Here’s what to expect from MATIC price as Polygon asserts dominance in Ethereum scaling solutions

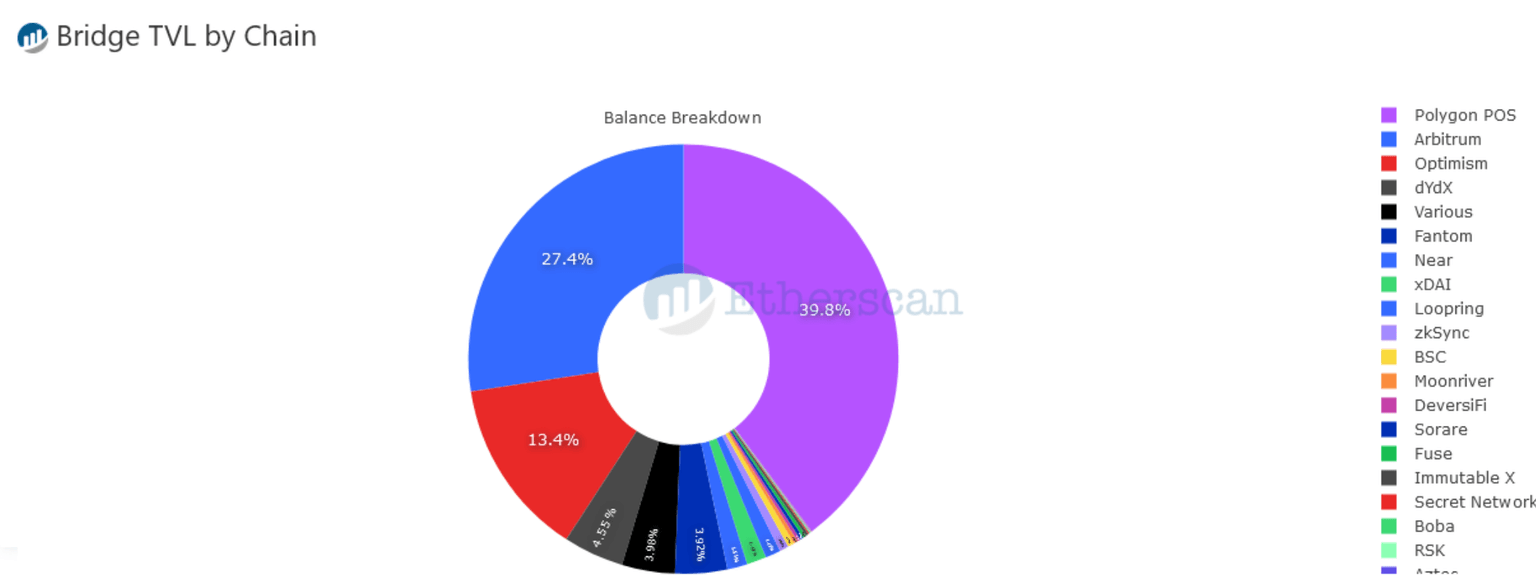

- Polygon bridges have asserted their dominance with $2.18 billion of assets locked in the Ethereum-Polygon ERC-20 bridge.

- The value of assets locked in Polygon bridges is nearly twice that of Arbitrum, a layer-2 Ethereum scaling solution.

- MATIC price is on track to breakout of a symmetrical triangle on the 1D price chart with a target of $2,474.

Polygon, the Ethereum scaling solution is competing with Arbitrum and other layer-2 protocol’s bridges, asserting its dominance in the ETH ecosystem. The Ethereum scaling solution is on track to witness a bullish breakout from a symmetrical triangle pattern according to technical analysis of the Polygon token MATIC’s price chart.

Also read: Jim Cramer warns investors to stay away from crypto: another buy signal for Bitcoin?

Polygon dominates Ethereum scaling solutions with high value of assets locked

Polygon, the layer-2 scaling solution for the Ethereum network has asserted its dominance among other protocols. The Polygon-Ethereum bridge is a system that allows for the transfer of assets between the Ethereum mainnet and the Polygon (formerly known as the Matic) network. It enables users to move assets, such as ERC-20 tokens, from the Ethereum mainnet to the Polygon network, where they can be used in faster and cheaper transactions.

The Polygon-Ethereum bridge has $2.18 billion worth of assets locked. This is nearly twice the value of assets locked between the Ethereum-Arbitrum bridge which stood at $1.36 billion. Polygon’s bridge has established its dominance.

Polygon Ethereum bridge

MATIC price is on track to hit the $2,474 target

MATIC, the native token of the Polygon network, is currently trading within a symmetrical triangle. As seen in the chart below, MATIC is on track to witness a bull run to the $2,474 target. Using the Bulkowski Measure rule, the symmetrical triangle’s upward breakout target is $2,474, after taking the difference between A and B and adding it to the 58% percentage meeting price target for an upward breakout.

MATIC/USDT price chart

The Relative Strength Index (RSI) momentum indicator reads 64.32, it is below the overbought level of 70. This implies there is room for MATIC price to climb higher.

However, a drop below the lower trendline forming the symmetrical triangle, or the confluence of the 50-day and 200-day Exponential Moving Averages (EMAs) could invalidate the bullish thesis for MATIC.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.