Here’s the list of crypto exchanges that will support Terra’s LUNA hard fork

- Binance, HitBTC, Huobi and Bitfinex are the leading cryptocurrency exchanges working with Terra on the launch of LUNA 2.0, Terra hard fork.

- LUNA price could wipe out losses incurred by holders in the colossal crash of LUNC and UST.

- Exchanges have thrown their weight behind Do Kwon’s proposed rebirth of Terra network and the upcoming airdrop for LUNA and UST holders.

Cryptocurrency exchanges are on board Terra’s LUNA hard fork and Do Kwon’s plan for the Terraform Labs token’s rebirth. Do Kwon has garnered support from leading cryptocurrency exchanges for the new Terra chain.

Also read: Terra’s recovery plan continues despite South Korean authorities pressure on Do Kwon

Crypto exchanges welcome Terra’s LUNA chain

Terraform Labs’ sister tokens LUNA and UST witnessed the first “crypto bank run '' in history after the algorithmic stablecoin depegged. Co-founder Do Kwon wasted no time in coming up with a revival plan for LUNA, without UST, proposing a new chain.

While the community has criticized the hard fork, Terraform Labs considers it a “genesis”, birth of a new Terra LUNA chain that does not share history with the previous blockchain.

Cryptocurrency exchanges that previously delisted or pulled support for Terra’s LUNA, during the event of the crash have welcomed the new chain. The world’s largest cryptocurrency exchange Binance was among the first few platforms to delist Terraform Lab’s tokens from the futures exchange.

Binance recently revealed that they are working “closely” with Terra on the LUNA 2.0 recovery plan.

The Terra community just passed a vote to ‘Rebirth Terra Network’.

— Binance (@binance) May 25, 2022

We are working closely with the Terra team on the recovery plan, aiming to provide impacted users on Binance with the best possible treatment. Stay tuned for further updates.

Changpeng Zhao (CZ), the CEO of Binance has previously criticized the collapse of stablecoin UST and the negative impact on the crypto ecosystem. However, keeping in mind the best interests of the community of LUNA and UST holders, the exchange has come forward, and welcomed the LUNA 2.0 chain and token.

In the last 24 hours, Huobi, Bitfinex, Bitrue, HitBTC and FTX have all announced their intention to welcome Terra’s LUNA 2.0 and support the new version of the blockchain.

Huobi Will Support the #Airdrop of $LUNA and $UST.https://t.co/29qsZZ1tfQ pic.twitter.com/eBpviLvgsc

— Huobi (@HuobiGlobal) May 26, 2022

FTX will support new LUNA airdrop and suspend LUNA and UST markets.

— FTX (@FTX_Official) May 26, 2022

Details here: https://t.co/1tTdM4q4li pic.twitter.com/ElU7gKSJar

Coinbase pulls support for new Terra chain after LUNA price crash

While leading cryptocurrency exchanges announced support for Terra’s hard fork, Coinbase’s infrastructure arm revealed that no new LUNA chain would be supported.

1/ Through speaking with customers and ecosystem participants, we are making a tough decision to wind down support for the Terra ecosystem. We are discontinuing support for the existing Terra chain and are not planning to support a potential new Terra chain at this time.

— Coinbase Cloud (@CoinbaseCloud) May 20, 2022

The exchange has no plans to support Terra 2.0 at this time. Interestingly, the exchange suspended trading in UST and WLUNA on May 27, the day of Terra’s rebirth.

Coinbase suspends UST and WLUNA trading

Who will receive LUNA 2.0 after the hard fork

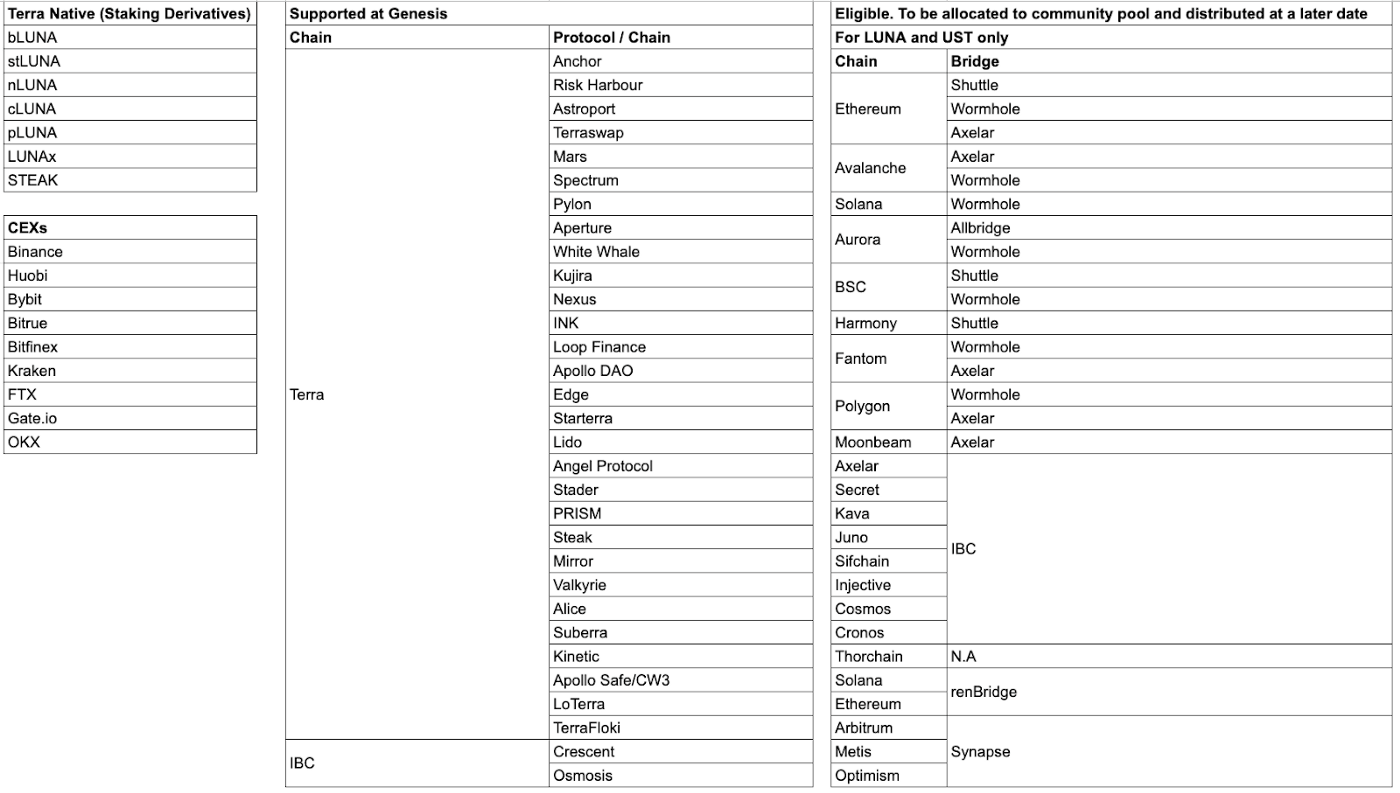

At Terra’s genesis the following chains, bridges and centralized exchanges have announced support for the airdrop. Users with their LUNA and/or UST on these platforms can expect an airdrop of LUNA 2.0.

List of Chains, Bridges, & CEXs supporting Terra 2.0 airdrop at Genesis

What you need to know about Terra 2.0

After its rebirth, Terra 2.0 will be joined by projects from Terra Classic. A confirmed list of projects is:

- Astroport

- Prism

- RandomEarth

- Spectrum

- Nebula

- Cosmos

The new network will inherit the community of developers and users. Funds will be distributed to pre and post attack LUNA and UST holders, set aside and locked in community pools, at Genesis.

Terra 2.0 will abandon the history of transactions from the old Terra chain, the Classic. All LUNA (set aside for airdrop) will be automatically staked to Terra validators to preserve network security. Users can reap staking rewards or unbond their tokens.

After unlocking the first 30% of their tokens, users will not receive any additional LUNA until six months later, this is a 6-month cliff.

Terra 2.0 launch is accompanied by a big move in Binance Coin

Cryptocurrency analysts at FXStreet have identified a possible big move in Binance Smart Chain’s token BNB. Though Binance Coin is still within the corrective trend channel, analysts have set a bullish target for BNB price recovery.

Watch this video for more information:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.