HBAR sentiment rises 200% over Hedera network's partnership with institution finance for cross border payments

- Institutions from South Korea and Taiwan have joined hands to launch a stablecoin remittance proof of concept project to improve cross-border payments.

- The three institution finance players have launched the product on the Hedera network, leveraging its high-efficiency and eco-friendliness.

- HABR trading volume is up 190%, suggesting a surging interest in the token as markets embrace the new feature.

- The project pursues efficiency, reduced cost, and effective cross-border payments for EVM-based customers.

HBAR, the ticker for the Hedera Hashgraph ecosystem, is recording a surging interest among community members following a recent network announcement. The optimism emboldens the bullish streak the token has been demonstrating, sustaining its uptrend since the first week of July.

HBAR mostly bullish on network announcement

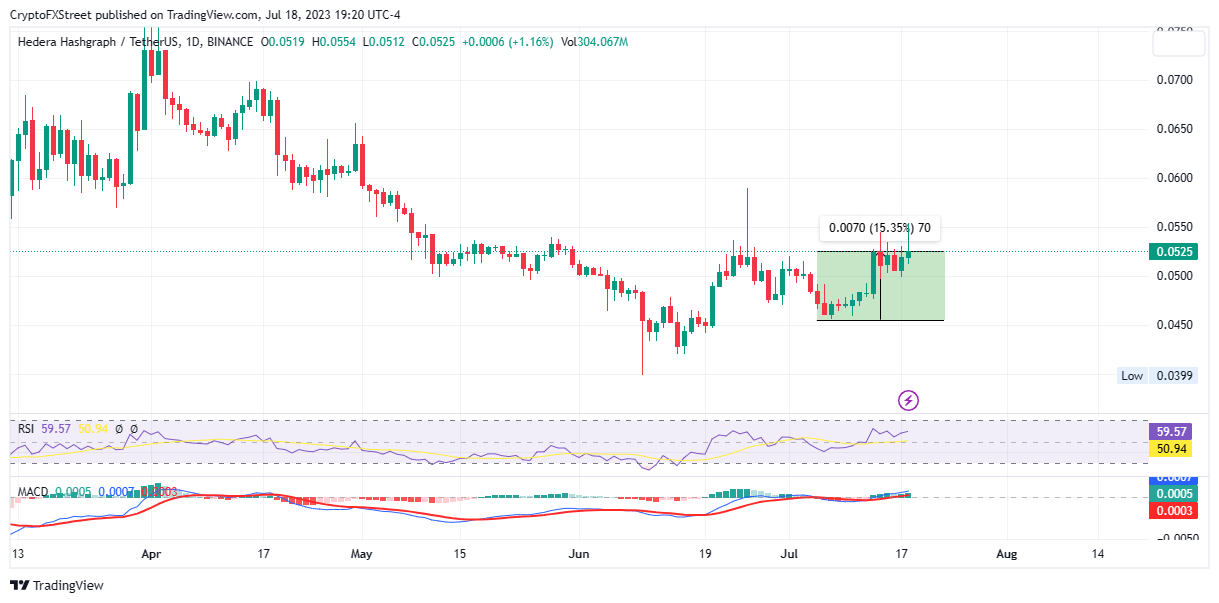

HBAR token boasts a 24-hour trading volume increase of 190% and an almost 5% price surge on the day. This bolsters its 15% uptrend that began on July 7, characterized by the series of higher highs indicated in the 1-day chart below.

HBAR/USDT 1-Day Chart

Notably, trading volume can help identify the kind of momentum that is driving the market. It helps determine the direction of a price pattern, such that when the trading volume rises, the asset's price typically moves in the same direction.

HBAR metrics on CoinMarketCap

When trading volume increases in tandem with the price of an asset, it points to strong interest in the token by the buyers. It can also be attributed to a fundamental development or news in the concerned ecosystem.

Santiment corroborates this data, with the volume metric rising from 31.42 million on July 18 to 93.02 million on July 19. This constitutes a 196% volume surge in 24 hours.

HBAR on-chain volume

As Bloomberg reported, the Hedera network has recently collaborated with institutional players in South Korea and Taiwan. Specifically, the protocol has provided a base for South Korea's first modern bank, Shinhan, and Taiwan's largest financial institution, SCB TechX, to launch the trial version of a stablecoin payments proof-of-concept (PoC).

Last year, the F&P Fund published its strategy that highlighted #stablecoins and international remittances as one of four key focuses

— HBAR Foundation (@HBAR_foundation) July 18, 2023

Today, we reach a milestone of that strategy with ecosystem partners Shinhan Bank, SCB TechX, and Taiwan's leading financial institution https://t.co/lB1Vvu4Q1B pic.twitter.com/qXosvrp3UC

The PoC, which leverages Hedera's methodical and environmentally friendly open-source, public network, proved successful when tested with the Thai Baht (THB), the New Taiwan Dollar (NTD), and the South Korean Won (KRW). It is compatible with the Ethereum Virtual Machine (EVM), which means that all stablecoin issuers whose protocols are built atop the EVM network can use the framework.

Notably, this is not the first time the South Korean bank is collaborating with another player in the institutional finance space. In 2021, Shinhan Bank partnered with multinational bank Standard Chattered for an international stablecoin remittances payments project.

With this feature, EVM-based stablecoin users are poised to enjoy efficient, affordable, and sustainable cross-border payments. According to Shinhan Bank's Chief of the Blockchain division Byunghee Kim, the entire framework is centered on the characteristic nature of stablecoins, which:

Offer a low-cost, fast, and reliable way to transfer value across borders, which can help to increase financial inclusion and improve access to financial services for individuals and businesses in underserved communities.

The feature demonstrates how Hedera's EVM-compatible technology can eliminate third parties, lower costs, and expedite the remittance process.

The development echoes the recent efforts by players in the traditional finance (TradFi) spaces like BlackRock, Citadel Securities, Fidelity, WisdomTree, and others, which have demonstrated an interest in crypto and blockchain sectors for the Exchange-Traded Fund (ETF) applications.

As more TradFi players take steps to leverage the vast opportunities presented by blockchain technology, the Shinhan, SCB TechX, and Hedera collaboration marks a significant milestone for the financial sector toward the successful transformation of how cross-border payments happen.

Like this article? Help us with some feedback by answering this survey:

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B08.24.11%2C%252019%2520Jul%2C%25202023%5D-638253320969295775.png&w=1536&q=95)