- Bitcoin Futures trading volume hit another all-time high on Bakkt.

- Bitcoin price may retreat to $10,500 before the growth is resumed.

Bitcoin futures trading volume on Bakkt surpassed the threshold of $200 million worth of BTC contracts. According to the Bakkt, 17,745 contracts changed hands on September 15, which is 36% higher than the previous peak at the end of July.

Another record day in the books for our physically delivered futures:

— Bakkt (@Bakkt) September 15, 2020

15,955 Bakkt Bitcoin Futures were traded today, representing over $200M of volume and a 36% increase from our previous all-time high

What is Bakkt, and why traders should care

Bakkt is a regulated platform that provides for cryptocurrency trading and custodial services. It is fully owned by Intercontinental Exchange and has Money Transmitter Licenses in 43 US jurisdictions.

The platform was launched on September 23, 2019, after a series of delays caused by technical and regulatory issues. The Bakkt launch was a much-anticipated event in the cryptocurrency industry. It was supposed to lift the barriers for the institutional investors to join the market and eventually send BTC price to the moon.

The platform is the first place where traders and investors could buy futures contracts on Bitcoin with physical delivery. It means that sellers of the contracts will have to deliver the actual underlying asset to the buyers upon the specified delivery date, provided that the contract is not rolled over to the next period. In this case, the contract does not expire, and the asset is not delivered.

However, Bakkt failed to live up to expectations. A shaky start and a low demand for the platform's products frustrated the traders and led to BTC sell-off. The market realized the pattern "buy the rumor, sell the fact."

Bakkt and Bitcoin: the uneasy relationship

Bakkt trading volumes have little impact on BTC prices, and not without reason. First, despite the steady growth since mid-summer, it is still far below the market leaders. Currently, Binance is the leader of the pack in terms of the trading volume, while Bakkt is outside the top-10 platforms for trading BTC futures. It means that its impact on the market is minimal.

Second, the trading volumes data says nothing about the direction of the trade. We still have no idea whether people are selling or buying futures contracts. Moreover, they will not influence the physical demand if the buyers choose to roll out their positions ahead of the expiration date.

Also, some cryptocurrency community members believe that the increased trading volume on Bakkt might signal that institutional traders are trying to jump into the market with the sell orders.

This means big dump is in the cards sometime soon.

— CryptoBit (@bitcoin_whales) September 15, 2020

Big boys are getting their short fills.

The trader also added that people don't buy BTC on Bakkt, but use the platform to bet on the price going down.

BTC/USD: The technical picture

At the time of writing, BTC/USD is changing hands at $10,758, mostly unchanged since the start of the day. The pioneer digital asset broke free from the recent consolidation range on Tuesday, September 15, but the further recovery is still limited by the psychological $11,000-$11,200. This area served as strong support for the most of August. Now BTC may retest it as a resistance.

BTC/USD daily chart

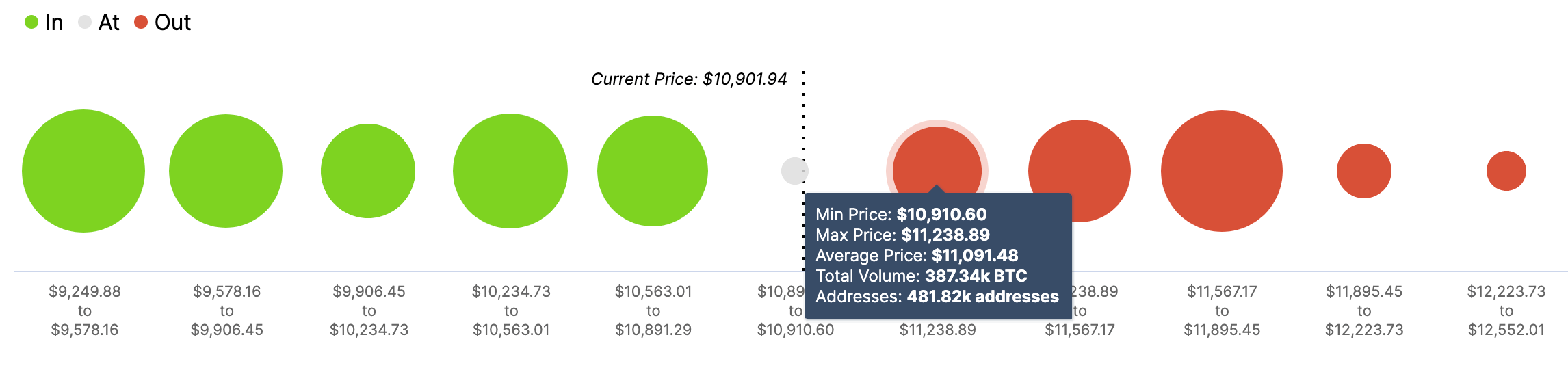

Bitcoin bulls may have a hard time pushing the price through the above-mentioned area due to a potential wall of supply. Nearly half a million BTC addresses holding 387k BTC have their breakeven point on the approach to $11,000 and may choose to cash out once their positions move into a green zone. Even stronger barriers are located on the approach to $11,500 and $11,700, according to Intotheblock data. However, once cleared, nothing will stop BTC from a sustainable rally towards new 2020 highs.

Bitcoin's In/Out of the Money

Source: Intotheblock

The intraday charts suggest that the former resistance of $10,500 has flipped into strong support and now it coincides with an upside trendline, visible on the 4-hour time frame. A sustainable move below this area will push BTC inside the previous range and bring $10,000-$9,800 into focus. As the FXStreet previously reported, a spike of BTC inflows to the cryptocurrency exchanges from miners adds credibility to the short-term bearish scenario.

BTC/USD 4-hour chart

To conclude: The growing trading volumes of Bakkt traditionally have little effect on BTC price; however, some market participants consider it a bearish signal. From the technical point of view, BTC/USD will have a hard time moving through a thick layer of barriers going all the way up to $11,700, meaning that the downside is the path of least resistance for now. Meanwhile, the former resistance of $10,500 mow serves as formidable support that may slow down the bears and leave BTC consolidating in a new range. Once it is broken, the sell-off will gain traction with the next focus on $10,000.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

XRP gains as traders gear up for futures ETFs debut this week

XRP climbs over 3% on Monday, hovering around $2.33 at the time of writing. The rally is likely catalyzed by key market movers like XRP futures Exchange Traded Funds (ETFs) approval by the US financial regulator, the Securities and Exchange Commission (SEC), and a bullish outlook.

Bitcoin Price Forecast: BTC eyes $97,000 as institutional inflow surges $3.06 billion in a week

Bitcoin (BTC) price is stabilizing above $94,000 at the time of writing on Monday, following a 10% rally the previous week. The institutional demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637358423764755134.png)

-637358424273243343.png)