HEX Dives 60% on Bitcoin.com as Backlash Builds Over Exchange Listing

Bitcoin (BTC) skeptical cryptocurrency exchange Bitcoin.com Exchange has sparked fresh controversy after supporting an altcoin widely considered to be a scam.

In an article and Twitter post on Dec. 15, officials confirmed that trading of HEX had gone live two days previously.

Wild volatility greets HEX traders

The move makes Bitcoin.com one of the few recognized trading platforms to forge ties with HEX, which together with founder Richard Heart continues to field widespread accusations of fraud.

Explaining the decision, Bitcoin.com claimed it wished to offer security to those looking to trade the coin, which launched earlier this month.

“We are thrilled to announce that we have just listed #HEX by @RichardHeartWin on our exchange, giving anyone who wants to trade it a secure venue to do so. Check it out!” its Twitter announcement reads.

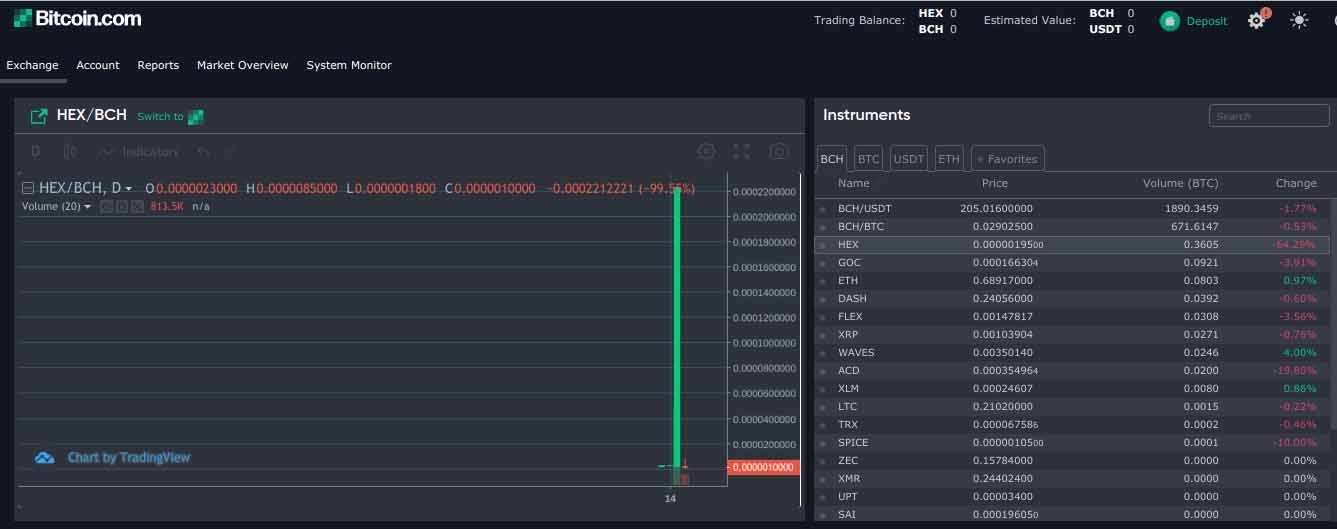

While little overall trading data is available, Bitcoin.com’s HEX markets have traded the equivalent of 0.81 BTC ($5,700) in the past 24 hours. In that period, the platform’s two HEX trading pairs, HEX/BCH and HEX/ETH, have dropped in price by 64% and 57% respectively.

HEX/BCH trading volumes on Bitcoin.com Exchange since launch. Source: Bitcoin.com Exchange

Warnings over HEX founder’s “perpetual self-enrichment”

As Cointelegraph reported, HEX purports to enrich investors by giving away free tokens in return for confirming BTC holdings.

Others purchased tokens using Ether (ETH), with Heart quickly reacting to suspicions that the entire project was being run in a manner that mirrors a pyramid scheme.

Critics point out that Heart, as owner of HEX’s so-called “origin address,” will control around 45% of the entire HEX supply just one year after the launch. This will be achieved by claiming a constant stream of HEX tokens from various types of transactions, while Heart will also keep the ETH from purchases.

“Not only will Richard control close to half of all HEX after the first year, but it is the first token I have seen to have its founder’s perpetual self-enrichment baked into the protocol,” a blog post on HEX by the private researcher known as Goldman Sats summarized on Dec. 7.

Goldman Sats added that Heart seeks to downplay the existence of the origin address, despite its likely status as a giant centralized repository capable of crashing the entire HEX market with a single sell-off.

Controversy continues for Bitcoin.com

Bitcoin.com Exchange, the trading arm of cryptocurrency news outlet Bitcoin.com, already holds a controversial reputation among community participants over its sidelining of Bitcoin, which it calls “Bitcoin Core,” while championing altcoin Bitcoin Cash (BCH).

The company’s owner, Roger Ver, has sought to present BCH as the “real” Bitcoin, arguing the altcoin has better features as a currency.

Rebuttals which have surfaced since BCH’s debut in 2017 include the fact that BCH network participation is overly centralized, and that users would rather hold BTC but spend BCH as soon as possible.

Following the HEX announcement, Twitter users led recriminations against Bitcoin.com, with large numbers of comments voicing disbelief at the decision to launch trading.

“Why would you do this?” the owner of popular cryptocurrency podcast, Colin Talks Crypto, responded.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.