- Cardano price shows promise of an uptrend to $1.26 but its path is sprinkled with significant hurdles.

- A decisive daily candlestick close above $1.35 could trigger a move to $1.60.

- A daily candlestick close below $1 will invalidate the bullish thesis for ADA.

Cardano price has worsened its situation over the past two days and is now trading below a significant level. While recovery is bullish, no doubt, its destination is far away and contains hurdles at every step.

Cardano price goes against the wind

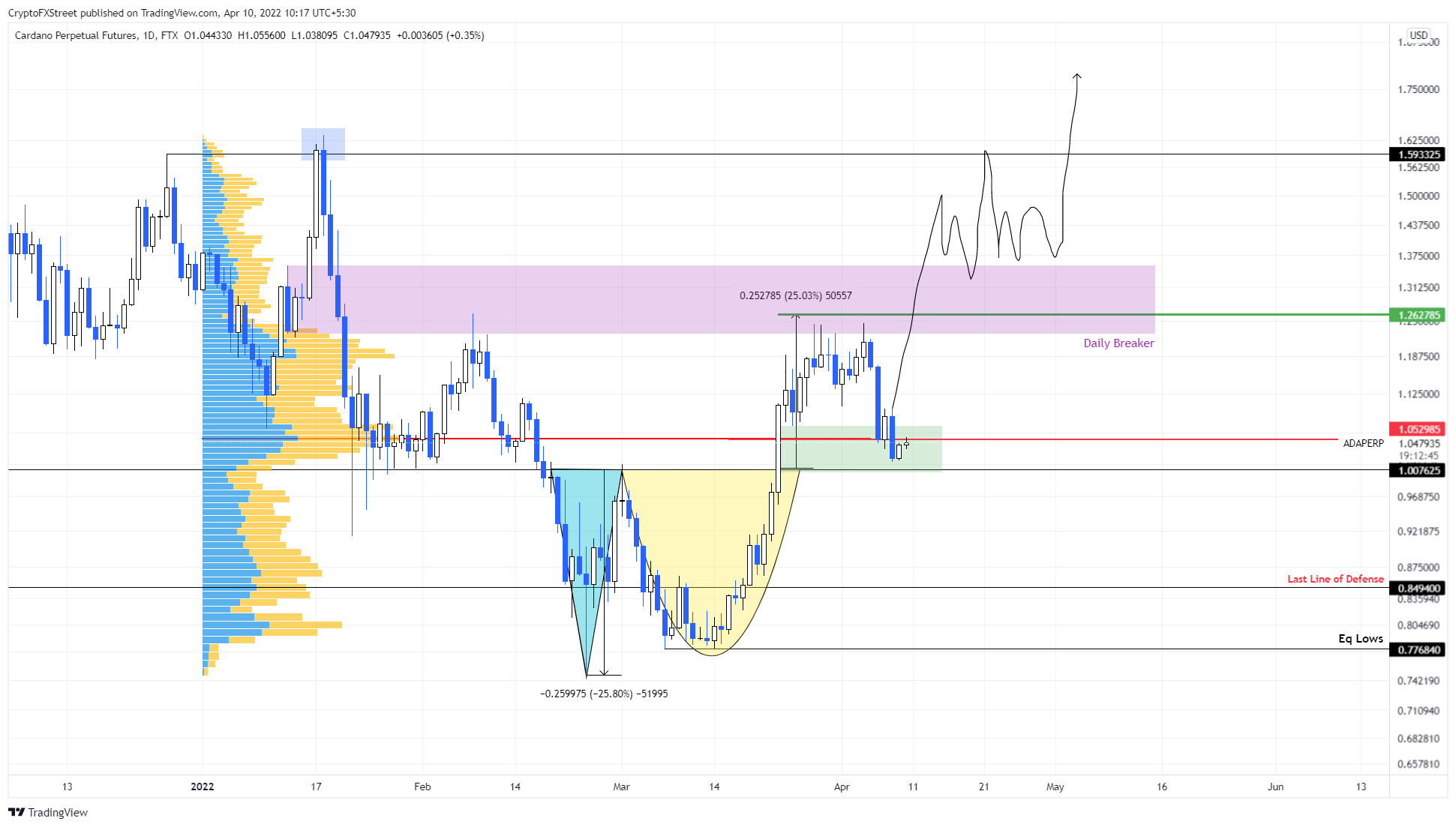

Cardano price action from February 19 to March 23 created a bottom reversal pattern known as Adam and Eve. This technical formation contains a V-shaped valley known as “Adam” followed by a rounded bottom referred to as “Eve”.

A breakout from this pattern indicates a trend change favoring the bulls and forecasts a 25% upswing to $1.26. This target is determined by adding the valley’s depth to the breakout point at $1.

Despite an excellent breakout from the $1 psychological level on March 23, Cardano price failed to tag the forecasted target at $1.26 since it fell short of momentum. Additionally, ADA reversed the trend, retracing to the 2022 volume point of control at $1.05.

Due to the massive volume traded at $1.05, it served as a support for some time, but ADA eventually broke below this and is currently trying to overcome it.

A successful recovery above $1.05 could trigger a run-up to its destination at $1.26. During its second attempt, ADA might try to invalidate the bearish breaker that extends from $1.22 to $1.35 by pushing through it and producing a decisive close above $1.35. However, if the so-called Ethereum-killer can clear the said hurdle, it would open the path for Cardano price to retest the $1.60 hurdle.

ADA/USDT 1-day chart

A daily candlestick close below $1 will produce a lower low and invalidates the Adam and Eve pattern. In such a case, Cardano price could see drowning to 0.85, which is the last life of defense for the smart contract token.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH, and XRP decline as President Trump’s team considers “broader and higher tariffs”

Bitcoin continues its decline, trading below $82,000 on Monday after falling 4.29% the previous week. Ethereum and Ripple followed BTC’s footsteps and declined by 9.88% and 12.40%, respectively.

XRP Price Forecast: Weak demand and rising supply could trigger a downtrend

Ripple's XRP is down 7% on Friday following bearish pressure from macroeconomic factors, including United States (US) President Donald Trump's tariff threats and rising US inflation.

Crypto Today: XRP, SOL and ETH prices tumble as South Carolina moves to buy up to 1 million BTC

Bitcoin price tumbled below the $85,000 support on Friday, plunging as low as $84,200 at press time. The losses sparked over $449 million in liquidations across the crypto derivatives markets.

Hackers accelerate ETH decline following $27 million dump, bearish macroeconomic factors

Ethereum (ETH) declined below $2,000 on Friday following a series of hacks traced to accounts of crypto exchange Coinbase users, which caused a loss of $36 million.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.