Here’s why Solana can reposition itself as an Ethereum-killer in 2023

- Solana network is ready to position itself as a layer-1 blockchain competitor, according to Coinbase’s latest research report.

- The Ethereum-killer suffered a setback after the collapse of FTX exchange, founded by its most influential supporter, Samuel Bankman-Fried.

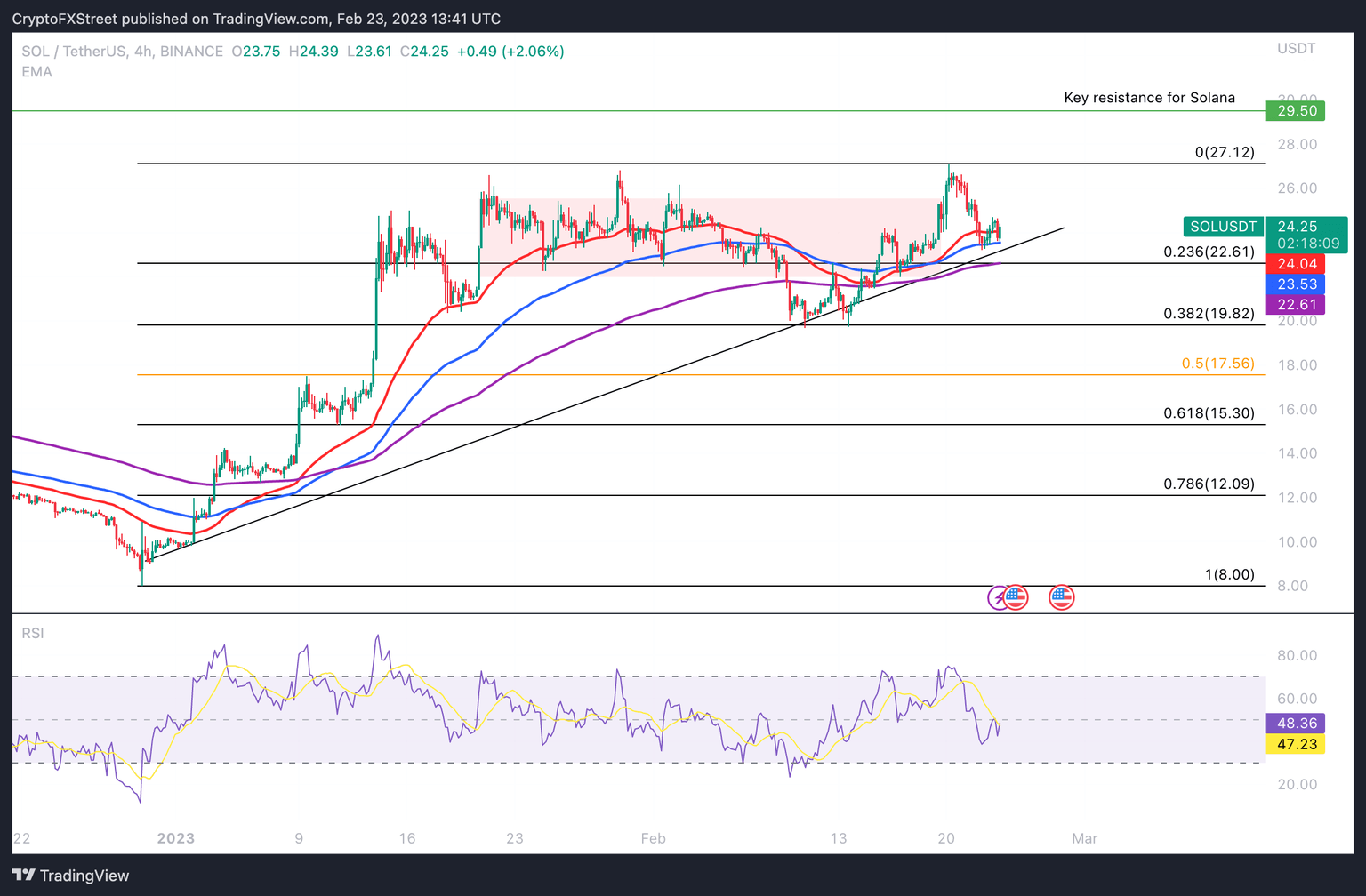

- Solana bulls could push SOL price to the bullish target at $29.50, a 22% rally from the current level.

Solana blockchain is on track to position itself as a layer-1 competitor after months of recovering from the collapse of the FTX exchange and outages on its network. According to a latest Coinbase report, the fundamental value proposition of the Solana protocol persists, from a technical perspective.

Solana survives FTX crash, makes comeback as layer-1 blockchain

Solana, a smart contract network that took a massive hit when Samuel Bankman-Fried’s FTX exchange collapsed, is ready from a technical perspective to compete with layer-1 blockchains. SOL is ready to compete with Ethereum, Avalanche, Cardano and other layer-1 blockchains, according to Coinbase’s latest research report.

Coinbase’s analysts believe that Solana’s fundamental value proposition persists. Coinbase addressed the token’s relationship with the now-defunct FTX exchange and agreed with the project’s founder, Anatoly Yakovenko in that Solana’s linkage with the collapsed trading platform has been overstated.

Brian Cubellis, Coinbase’s analyst, argued that Solana’s blockchain is optimized for high throughput, minimal costs and native scalability. It represents legitimately differentiated approaches taken by layer-1 projects in the crypto landscape.

Solana’s relative strength is visible in network activity and development

Coinbase’s report identified relative strength in the Solana blockchain in terms of network activity with regards to transactions, users and development. Activity on the Ethereum-killer’s network compares favorably to Ethereum, this suggests that Solana may be undervalued relative to ETH, according to the analyst.

Solana’s market capitalization is only at about 4.3% of Ethereum’s while the number of daily active users is 43.7% that of ETH. SOL processes nearly 17 times the transactions on Ethereum network.

What to expect from Solana price?

Solana is positioned for a 22% price rally as the altcoin is in a short-term uptrend. SOL price started its uptrend in the beginning of 2023 and is currently battling resistance at $27.12, as seen in the chart below.

SOL/USDT price chart

Solana price is in the support zone between $23.50 and $25.50, a decline below this level could result in a drop to the 38.2% Fibonacci Retracement at $19.82. It would invalidate the bullish thesis for the Ethereum-killer token.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.