Here’s what to expect from Solana price after OpenSea integration

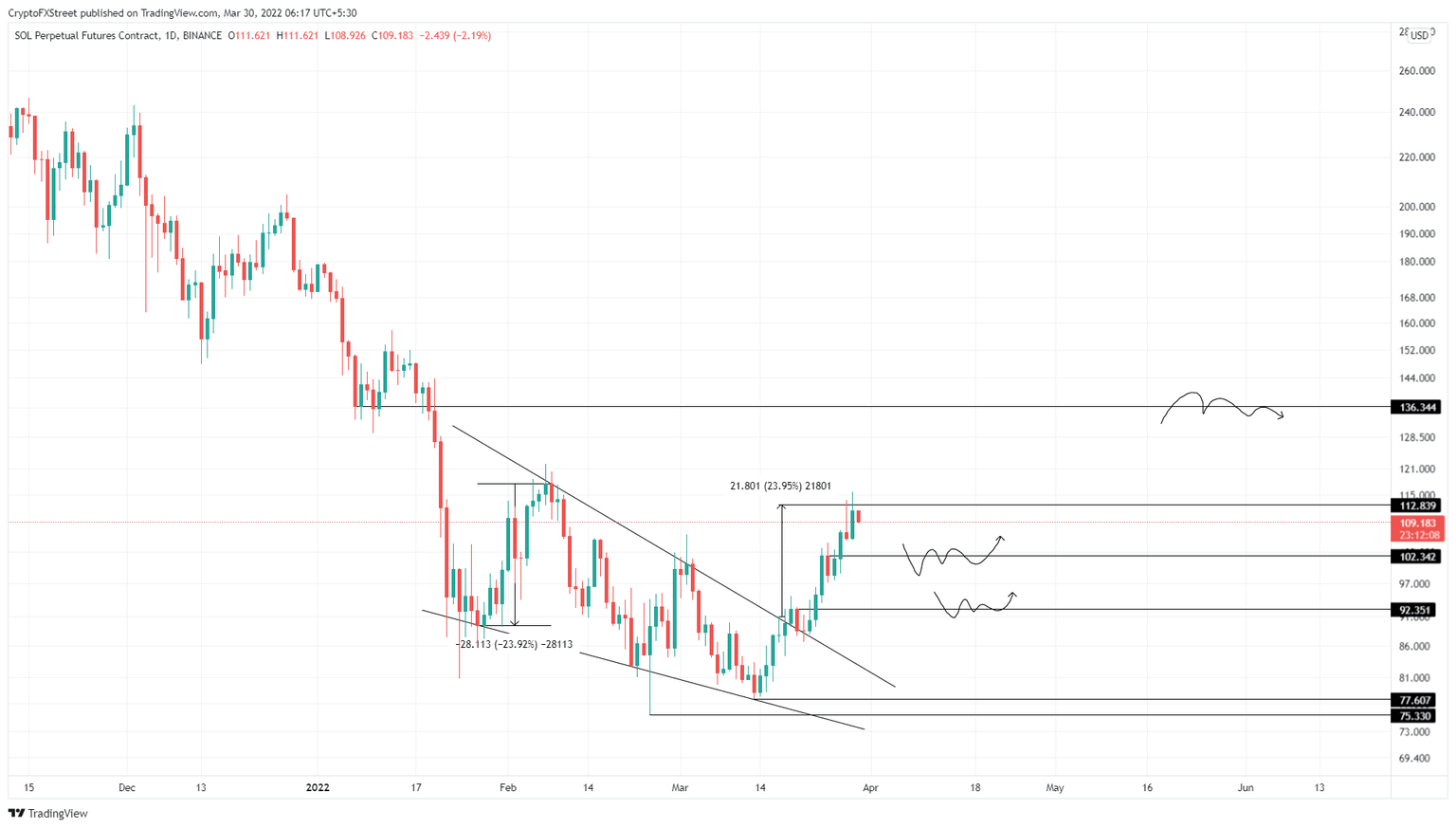

- Solana price shows signs of exhaustion after the recent 24% upswing.

- Investors should note SOL could trigger another run-up to $136 after a minor retracement.

- A daily candlestick close below $77.61 will invalidate the bullish thesis.

Solana price is on the verge of setting up a swing high around a crucial resistance barrier, suggesting that a reversal is likely. This move could be foreshadowing a retracement before the next leg-up, especially after OpenSea, one of the biggest NFT platforms announced support for Solana NFTs.

OpenSea is mostly known for its NFTs based on Ethereum but the recent addition makes SOL the fourth blockchain to receive support after Polygon and Katlyn.

The best kept secret in web3 pic.twitter.com/xuZn64cZ4U

— OpenSea (@opensea) March 29, 2022

Solana price ready for a minor retracement

Solana price action from January 24 to March 18 set up a falling wedge pattern. This setup forecasted a 21% upswing to $112, which SOL achieved in less than two weeks. Now, the so-called “Ethereum-killer” seems ready for a minor retracement.

As investors continue to book profits, there is a good chance SOL will pull back to the immediate support level at $102.34. If the buyers make a comeback here, a new leg-up will originate, but the probability of this outcome is dependent on BTC.

If the big cryptic continues to chop, then there is a good chance the next rally will emerge. However, if the Bitcoin price continues to drop and fill the inefficiencies below, the Solana price will promptly follow.

In such a case, the $92.35 level seems like a good support level to count on sidelined buyers to come out of the woodwork and trigger a reversal for Solana price. Regardless of where the next rally originates, the upside for SOL seems to be limited to a significant resistance barrier at $136.

SOL/USDT 1-day chart

Regardless of the bullishness among altcoins, if Bitcoin pulls a 180, there is a good chance altcoins including Solana price will take a turn to the downside.

A daily candlestick close below $77.61 will invalidate the bullish thesis for Solana price by producing a lower low. This development could see SOL drop to the February 24 swing low at $75.33. Here, buyers can regroup and attempt another run-up.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.