Tether could shock the commercial paper and US short-term securities market

- With its rapidly growing market capitalization, one-to-one stablecoins are competing with short-term debt products.

- Fitch analysts believe that the current growth rates and reserve allocations imply that stablecoins could emerge as a key investor group.

- Stablecoin-related turbulence could have a direct impact on the commercial paper market and transmit shocks to other areas.

Tether was recently slapped with $41 million in fines by the CFTC for misleading statements on its one-to-one stablecoin reserves. Analysts at a leading credit rating agency examine Tether’s negative impact on the short-term debt market.

Stablecoins could pose risks to securities and short-term debt market, Fitch analysts argue

A major American credit rating agency warns that one-to-one stablecoins like USD Tether could put securities markets at risk. Fitch Ratings was quoted in a recent report:

Stablecoin-related turbulence could both affect the CP [commercial paper] market itself and transmit shocks to other market participants.

Stablecoin issuers are considered within the anti-fraud jurisdiction of the CFTC, and the enforcement action against Tether was founded on the belief that stablecoins pose risks to the US economy.

Fitch Rating analysts believe that stablecoins are likely to become increasingly relevant in short-term credit markets. The rising market capitalization of stablecoins has proportionately increased investment in short-term securities, such as commercial paper (CP).

At the end of June 2021, Tether held 49% of its reserves in CP and commercial deposits (CD), according to the Fitch Ratings stablecoin dashboard. Stablecoins rapidly invest in money market instruments like corporate bonds, funds and, potentially, precious metals.

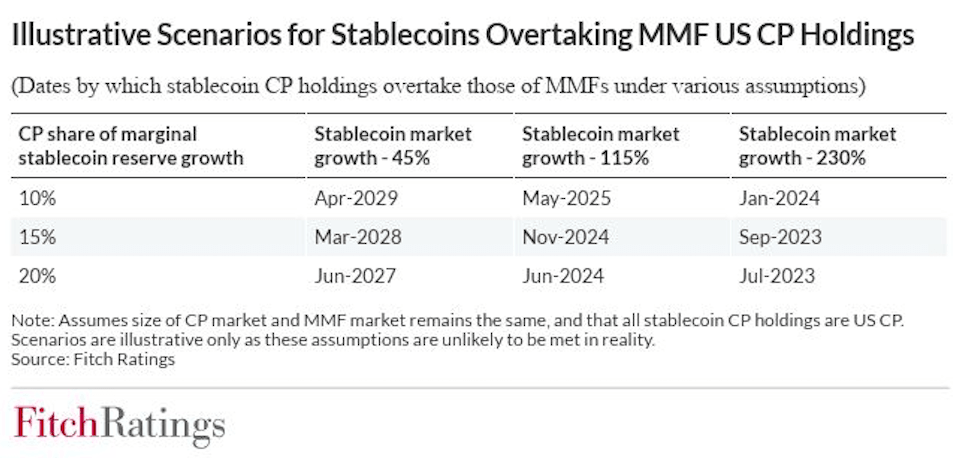

Fitch Ratings illustrative scenarios for stablecoins overtaking commercial paper holdings.

The use cases for stablecoins may expand over time with an increase in regulatory clarity. When stablecoins gain more traction, analysts expect that their contribution to CP and CD markets will rise.

Analysts argue a hypothetical scenario in which rapid stablecoin expansion (with 20% of marginal stablecoin reserves growing into the commercial paper market) could overtake money market funds by mid-2023. Analysts have stressed that the calculation is illustrative only. In other words, it is not a forecast or prediction.

Stablecoin’s growth is volatile, and the lack of transparency on the nature of the holdings of reserves makes it challenging for experts to make a forecast or prediction. Unless regulatory requirements on stablecoin reserves are introduced, stablecoin influence on short-dated government debt is expected to be significant.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.