- Lawmakers in the US are set to end the stalemate over the $1 billion COVID-19 relief plan.

- Bitcoin is believed to have rallied from $6,000 to $11,000 following the first stimulus check.

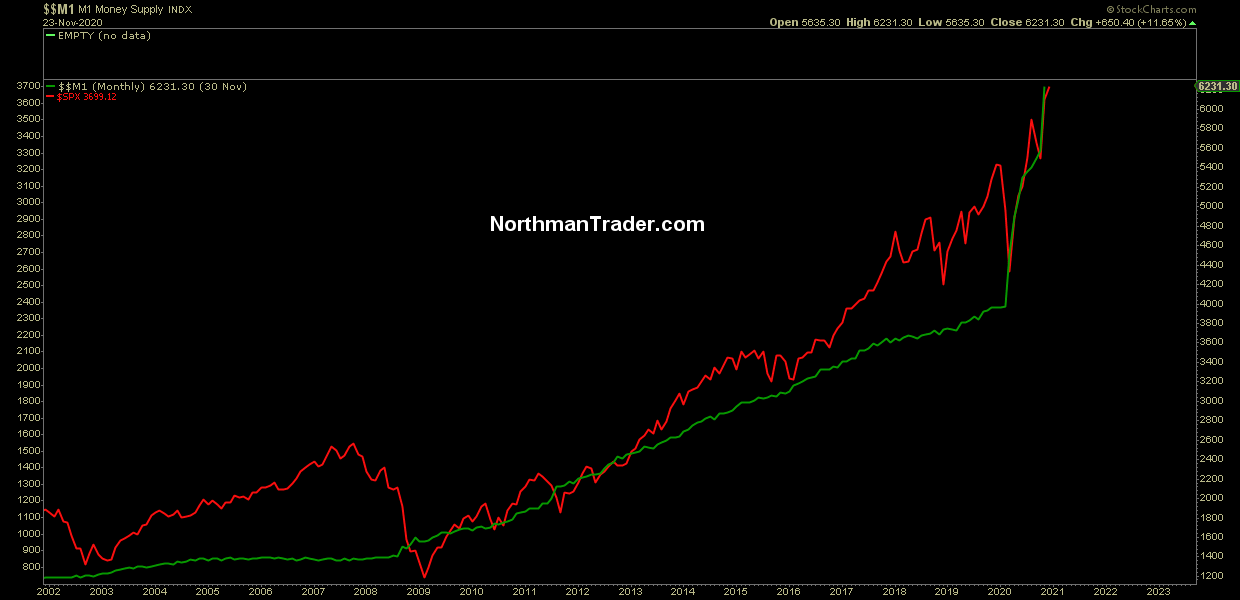

- Money supply in the US has gone up by 55% from February amid the rocketing BTC prices.

The Coronavirus pandemic has wreaked havoc across the world, changing how people live and how businesses run. Unemployment figures shot up significantly, warranting governments to consider relief plans for their citizens. The first stimulus check in the United States, worth $1,200, saw Bitcoin rally extensively from $6,000 to $11,000.

It was clear that Americans were using part of their relief package to buy Bitcoin and other cryptocurrencies. Bitcoin offers an investment alternative that is almost inflation-free. On the other hand, the Federal Reserve has been on a printing spree for dollar bills, which increase the money supply and inflation.

Bitcoin rally commenced following the United States stimulus check

The Fed committed to keeping interest rates at the lowest besides the stimulus check. Several institutions that have been inherently dominant in the traditional investment sector have also dived into Bitcoin. For instance, in September, MicroStrategy increased its holdings in BTC by $175 million to $425 million.

Cryptocurrency exchanges reported an upsurge in Bitcoin purchases following the first check. In about five months, Bitcoin skyrocketed from price levels around $6,000 to highs above $11,000. The US citizens would prefer to bet on Bitcoin with their relief packed, which has been massively yielding.

BTC/USD daily chart

How might Bitcoin react to a $1 billion relief plan?

A vaccine to help curb the spread of COVID-19 is likely to be distributed in the first quarter of 2021. However, the damage caused by the pandemic has been disastrous, and its impact is set to be long lasting. Republicans and Democratic negotiators are currently conversing about the ballooning government spending bill and the COVID-19 relief plan.

In the meantime, talks regarding the proposed $1 billion COVID-19 relief seem to have hit a barrier, with legislators squabbling over the $1.4 trillion omnibus bill set to fund the US economy in 2021. The $1 billion relief is set to be attached to the same gigantic bill.

Time is running out for US lawmakers, especially with the prevailing funding set to expire on December 11. Some legislators like the Senate Leader Mitch McConnell have resorted to allowing a funding extension to avoid shutting down. The Relief plan is likely to remain unchanged but will encompass $160 billion for states and local governments.

Details about when this package will start being redistributed remain unknown, mainly due to the 2021 funding bill's disagreements. A funding formula is being developed at the moment; however, it will focus on getting the money to the states with the greatest need.

Bitcoin price status quo

Bitcoin is holding above $19,000 as consolidation becomes dominant. The flagship cryptocurrency dropped to levels near $18,000 last week but made a considerable recovery. In the meantime, BTC is struggling to sustain the uptrend to $20,000 due to the acute resistance at $19,500.

BTC/USD 4-hour chart

Consequently, Bitcoin is likely to scale to higher levels on the release of the COVID-19 relief fund. A good number of lawmakers, both Democratic and Republican, want the relief plan to include an individual check. For now, talks have stalled over business support, extended unemployment benefits, and funding for COVID-19 vaccines.

A correlation is likely when the relief fund starts distribution. Cryptocurrency exchanges are expected to experience a higher volume of BTC purchases. Eventually, the attention will create enough tailwind to kick start another rally. Besides, as we have covered before, Bitcoin is nowhere near its peak, even in the ongoing bull run.

The correlation between money supply and Bitcoin

The United States M1 money supply is said to have risen by 55%% since February this year. In other words, 35% of all the circulating US dollar bills have been released into the economy in just ten months.

US M1 money supply

As the money supply shot up to astronomical figures, Bitcoin rallied to new yearly highs from March lows of around $4,800. However, it is essential to note that this is a correlation but not causation. Therefore, it cannot be used on its own to predict where Bitcoin is heading.

US M1 money supply

The current money supply figures are likely to increase with the proposed COVID-19 relief fund. A higher money supply leads to inflation, which pushes investment companies, retail investors, and individuals to seek alternative noninflationary assets such as Bitcoin and gold.

In other words, if the Fed continues with the printing spree, Bitcoin, and other cryptocurrencies are likely to continue getting the investors' attention, hence the potential to spike to higher price levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637429969129350948.png)

%20(1)-637429970023032881.png)