- Ethereum whales continue accumulating SHIB in vast quantities, and Shiba Inu ranks as most traded by top 100 whales.

- The largest Ethereum whales hold $635.6 million worth of Shiba Inu tokens in their wallets.

- Shiba Inu price could rebound from the 38.2% Fibonacci retracement level and make a comeback to $0.00001239.

Ethereum whales continued their accumulation of Shiba Inu, the second-largest meme coin in the ecosystem. Shiba Inu (SHIB) ranks in the top ten most traded cryptocurrencies among 100 largest whales on the Ethereum blockchain. This could fuel a bullish narrative for SHIB and drive the meme coin’s price higher.

Also read: Here’s what Bitcoin, Ethereum prices need for an explosive rally following US PPI release

Ethereum whales hunt massive gains in Shiba Inu

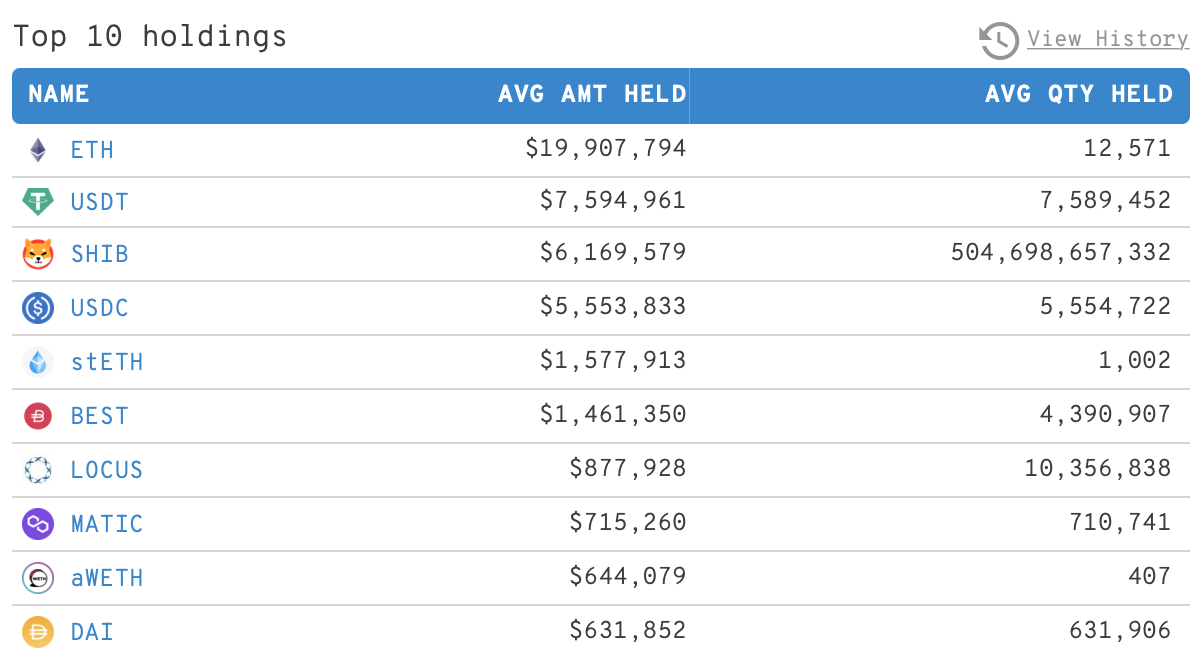

Shiba Inu ranks in the top 10 traded tokens by the Ethereum network’s 100 largest wallet investors. Shiba Inu is the third largest token held by Ethereum whales, after ETH and the stablecoin Tether (USDT).

The 100 largest whales on the Ethereum network hold an average of $6.16 million worth of SHIB, in 504.69 billion SHIB tokens.

Ethereum network’s 100 largest ETH whales

Based on data from crypto aggregator Whalestats, Shiba Inu is the token with the biggest position by US Dollar value. Whale activity recently hit a peak, on January 17. A spike in whale activity is usually considered bearish for the asset’s price, however, Shiba Inu is at a critical level and experts predict a recovery in the Dogecoin-killer.

Shiba Inu price prepares for recovery after recent decline

Shiba Inu, the second-largest meme coin in the crypto ecosystem, broke out of its long-term downtrend on December 29. This marked the end of the Month-on-Month downtrend for the Dogecoin-killer.

SHIB failed to cross resistance at the 50% Fibonacci retracement level in its uptrend the 1D price chart. On the 4H price chart, Shiba Inu nosedived from the 50% Fibonacci retracement level.

SHIB/USDT price chart

Relative Strength Index (RSI), a momentum indicator reads 71.20, meaning SHIB is in the oversold territory and traders are advised not to open any fresh longs. If it falls below the 70 level it will be a signal to sell and might indicate the start of a pullback. Shiba Inu’s 50-day Exponential Moving Average (EMA) crossed above the 200-day EMA, in a bullish “Golden Cross” on the price chart on January 10, 2023.

With the recent decline in whale activity on the Ethereum blockchain, Shiba Inu could rebound from the drop in its price and hit the $0.00001250 level.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.