Hedera Hashgraph price pares back 10% gain as risk-off sentiment returns

- Hedera Hasgraph sees altcoins rallying firmly in ASIA-PAC session.

- HBAR undergoes fade in the European session.

- HBAR price risks another decline toward $0.0577

Hedera Hashgraph (HBAR) price is showing whipsaw moves as bulls jumped on the positive vibe during the ASIA-PAC session as a rescue plan arrived on Sunday in the wake of the default of Silicon Valley Bank. As the fade nearly pared back all the earlier gains, the risk of a complete reversal grows by the minute.

Hedera Hashgraph price at the mercy of the VIX

Hedera Hashgraph price is moving synchronously with other altcoins like Terra LUNA Classic. This Monday morning bulls were shooting through the first available cap and saw a rally stretched toward the European opening. Quite the turnaround in the European session appeared, however, as a large fade occurred with support to be found at that cap that has turned into support.

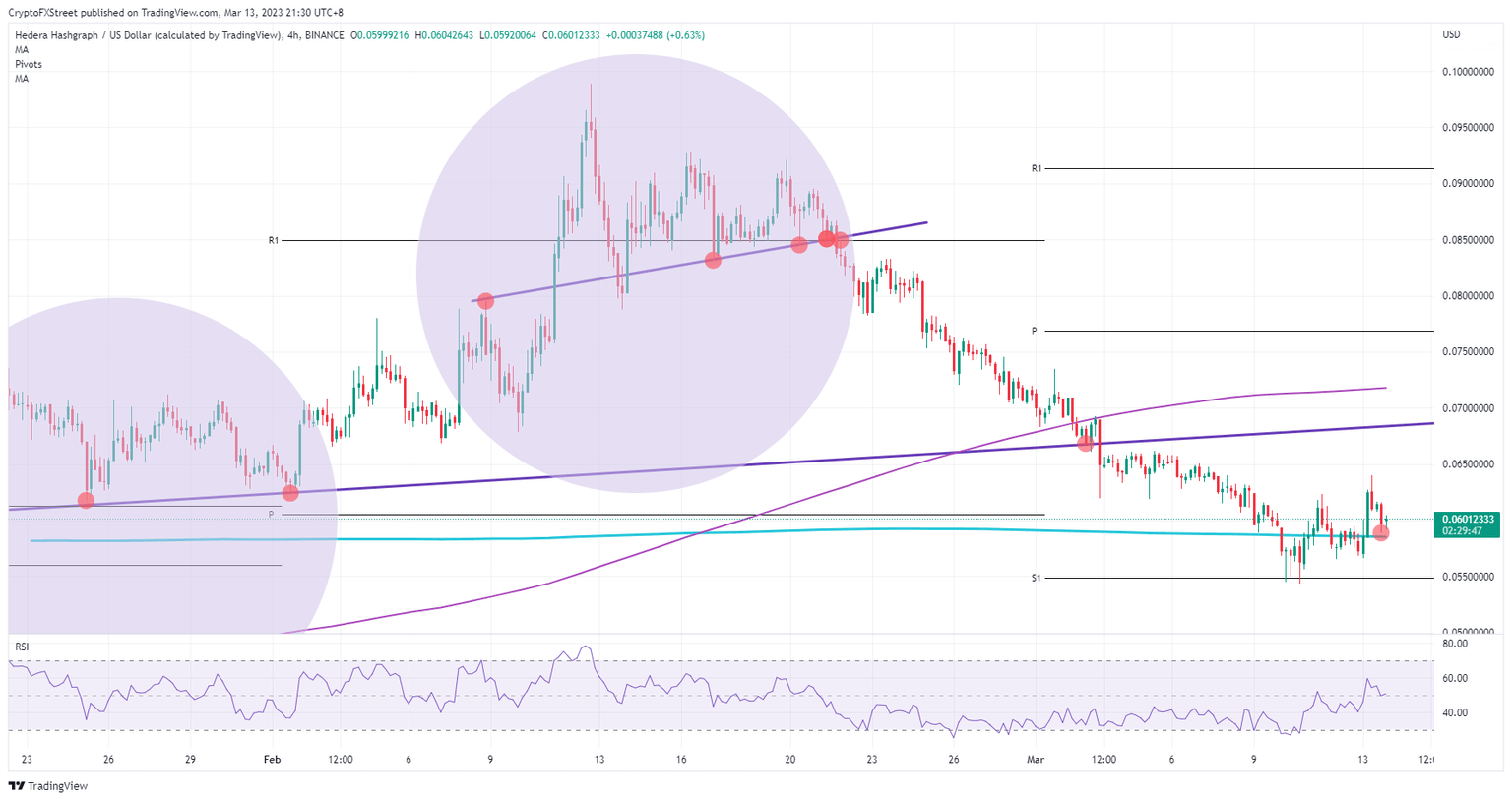

HBAR will have its traders watching that 200-day Simple Moving Average (SMA) at $0.058 like hawks. It was pierced through in the bullish ASIA-PAC session and is currently held as support in the European session. Expect to see a breakthrough toward $0.055 as sentiment in the US looks similar to the European session.

HBAR/USD 4H-chart

The US session could trigger a turnaround though and instead choose the sentiment from the ASIA-PAC session. With much of the dust settled over the current turn of events, US traders could buy the dip and send HBAR higher. HBAR would jump toward $0.065 and possibly even test that blue ascending trend line near $0.070.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.