- Ethereum tokens that are out of circulation hit a new all-time high of 18.87 million, following the Shapella upgrade.

- Spike in volume of Ether out of circulation signals the likelihood of recovery in ETH and a reduction in selling pressure on the altcoin.

- Experts believe Ethereum price could hit the bullish target of $1,925 once it begins its recovery.

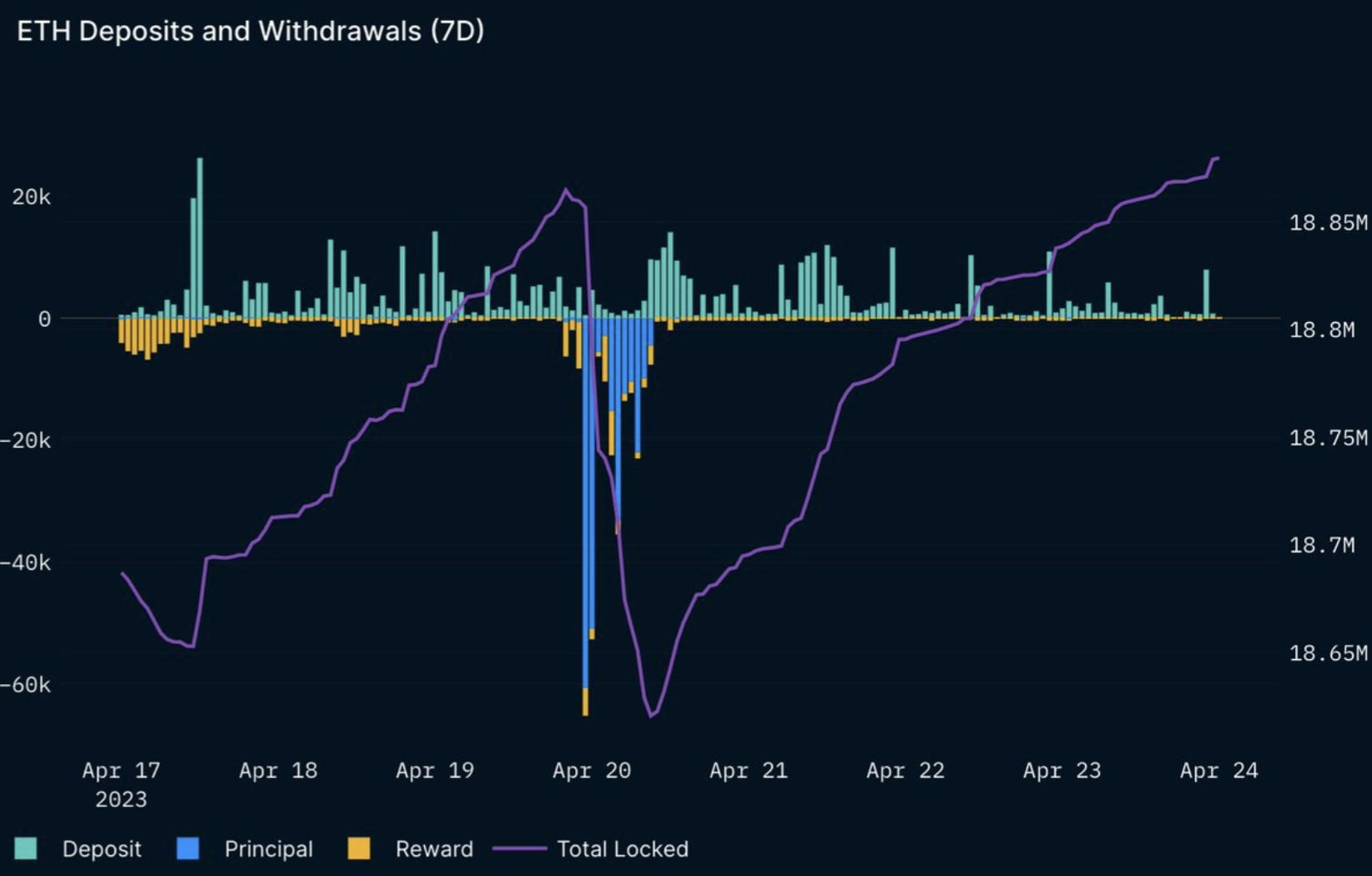

Ethereum tokens being pulled out of circulation have hit a new all-time high based on data from crypto intelligence tracker Nansen. Following the Shapella upgrade, Ethereum locked out of circulation hit 18.87 million ETH.

Also read: Meme coin traders hunt for the next PEPE, ape into low market cap projects for gains

Ethereum locked out of circulation hits record since Shapella

Ethereum recently wiped out all its gains since the Shapella upgrade. Based on data from crypto intelligence tracker Nansen, total ETH locked out of circulation, which includes staked ETH, the altcoins deposited to the contract but not validated yet and the rewards on the contract have together exceeded 18.87 million, a new all-time high.

Ethereum deposits and withdrawals

This is a key metric since Ether that is pulled out of circulation reduces the selling pressure on the altcoin. It indicates decline in exchange wallet reserves and supports a bullish thesis for the asset.

Will Ethereum recover its losses?

A spike in ETH locked out of circulation fuels the thesis for Ethereum price recovery. Experts believe the altcoin is primed to recover its gains. Interestingly, ETH price has nosedived below $1,850, reducing the percentage of holders profitable at the current price level. This is likely to discourage traders that are sitting on unrealized losses, from shedding their ETH holdings.

As seen in the price chart below, Ethereum is currently in a short-term uptrend that started in December 2022. The altcoin hit a peak at $2,138 before receding to critical support at $1,851. If buying pressure sustains and volume of ETH locked continues climbing higher, Ether is likely to recover and make a comeback above $1,925, a level that coincides with the 10-day Exponential Moving Average (EMA).

ETH/USDT 1D price chart

Ether price is steady above the 50-day and 200-day Exponential Moving Averages at $1,829 and $1,654 respectively. Bullish targets for Ether are resistance at $1,925, and $2,023, followed by the April 2023 peak of $2,138. A decline below the 50 and 200-day EMAs could invalidate the bullish thesis for Ethereum.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC remains calm before a storm

Bitcoin price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday. A K33 Research report explains how the markets are relatively calm and shaping up for volatility as investors absorb the tariff announcements.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

Ethereum Price Forecast: Whales increase buying pressure as developers set April 30 for Pectra mainnet upgrade

Ethereum developers tentatively scheduled the Pectra mainnet upgrade for April 30 in the latest ACDC call. Whales have stepped up their buying pressure in hopes of a price uptick upon Pectra going live on mainnet.

BTC stabilizes while ETH and XRP show weakness

Bitcoin price stabilizes at around $87,000 on Friday, as its RSI indicates indecisiveness among traders. However, Ethereum and Ripple show signs of weakness as they face resistance around their key levels and face a pullback this week.

Bitcoin: BTC remains calm before a storm

Bitcoin (BTC) price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.