Here’s why analysts have predicted Bitcoin price drop to $28,000

- Sentiment among crypto investors has been “fear” and “extreme fear” for most of 2022, according to the Crypto Fear & Greed Index.

- Bitcoin inflows from private wallets now account for 40% of total inflows across exchanges, signaling a rise in selling pressure.

- Analysts observe Bitcoin recently completed its sixth red weekly candle, and the price could plummet to $28,000.

Amidst the broad crypto market bloodbath, analysts have identified key metrics that indicate further drop in Bitcoin price. BTC price has consistently dropped after hitting an all-time high six months ago, hinting at the possibility of crypto winter.

Bitcoin price could bleed as crypto winter arrives

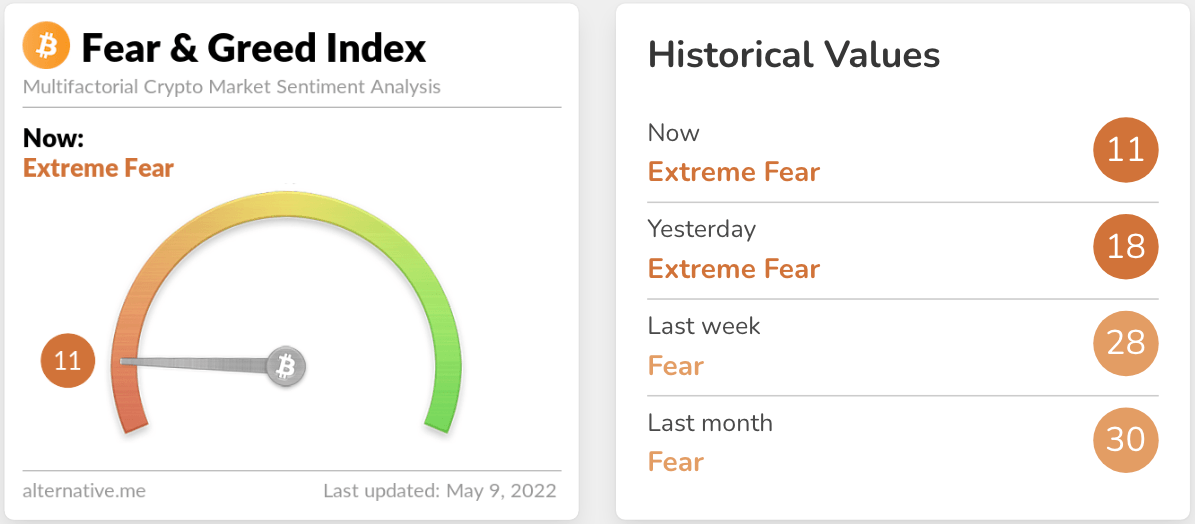

The “Crypto Fear and Greed Index” by Alternative.me is considered a key indicator of investor sentiment. The indicator compiles data on volatility, market momentum, social media surveys, Bitcoin dominance and trends.

The sentiment, therefore, reflects the attitude of investors towards a cryptocurrency. Since sentiment can influence traders, it is used for short-term price predictions.

The index reveals for a large portion of 2022, the sentiment in market participants has been “fear,” and “extreme fear.”

Crypto Fear & Greed Index

The sentiment has remained largely unchanged since January 2022, alongside a general slump in sentiment on stocks. A prolonged period of falling prices and negative market sentiment is indicative of crypto winter.

In early 2018, crypto winter set in, Bitcoin price plummeted 85%, and altcoins continued to bleed. Lark Davis, a leading crypto analyst, recently observed that Bitcoin closed its sixth consecutive red candle. The last time this occurred was in 2014, ahead of a Bitcoin bear market.

#bitcoin has just completed its 6th red weekly candle.

— Lark Davis (@TheCryptoLark) May 9, 2022

The last time this happened was 2014!

That's crazy man! pic.twitter.com/kWdBiPA5th

The source of Bitcoin inflows to exchanges is another critical metric used to identify an upcoming trend reversal or a shift in trader sentiment. Inflows from private wallets were lower than 10% across exchanges. This number has hit 40% with a massive spike in exchange BTC inflows from private wallets.

Philip Gradwell, chief economist at Chainalysis, believes this metric reveals that there is a rise in selling pressure on Bitcoin across exchanges.

Private wallets are now 40% of exchange bitcoin inflows rather than the typical 10%, which means there is a lot of extra sell pressure - and it is a similar story for ETH... pic.twitter.com/Vxfj7fF8p7

— Philip Gradwell (@philip_gradwell) May 9, 2022

Peter Brandt, legendary veteran trader recently predicted Bitcoin price drop to $28,000. While analysts like @rektcapital believe Bitcoin price could plummet lower, @Nebraskangooner, advisor at PrimeXBT, argues Bitcoin price could recover if the asset sustains above the $32,000 support level. The analyst notes that, for now, Bitcoin price is at lower support areas.

Everyone still super bearish calling for $28k.

— Nebraskangooner (@Nebraskangooner) May 9, 2022

Yes it could happen.

But we just dropped straight from $43k and $32,000 was my lower support so I'm not going to be uber bearish unless we break through that.

For now we assume we're at lower support areas.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.