Hong Kong leaves the door open to Ethereum killers Cardano, Solana, AVAX, MATIC and LINK

- Hong Kong Securities and Futures Commission released a general framework for assets to be included in retail transactions on Tuesday.

- In addition to Bitcoin and Ethereum, several Ethereum alternatives like Cardano, Solana, Avalanche, Polygon and Chainlink ranked on the list.

- The introduction of these tokens to retail traders in Hong Kong could intensify competition among Ethereum alternatives.

Hong Kong’s independent statutory body charged with the regulation of the securities and futures market shared a general framework for assets to be included in retail transactions, earlier today.

Several Ethereum alternatives fit the criteria defined by the Hong Kong Securities and Futures Commission (SFC), intensifying competition among these assets.

Also read: Shiba Inu’s Shibarium heats up competition among Ethereum-based blockchains Arbitrum and Optimism

Ethereum alternatives find a place among assets open for retail trade in Hong Kong

The Hong Kong SFC issued conclusions on the consultation papers proposing regulatory requirements for virtual asset trading platforms, earlier today. Non-security tokens with 12 months of no bad record are open for retail trade in Hong Kong. As of now, stablecoins are not allowed.

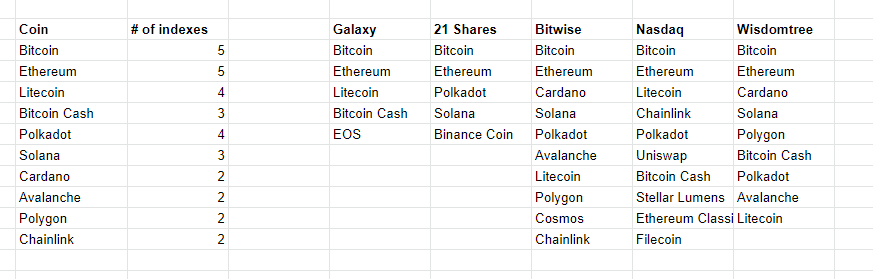

Analysts that evaluated the consultation conclusion released by the Hong Kong SFC explained that the general framework is not much different from the previous one, and requires that the asset be included in the two cryptocurrency indexes as a minimum for retail transactions.

Based on the above criteria, Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Polkadot (DOT), Solana (SOL), Cardano (ADA), Avalanche (AVAX), Polygon (MATIC) and Chainlink (LINK) are most likely to be directly included in retail transactions.

Assets likely to be included for retail transactions

On May 25, the SFC will gazette guidelines for entities engaged in virtual asset trade and apply for relevant licenses. The regulator will accept applications for virtual asset trading platforms starting June 1, 2023.

Competition among Ethereum alternatives to intensify

Besides large market capitalization assets Bitcoin and Ethereum, several alternatives such as ADA, SOL, AVAX, DOT, MATIC and LINK qualified and are likely to be open for retail trade in Hong Kong.

This can be equated with an influx of capital, new traders and on-chain activity to these blockchain networks. Ethereum alternatives are likely to compete for a higher market share, user acquisition and offering traders opportunities with lower transaction costs.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.