Has Tesla secretly bought more Bitcoin?

- Rumors on social media hint Tesla could have recently purchased around 1,000 BTC.

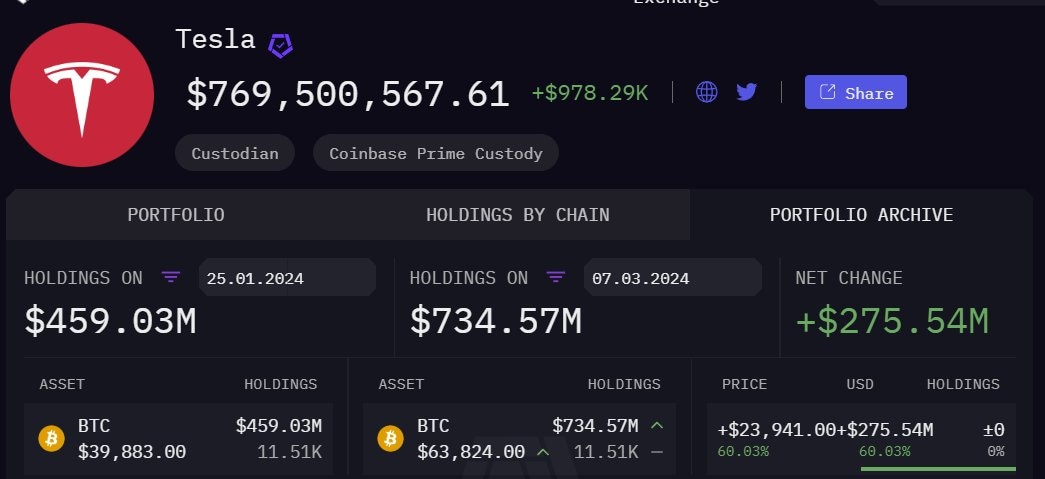

- These talks of Tesla buying BTC are based on Arkham Intelligence’s data platform.

- Some suggest that the discrepancy between their BTC holdings may have arisen due to product sales.

The electric car company Tesla has allegedly purchased around 1,000 BTC, or at least that’s what the chatter is on social media. But a closer look at the source of these rumors reveals that it could be nothing but a case of misinterpretion.

arkham bamboozling or he bought?

— Hsaka (@HsakaTrades) March 7, 2024

Read more: Bitcoin price brews a recovery as MicroStrategy advances on plans to absorb more BTC

Tesla’s BTC balance increases

Tesla CEO Elon Musk’s announcement of purchasing BTC was a major driver of the crypto markets in February 2021. Late Wednesday, social media platform X’s users started talking about Tesla adding 1,000 BTC, worth roughly $68 million, to their balance sheet based on data from a popular crypto data analytics platform, Arkham. Neither Tesla nor Musk have commented on these rumors.

Tesla BTC wallet on Arkham

The above image shows that Tesla holds 11,500 BTC and not 9,700 BTC, which is higher than what was reported in its last earnings report published in January 2024. This discrepancy is what caused investors to speculate if Tesla was secretly buying more BTC.

EktaCT, a popular Twitter user among crypto enthusiasts known for timely updates on several breaking news, notes that this inconsistency in BTC held by Tesla could be attributed to “product sales.”

Apparently, they havent bought anything since their last earnings so the excess amount is probably from the product sales as someone suggested.

— Ekata (@ekataCT) March 7, 2024

But its good to have their addresses now. https://t.co/V34FTvPGXR pic.twitter.com/P67hhkagjY

Considering Elon Musk’s involvement in crypto, it is not uncommon for Tesla or any other companies headed by Musk to use crypto as a mode of payment for their products.

Also read: Bitcoin trade that gave Bankman-Fried his millions returns in South Korea

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.