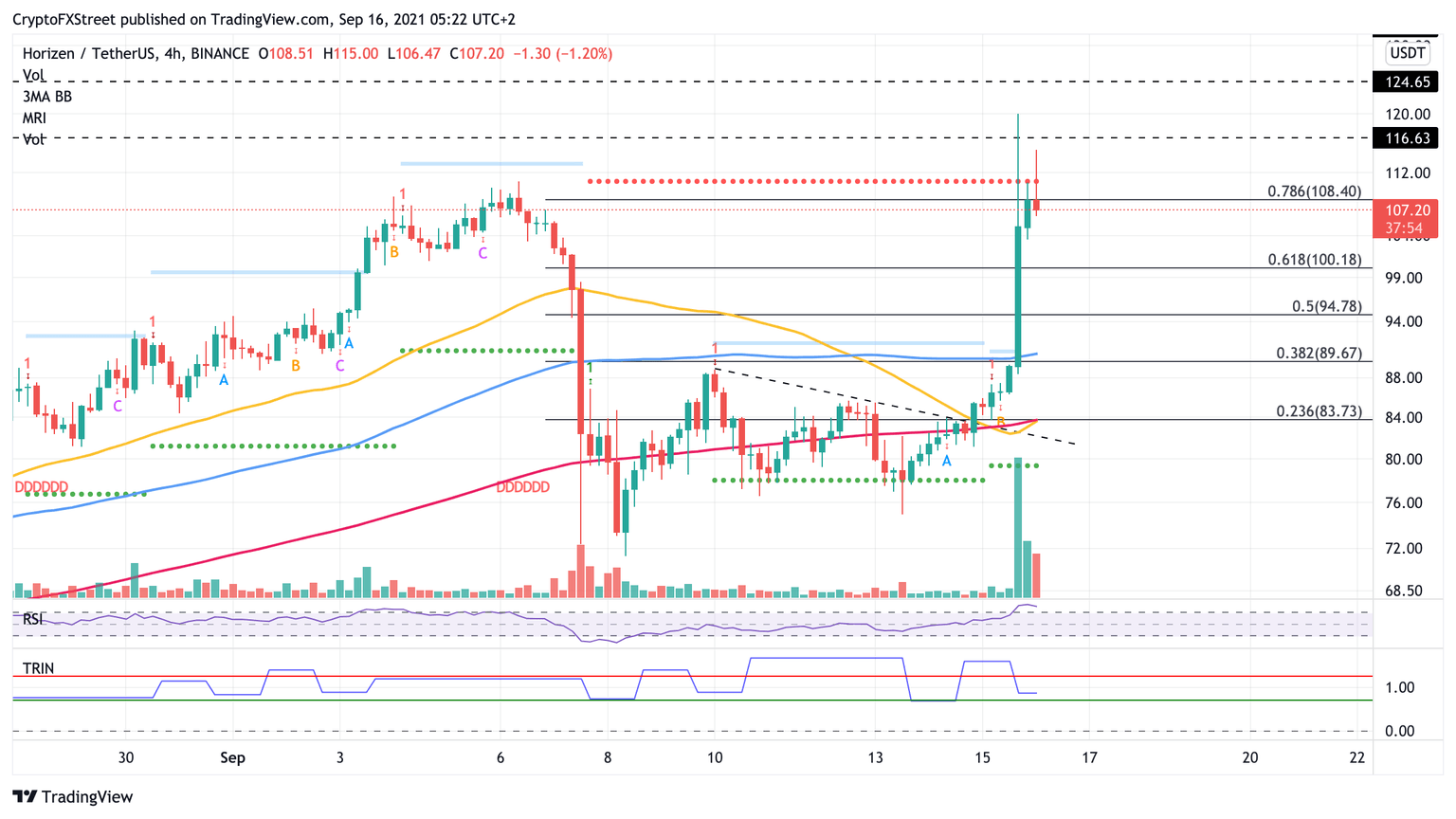

Horizon has faced tough resistance despite the recent push from the buyers at $110, as indicated by the resistance line given by the Momentum Reversal Indicator (MRI). It appears as the 78.6% Fibonacci retracement level currently also acts as an immediate hurdle for ZEN at $108.

ZEN/USDT 4-hour chart

The privacy coin would be able to discover support at the 61.8% Fibonacci retracement level, which sits at $100, and further lines of defense may emerge at the 50% Fibonacci retracement level at $94.

However, should Horizen price surge above the 78.6% Fibonacci retracement level at $108, it would open up the possibility of ZEN reaching a higher high. Further resistance will emerge at $116, the June 3 high, then at $124, the May 30 high.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.