- Dogecoin price is forming an inverse head-and-shoulders pattern, which projects a 55% crash to $0.137.

- Transactional data shows increased sellers pushing DOGE to immediate support, coinciding with $0.137.

- Social volume has seen a massive distribution to other meme coins, which might have triggered capital outflow.

Dogecoin price has been in a downtrend since the second week of May and has failed to establish a convincing swing high. However, DOGE price action from April 15 to date shows the formation of a bearish pattern that projects a massive downside.

On-chain metrics point to failing support levels that could flip to resistance, further credence to the bearish thesis.

Dogecoin price hints at continuation of bearish setup

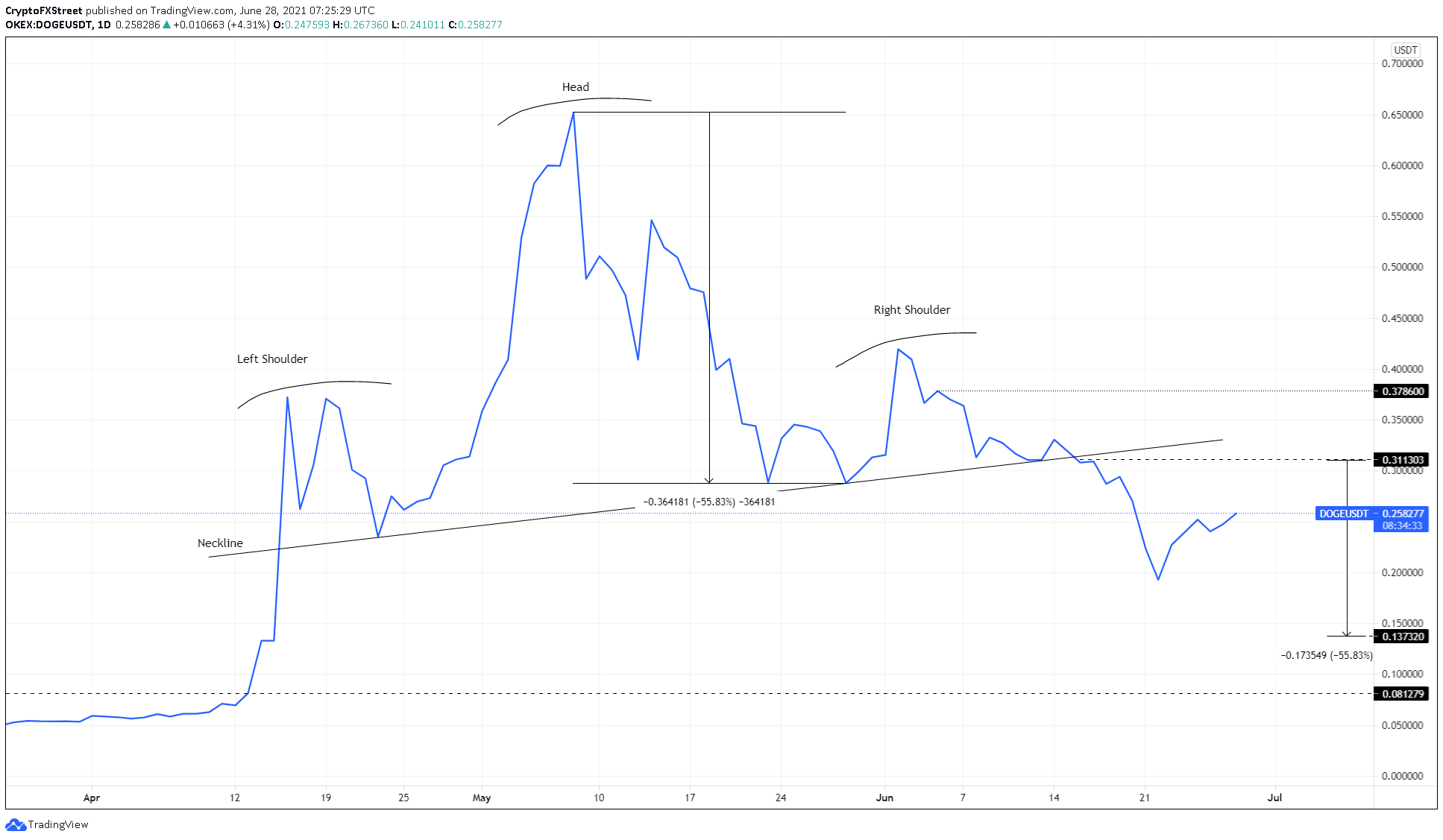

Dogecoin price is in a multi-month inverse head-and-shoulders pattern. This technical formation contains three distinctive peaks. The one in the middle is typically higher than the other two and forms the “head.” The slightly lower swing highs of equal height create the “shoulders.”

DOGE price sliced through the trend line connecting the swing lows of the peaks, known as the “neckline” on June 15, signaling a breakout.

This setup’s target is obtained by measuring the distance between the head and the neckline and adding it to the breakout point at $0.311, which puts Dogecoin price at $0.137.

Although the meme coin has already crashed 38% since the breakout, the recovery has pushed Dogecoin price closer to the neckline. However, the possibility of a further downswing cannot be ignored, at least from a technical perspective.

Therefore, a potential spike in selling pressure that pushes DOGE to produce a lower low below $0.193 will signal the continuation of the downswing toward the projected target at $0.137. This move would represent a 45% crash from its current position, $0.258.

DOGE/USDT 1-day chart

Transactional data hints at losing support level

The IntoTheBlock’s Global In/Out of the Money (GIOM) model adds credence to the bearishness displayed from a technical standpoint. This on-chain metric reveals that roughly 124,000 addresses that purchased 8.61 billion DOGE at an average price of $0.261 will be “Out of the Money” if the meme-themed cryptocurrency produces a decisive close below $0.242.

If this were to happen, panicking investors might sell their holdings to break even or prevent an increased loss. Such a move could cascade and exacerbate the sell-off, pushing Dogecoin price to the immediate support cluster at $0.180, where roughly 106,500 addresses hold nearly 13.56 billion DOGE.

Moreover, any short-term buying pressure might face headwinds from the underwater investors present above the current price level.

DOGE GIOM chart

Bull run shift snatched DOGE’s spotlight

The bull run that began in 2021 picked up in February, slowed down up to early April, but caught fire in mid-April, pushing many altcoins to new all-time highs. Despite Dogecoin having one of the best performances this bull run, its prospect as a meme coin dwindled.

Perhaps, the main reason for this is the increased meme coins or dog coins like Shiba Inu, Akita, SafeMoon and so on. The new tokens are extremely popular and were relatively less expensive than Dogecoin, which as a group siphoned many retail investors away from DOGE.

With retail shifting to newer meme coins, so did the capital, which might explain the almost zero social volume for Dogecoin.

This metric tracks the number of mentions on Twitter, Telegram, Discord and other platforms. The higher the social volume for an asset, the more investors are talking about it and/or are investing in it. Currently, DOGE’s social volume stands at 121, in contrast to 177 for SHIB and 53 for SAFEMOON, suggesting that buyers are clustered more toward Shiba Inu than Dogecoin.

While one can speculate that this shift might have also triggered capital rotation, it cannot be portrayed with the utmost certainty.

DOGE, SHIB, SAFEMOON social volume chart

Therefore, if investors continue to book profit, Dogecoin price is likely to create a lower low below the recent swing low at $0.193. If this were to occur, market participants could expect DOGE to continue its descent to $0.137, the target projected by the inverse head-and-shoulders pattern.

On the other hand, if the bid orders continue to pile up, pushing Dogecoin price to produce a decisive close above the neckline at $0.311, it will invalidate the bearish scenario while signifying the bulls’ strength and indicating the willingness to move higher.

In such a case, investors can expect DOGE to climb 21% to $0.379.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Why LIBRA meme coin promoted by Argentina President Milei is crashing?

LIBRA meme coin promoted by Argentina’s President Javier Milei is making headlines again, crashing nearly 15% on the day. A local Argentine media outlet, Perfil, reported that lawyer Gregorio Dalbón had requested Interpol for a red notice to be issued for Hayden Davis.

Metaverse narrative stalls as price action fades, but on-chain data signals continuing accumulation

Metaverse tokens Sandbox, Decentraland and Axie Infinity continue to face correction since they topped in early December. A Glassnode report suggests that despite price pullback, on-chain activity suggests holders accumulation.

DeFi user loses over $700K USDC in a sandwich attack that experts suggest could be money laundering

A DeFi trader became the subject of discussion among crypto community members on Wednesday after losing more than $700K worth of stablecoins to a sandwich attack on the Uniswap v3 protocol.

Tether on-chain activity surges to a six-month high with 143,000 daily transfers

Tether (USDT) stablecoin on-chain activity has rapidly risen, with over 143,000 daily transfers, surging to a 6-month high. Moreover, the USDT Network growth metric increases, indicating greater blockchain usage.

Bitcoin: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

Bitcoin price extends its decline on Friday, falling over 5% so far this week. BTC uncertainty and volatility spikes liquidated $1.67 billion as the first-ever White House Crypto Summit takes place on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

[12.11.43, 28 Jun, 2021]-637604658349720781.png)