- Miner flows provide an insight into Bitcoin price action but must be used alongside other metrics.

- Increasing exchange withdrawals, in general, suggest that Bitcoin is in a bull market.

- Bitcoin rally to $60,000 jeopardized by the resistance at the 50 SMA on the 4-hour chart.

Miners within the Bitcoin network are rewarded in coins (BTC) for their revenue. Besides holding the BTC, miners offload their bags on exchanges to get cash, which covers rent and electricity elements. Miner exchange inflow has for a long time not been considered a significant impact on the price. However, the emergence of on-chain metrics could disapprove of that notion, hence the need to take a closer look at miners’ activity.

Understanding Bitcoin price correlation to miner activity

Bitcoin has been in a persistent bull cycle since the last quarter of 2020. Despite the consistent rally, retracements have come into the picture – for instance, early this week, BTC tumbled from $58,000 to $45,000.

According to Glassnode’s Bitcoin spent output lifespan on a 30-day trailing average, the activity of miners who have been in the industry for more than ten years have signified several local tops.

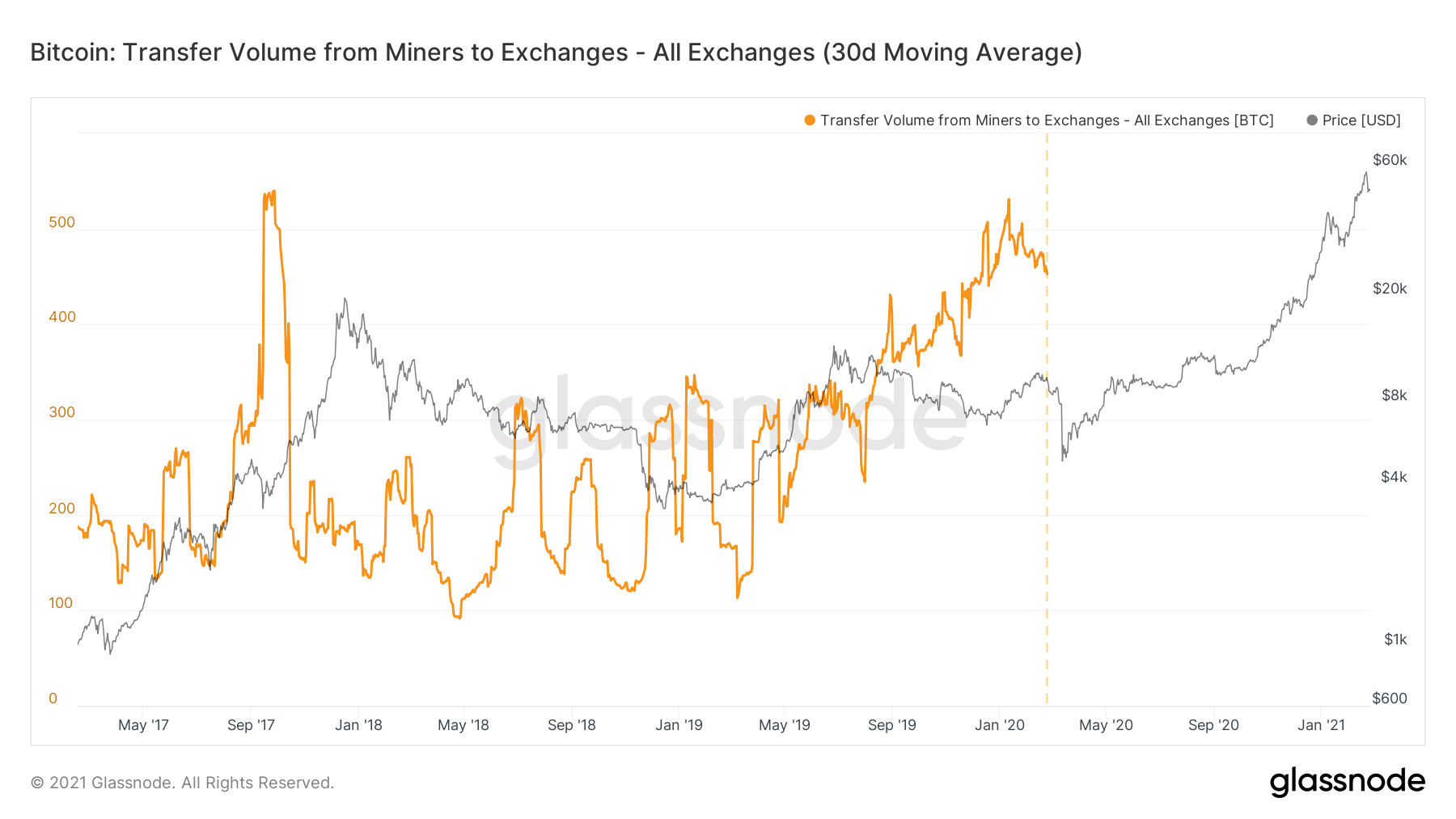

Note that the miners moved chunks of at least 1,000 BTC to exchanges since the beginning of December. The chart below indicates instances when Bitcoin price dropped after a surge in miner exchange inflow.

Bitcoin spent output lifespan

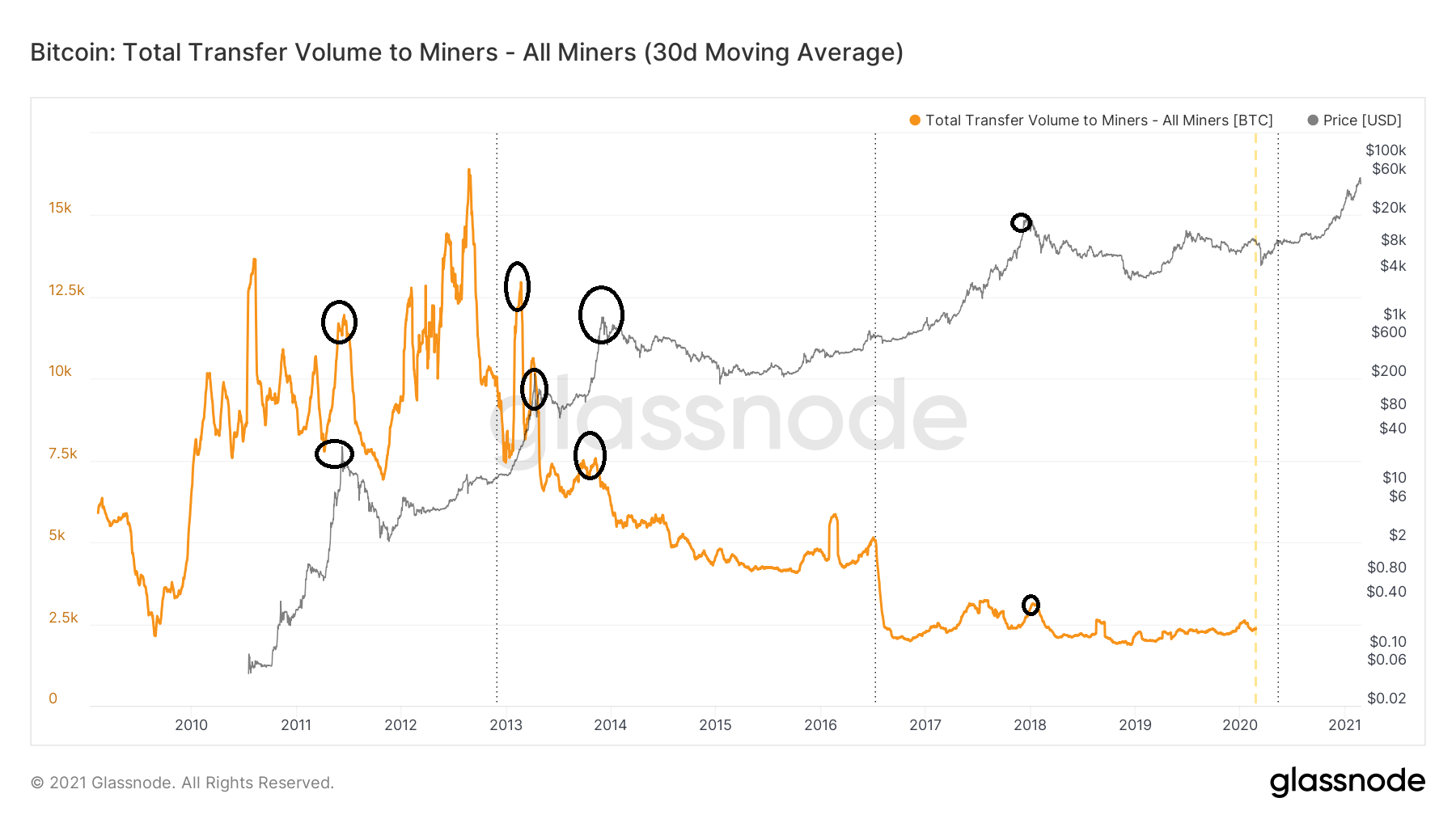

The miner inflow chart highlights the volume of coins transferred into miner addresses. Over the last ten years, an increase in miner inflow has led to a Bitcoin price spike. The degree of growth varies, which means that other factors must be considered when using this metric to predict BTC price action.

Bitcoin miner inflow

The Bitcoin miner transfers to exchanges also seem to validate the above metrics by illustrating that a higher volume sent to exchange leads to a drop in price. For example, the fall at the beginning of January preceded a consistent increase in miner exchange inflow.

Bitcoin miner exchange volume

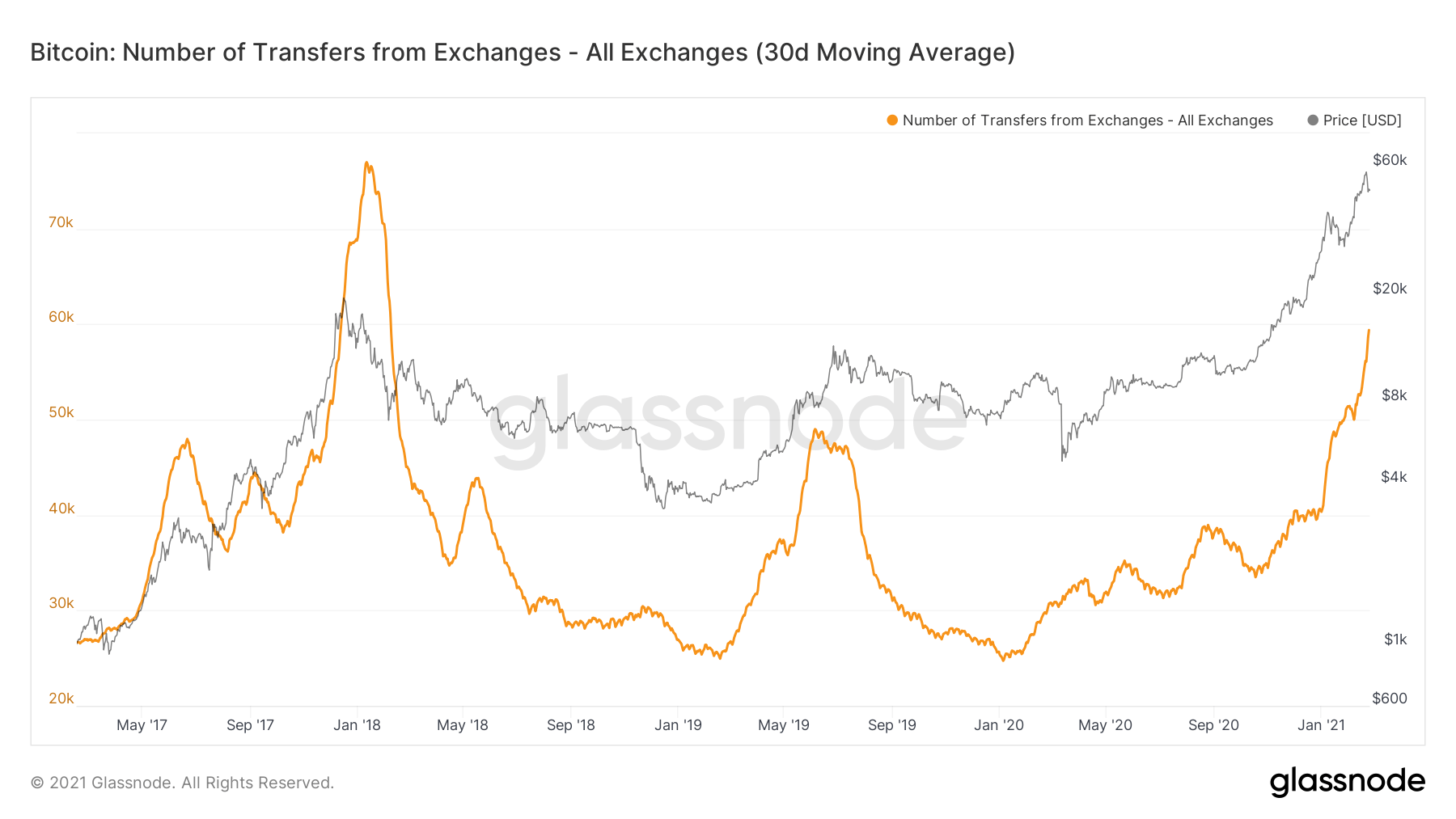

Generally, surging exchange withdrawals lead a significant bull runs. Note that the exchange withdrawals reduce reserves on platforms, consequently leading to diminishing supply. If the demand for Bitcoin remains the same or rises, Bitcoin price rallies to a new level. These demand and supply mechanisms can be observed on the chart.

Bitcoin exchange withdrawals

Looking at the other side of the fence

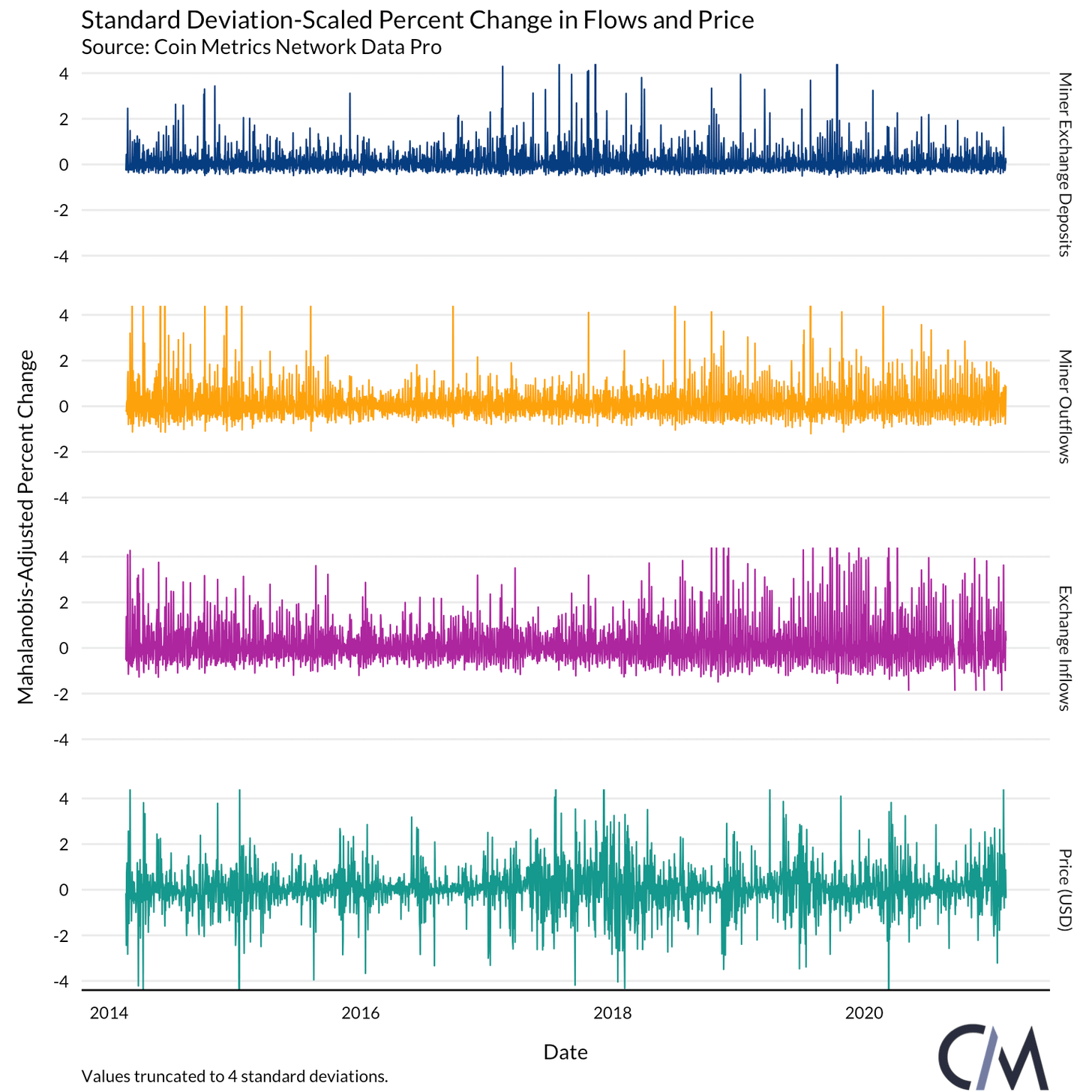

A recent report by Coinmetrics argues that miner-exchanges flows, exchange deposits and withdrawals are not in any way correlated to Bitcoin price. The research says that Bitcoin price “rarely move in tandem” with these metrics.

Bitcoin miner flows data

Econometric’s latest report, however, admits that the data has some blind spots. It also says that some miners prefer to sell on OTC desks. The research is accurate on the idea that miners sell on very few exchanges and mainly on Binance and Huobi.

Bitcoin price losses critical support

Bitcoin price has lost the support explored earlier at $50,000 and highlighted by the 50 SMA. If this support is not reclaimed, the bellwether cryptocurrency may freefall to retest support at $47,500. In the event this support is overwhelmed, the weekly anchor at $45,000 will come in handy.

BTC/USD 4-hour chart

On the flip side, the Moving Average Convergence Divergence (MACD) reveals that Bitcoin is gradually entering the bullish territory. Besides, a break above the 100 SMA at $52,500 will pave the way for gains toward $60,000.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

%20-%202021-02-25T135941.559-637498483160493949.png)