Here’s why Cardano price could drop 20%

- Cardano price is attempting a third bullish retest of a key resistance level, but whales’ bet is against the continuation rally.

- ADA could drop 20% to repost the March 11 lows around $0.29.

- The bearish thesis will be whitewashed if the altcoin achieves a daily candlestick close above the $0.39 resistance level.

Cardano price (ADA) kickstarted recovery to retest a key level with a bullish breakout on March 10 when the alt season headlined. However, the destination may not pan out as the altcoin is now experiencing a notable shift in its investor base compared to the previous month.

Cardano price faces a 20% cliff

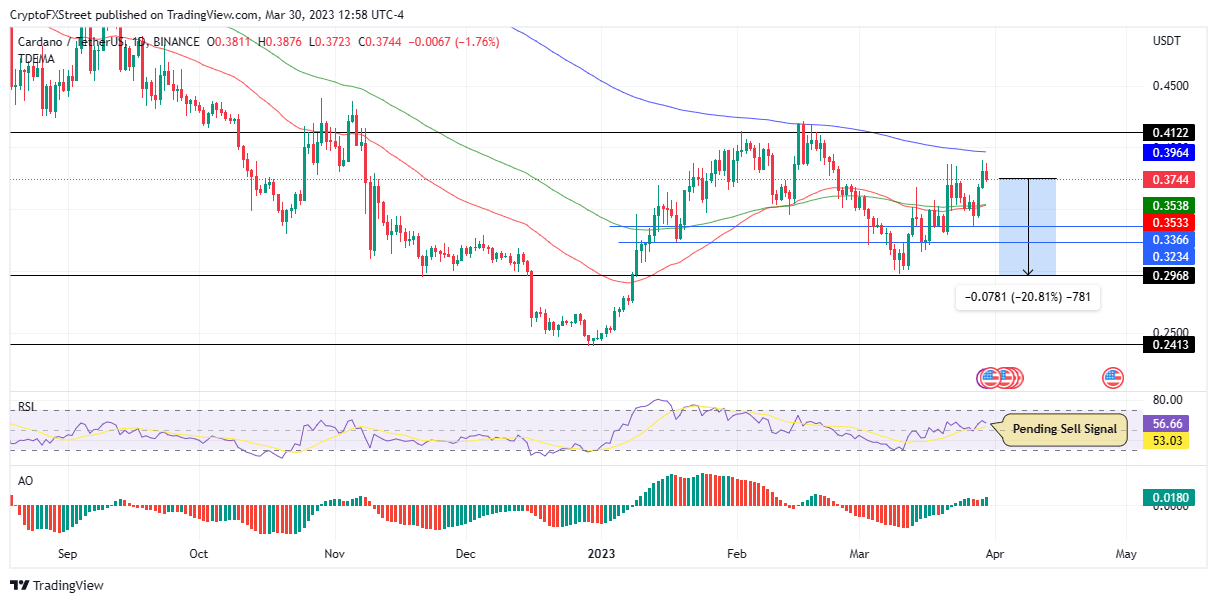

Cardano price has soared around 20% since March 11, but all that ground covered could soon be lost. At the time of writing, the token is auctioning for $0.37 after a rejection from the 200-day Exponential Moving Average (EMA) at $0.39.

An increase in selling momentum from the current price could suppress ADA, causing Cardano price to drop and tag the support confluence between the 100- and 50-day EMA at $0.35. If selling appetite continues below this level or spooked traders hedge their positions, ADA could plunge to tag the $0.33 support level.

In the dire case, Cardano price could shatter the $0.32 support level and extend a leg down to the March 10 lows around $0.29. Such a move would constitute a 20% drop from the current price.

The bearish thesis draws support from the Relative Strength Index (RSI), which had just tipped downwards, route-bound to break below the mean line. This showed that bears were taking control. Notice the pending sell signal on the ADA/USDT one-day chart below. This bearish call would be authenticated once the RSI (purple) crossed below the Stochastic RSI (yellow). If traders heed this call, Cardano price could plummet further. Notice that every time this happened on the chart, it coincided with a red bar to signify a bearish takeover.

ADA/USDT 1-day chart

On-chain metric shows retail investors driving Cardano price, not whales

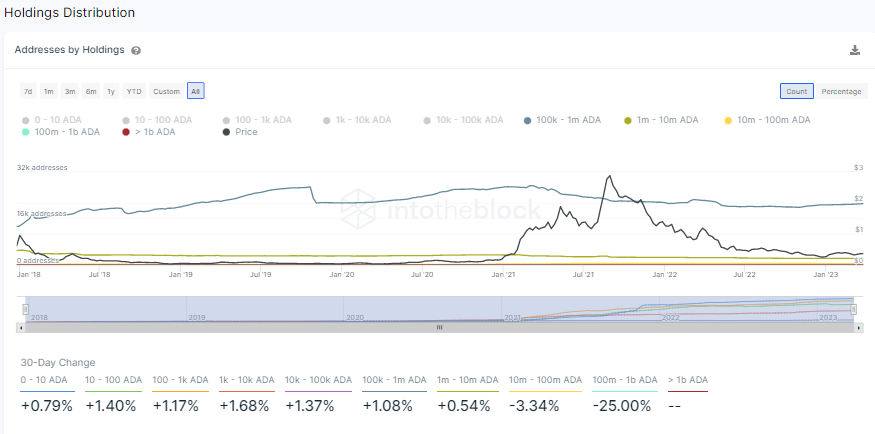

It appears the rally for Cardano price has reached its climax, as ADA whales have started cashing in on the gains made thus far. The market seems to be redistributing wealth between whales and smaller investors, with the latter capitalizing on the recent gains to accumulate more ADA.

Data from IntoTheBlock shows ADA whales and large token holders selling their positions and leaving smaller investors with the bag.

As shown, the number of whales holding between 100 million and 1 billion ADA tokens has plummeted 25% over the last month. There is also a significant drop in the number of whales holding between 10 million and 100 million ADA. All these points to investors not betting on the continuation rally and have resolved to book profits instead.

In contrast, smaller ADA wallet addresses have increased by around 2% in the last 30 days, indicating retail investors are behind the current rally, or sidelined investors are finally coming in.

Conversely, if sidelined investors come into play, Cardano price could increase and tag the resistance level presented by the 200-day EMA at $0.39. A decisive flip of this barricade into support will invalidate the bearish thesis.

In highly bullish cases, Cardano price could increase to tag the $0.41 resistance level, denoting a 10% ascent from the current price.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.