Update: HBAR price jumps 75% after traders misinterpret statement about Blackrock

(This story was updated on April 24 at 07:50 GMT to explain that Blackrock didn't choose Hedera to tokenize its money market fund (MMF). Tuesday's statement from Archax, Ownera and The HBAR Foundation explaining that the fund has been tokenized on the Hedera blockchain led to confusion among traders, wrongly attributing to Blackrock the decision to tokenize the fund. The correct version follows.)

- Archax, Ownera and The HBAR Foundation said on Tuesday they have enabled the first tokenization of BlackRock’s money market fund (MMF) on Hedera.

- The Foundation's announcement suggested Blackrock's direct involvement in the operation, but this wasn't the case.

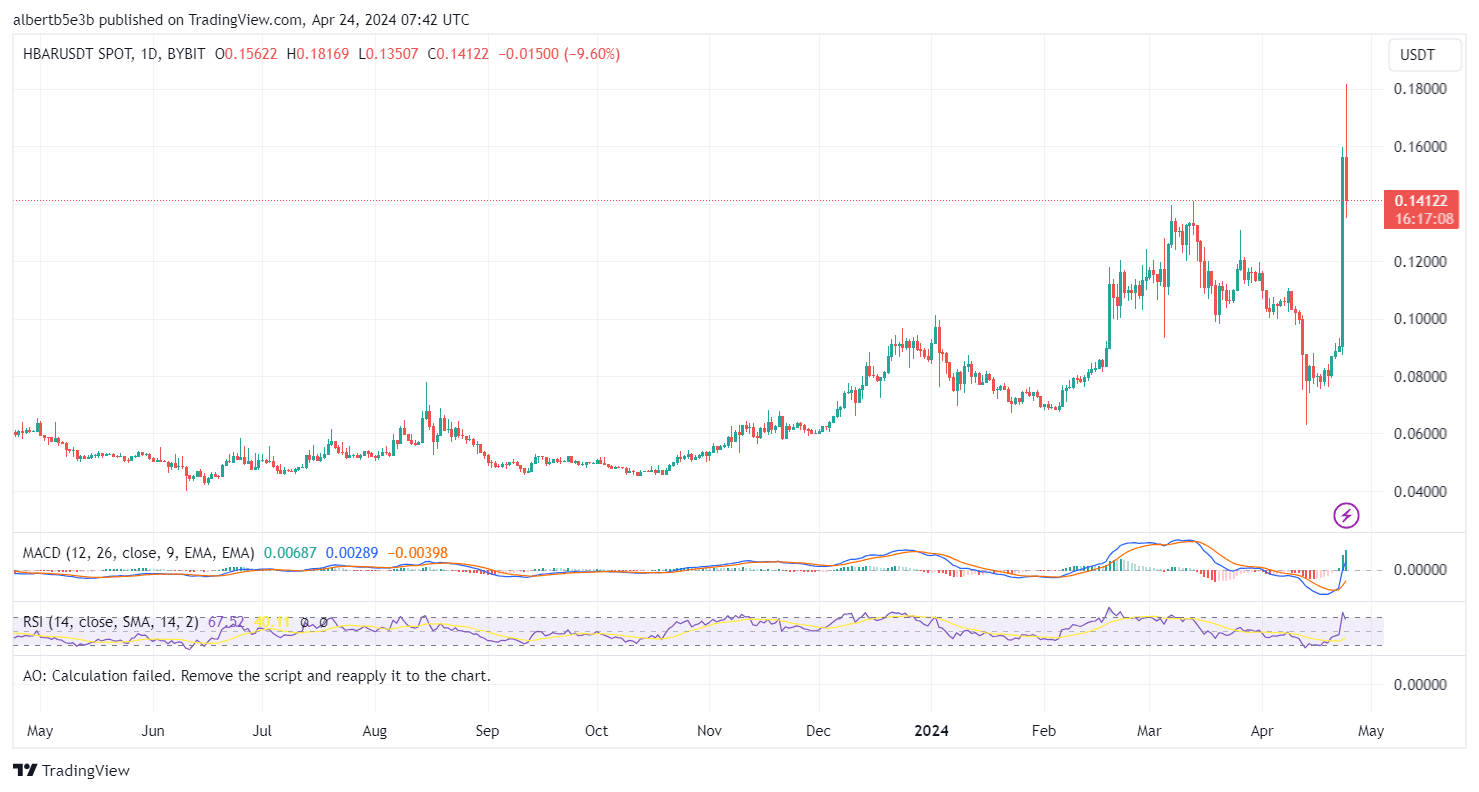

- HBAR price has exploded 75% to $0.1646, levels last seen in April 2022, but retreated afterwards.

Hedera Hashgraph (HBAR) price increased sharply on Tuesday after traders misinterpreted an announcement involving asset manager Blackrock in a fund tokenization project on the Hedera blockchain.

Also Read: Hedera Hashgraph: A rising competitor in the Blockchain space

Archax tokenizes Blackrock's MMF on Hedera

On Tuesday, Archax, Ownera and The HBAR Foundation said in an official tweet that they enabled the first tokenization of BlackRock’s money market fund (MMF) on Hedera.

Today we witness #RWA history as @BlackRock’s ICS US Treasury money market fund (MMF) is tokenized on @Hedera with @ArchaxEx and @OwneraIO, marking a major milestone in asset management by bringing the world’s largest asset manager on-chain pic.twitter.com/1Kye8cjAJx

— HBAR Foundation (@HBAR_foundation) April 23, 2024

The initial announcement suggested that Blackrock chose Hedera for the project, which isn't the case. Several crypto influencers on social media also highlighted this idea, supporting quick gains for the token. Archax CEO Graham Rodfort said later on its official X account that the choice to select Hedera came from them, not from Blackrock itself.

Hey @TheOCcryptobro it was indeed an @ArchaxEx choice to put on @hedera and, given our reg status we are one of the only places that can create, custody & trade these. It was our choice but everyone involved was aware. (1/2)

— Graham (@Grodfather) April 23, 2024

Archax is a London-based digital asset exchange, broker and custodian that partnered with the HBAR Foundation and Ownera, an institutional-grade digital assets platform, in a joint venture intended to bring the MMF to Hedera.

The news came after abrdn plc, the largest active wealth manager in the UK and one of the key members of the Hedera Council, tokenized its MMFs on Hedera in 2023. Its flagship tokenized funds represented a watershed moment in the asset management industry.

The @Hedera network is purpose built for institutional #RWA tokenization at scale

— HBAR Foundation (@HBAR_foundation) April 23, 2024

That's why #Hedera Governing Council @abrdn_plc, the UK's largest active wealth manager, tokenized its flagship Lux Sterling MMF on the network https://t.co/eEF3yagXnK

HBAR price pares gains

Hedera Hashgraph price soared 75% to a two-year high in response to the news, although it retreated somewhat once traders realized Blackrock wasn't behind the decision of its fund's tokenization.

HBAR/USDT 1-day chart

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.