Great Day for Ethereum, Bitcoin Loses Dominance

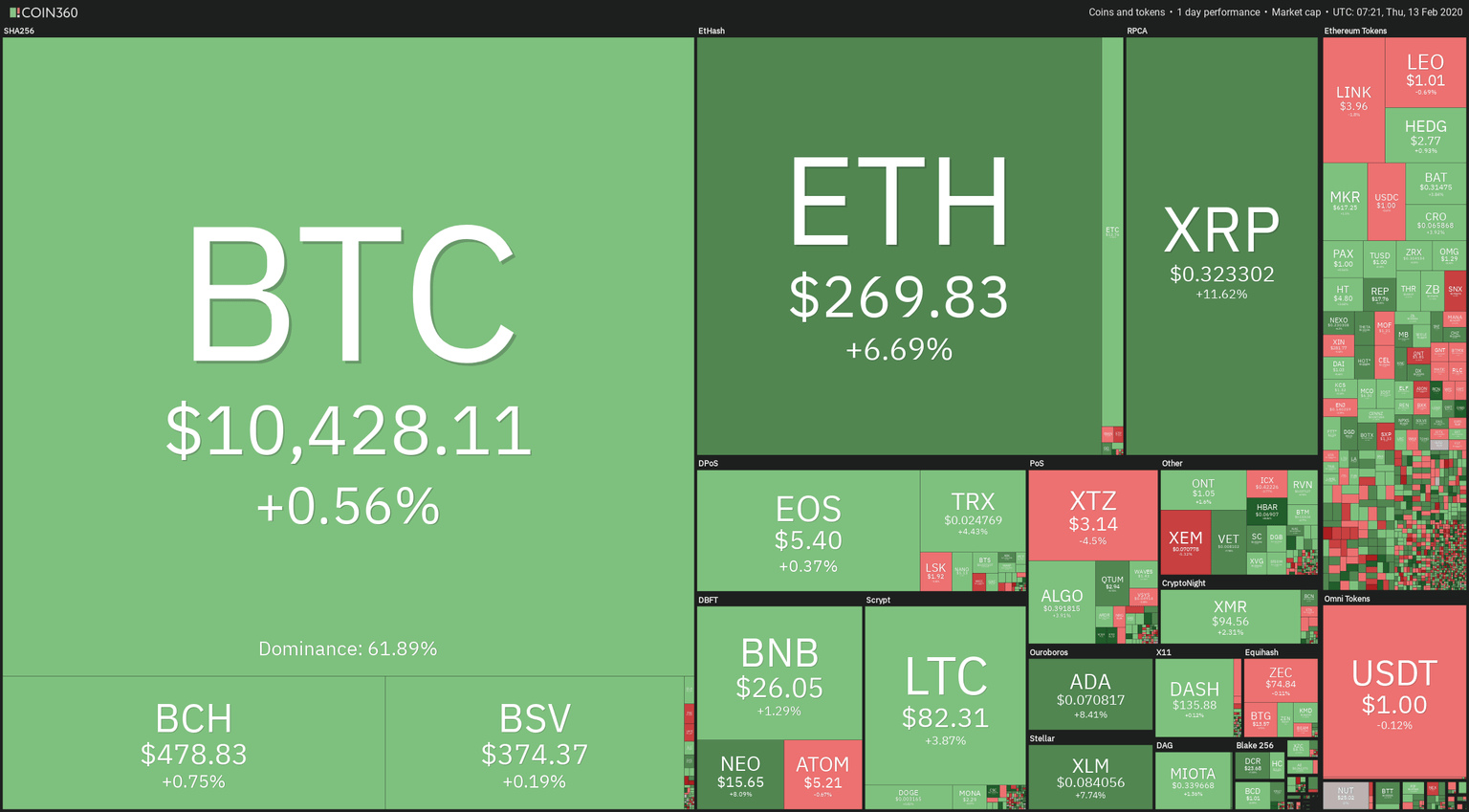

Wednesday was a great day for Ethereum (+6.9%), which seems headed soon to challenge the $370 high made in June 2019. In yesterday's move, Ethereum reached 15 percent appreciation and touched the $275 level. Bitcoin (+0.56%) lagged most altcoins and was stuck in a tight range between $10260 and $10,440. Besides Ethereum, also Ripple (+11.62%) moved strongly and now is above its $0.32 level. Also strong movers were Litecoin (+5%), Tron (+7.6%) Neo (+8.77%) Cardano (+9.8%), and, notably, HBAR that went 50 percent up.

Ethereum tokens had excellent movers, such as NEXO (+6.6%), REP (+6.1%), BAT (+4%), and MKR (+3.3%). Others, such as LINK (-1.36%), LEO (-0.65%), or SNX (-5.9%), were consolidating past gains or retracing.

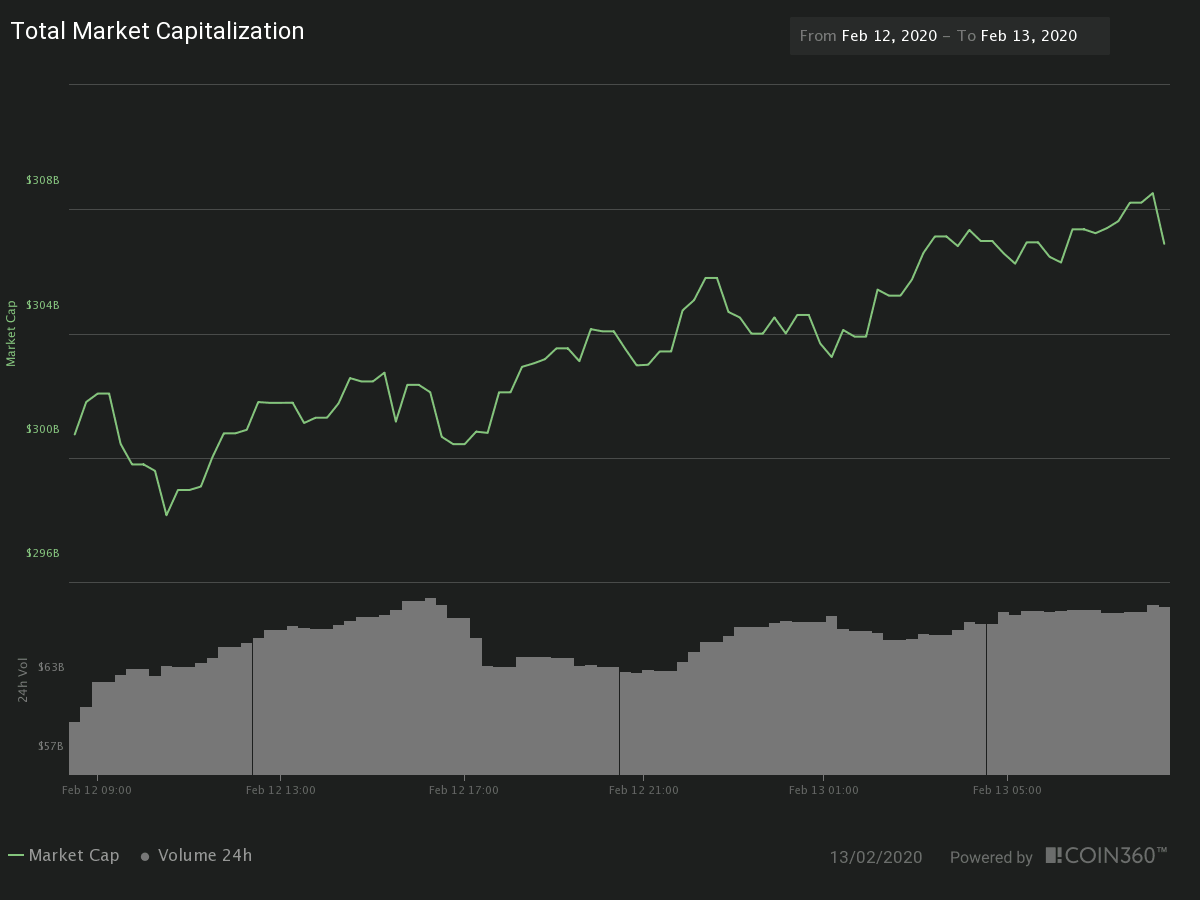

The market cap of the crypto sector moved to 306.888 billion (+3.85%), its highest valuation since July 2019. That increase was achieved with a 24 percent increment in the traded volume, which was $69.89 billion in the last 24 hours. Bitcoin dominance went down to 62.91 percent due to its lagging action. Also, the importance of Ethereum is growing, and its dominance - 9.9%- is approaching 10 percent from the 7.4 percent dominance of one month ago.

Hot News

US Treasury Secretary Steven Mnuchin, in its testimony to the US Senate hearing over the 2021 budget, stated that they would add significant new requirements at FinCEN. "[...]We want to make sure that technology moves forward, but on the other hand, we want to make sure that cryptocurrencies aren't used for the equivalent of old Swiss secret number bank accounts."

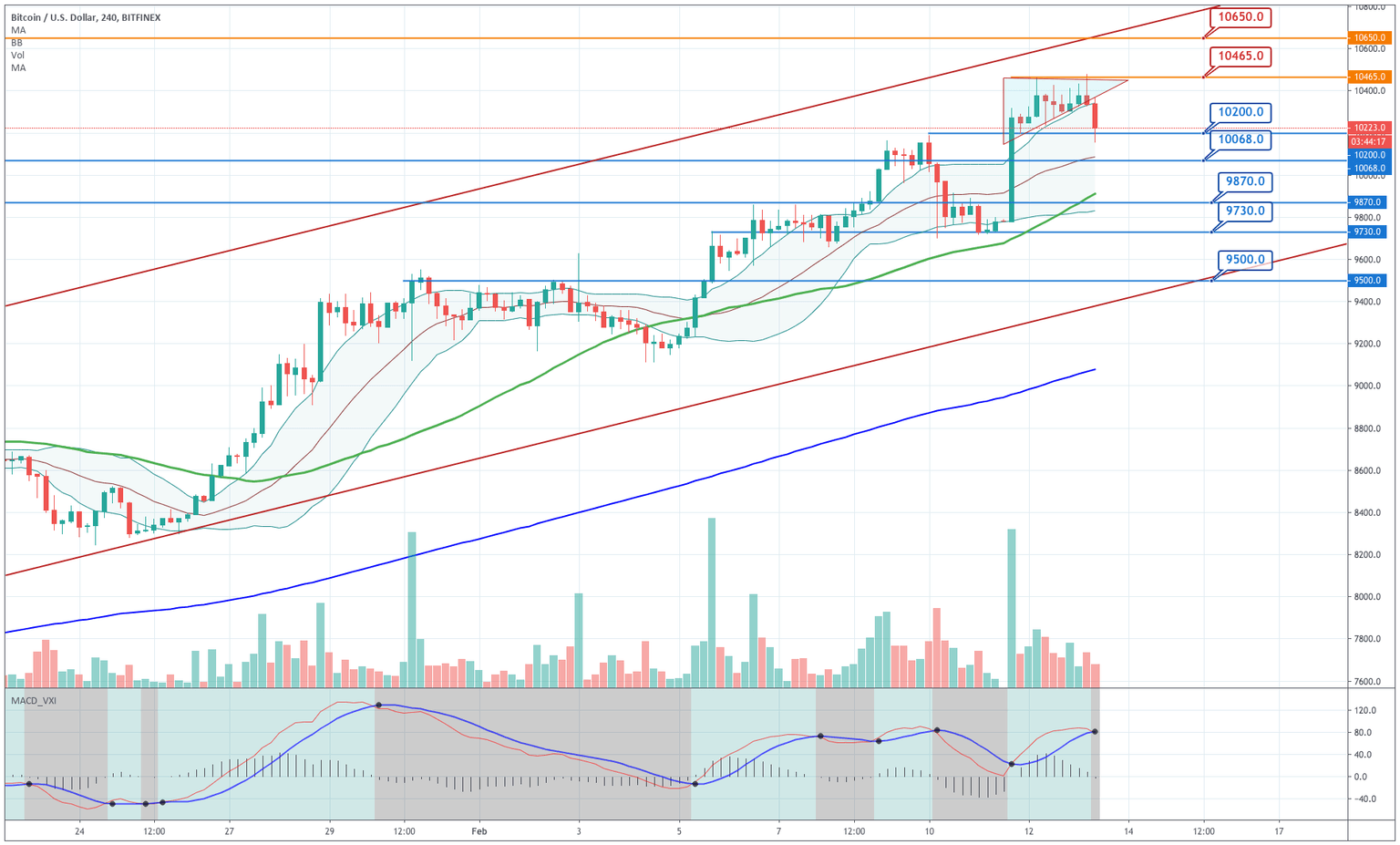

Technical Analysis: Bitcoin

Bitcoin is being unable to break the $10,465 resistance. The price is making large upper shadows in the last short-bodied candlesticks, and the MACD is weakening. The price action has been making a pennant, which, in most cases, is a consolidation figure, this time, though it broke to the downside. Currently, the price is held by the $10,200 level, but if this candle closes as is, we could see a challenge to the $10K level. Nevertheless, BTC still moves in the upper channel of the Bollinger Bands, and the primary upward trend is not compromised.

|

Support |

Pivot Point |

Resistance |

|

10,200 |

10,342 |

10,465 |

|

10,068 |

10,650 | |

|

9,870 |

10,800 |

Ripple

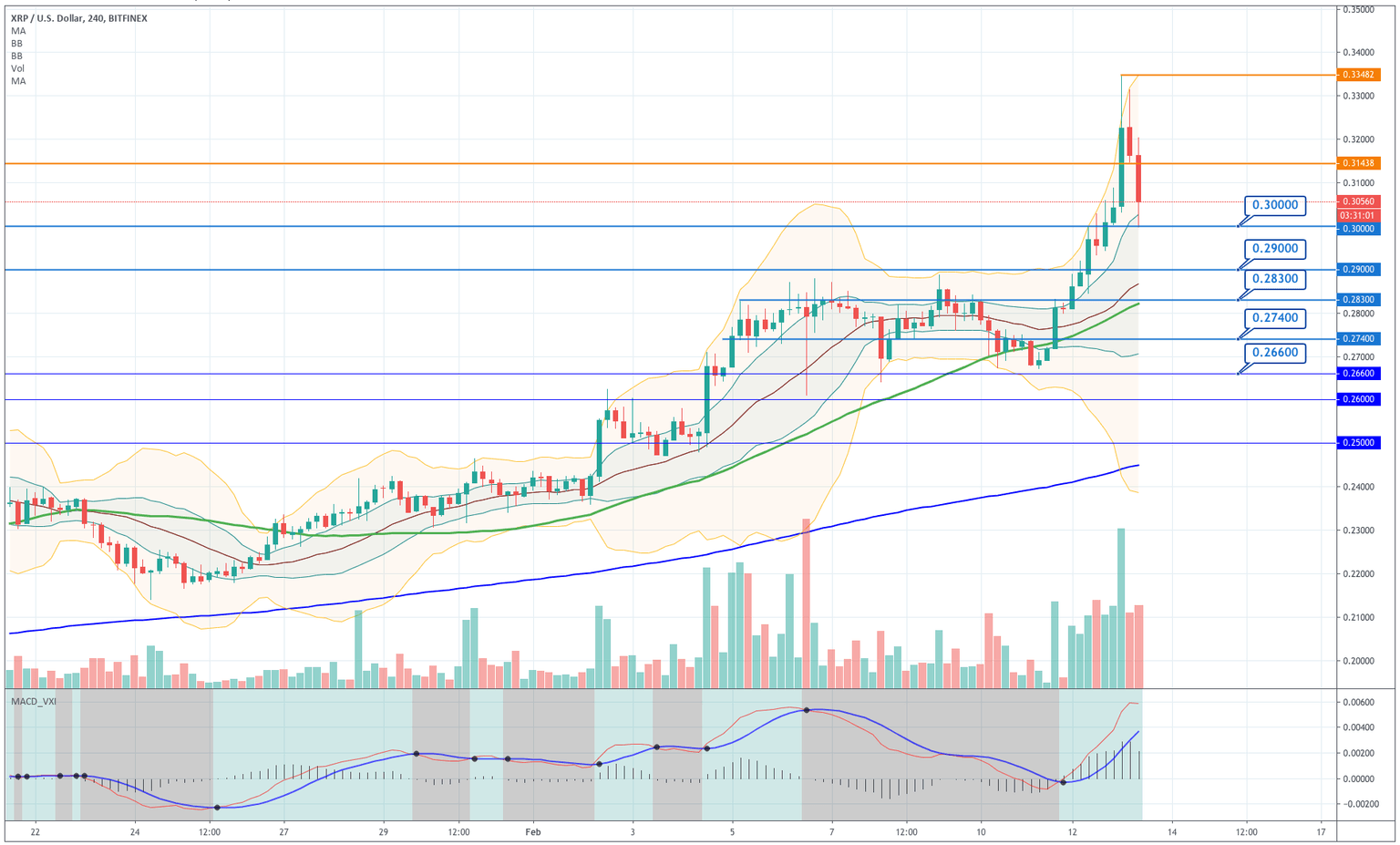

Ripple has been very bullish in the last 24 hours, and its price cut through the $0.30 level to reach the $0.3349 as the height of the session. Today is retracing heavily, and its price went back to test the $0.3 level. In the chart, we can see that the price moved above the +3SD Bollinger line, which is extremely overbought. Thus, this consolidation is just a short-term adjustment to move the action to normal levels. The level to keep is $0.30 and $0.29.

|

Support |

Pivot Point |

Resistance |

|

0.2900 |

0.3000 |

0.3140 |

|

0.2830 |

0.3220 | |

|

0.2740 |

0.3300 |

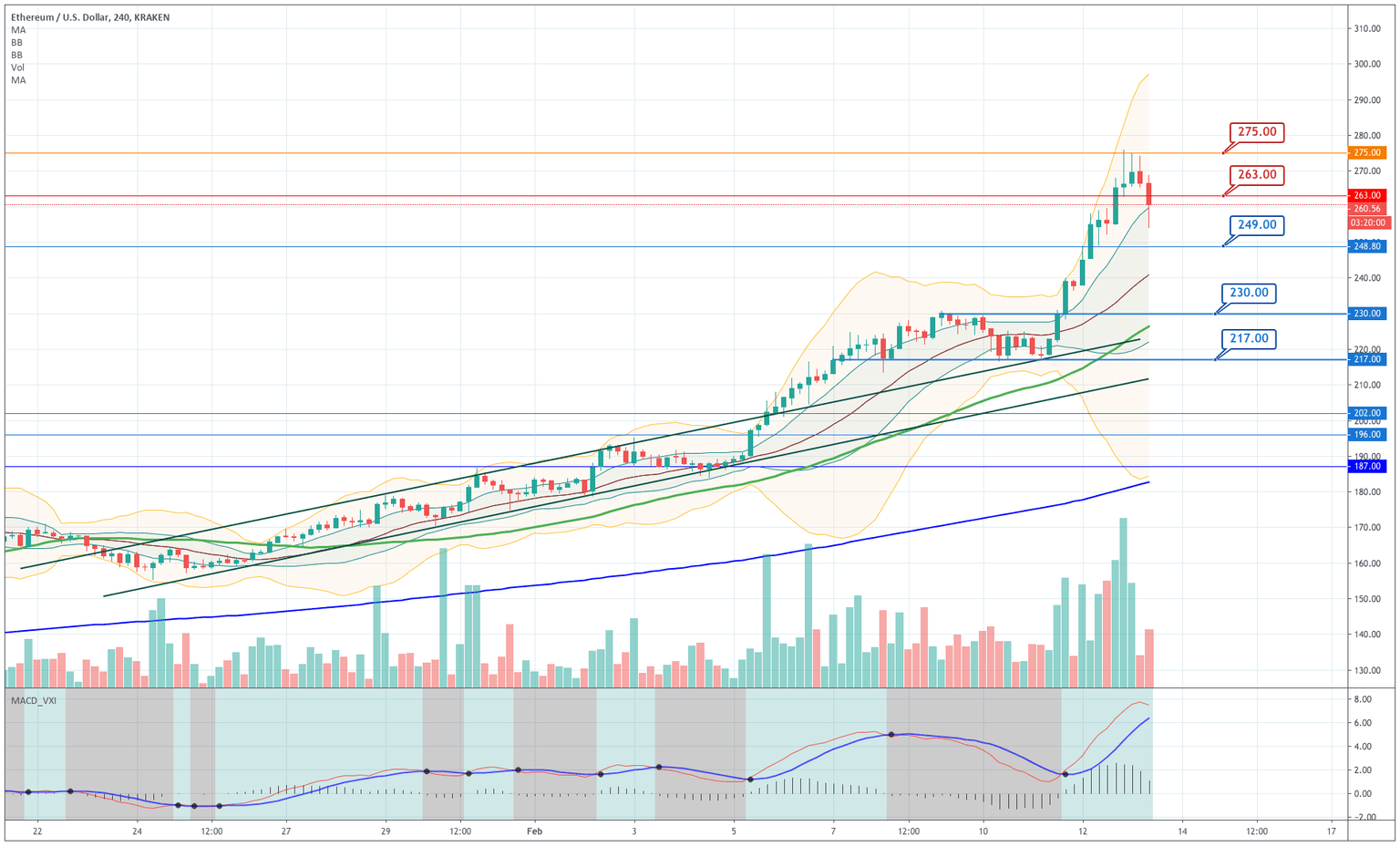

Ethereum

Ethereum had a great day yesterday with a huge move that brought it from $238 to $275. As we can see in the chart, the price is too oversold, so currently it is retracing partially the last gains, driven by short-term profit takers. There is presently nothing dangerous in this movement, and the underlying trend is bullish.

|

Support |

Pivot Point |

Resistance |

|

250 |

260 |

275 |

|

245 |

280 | |

|

240 |

285 |

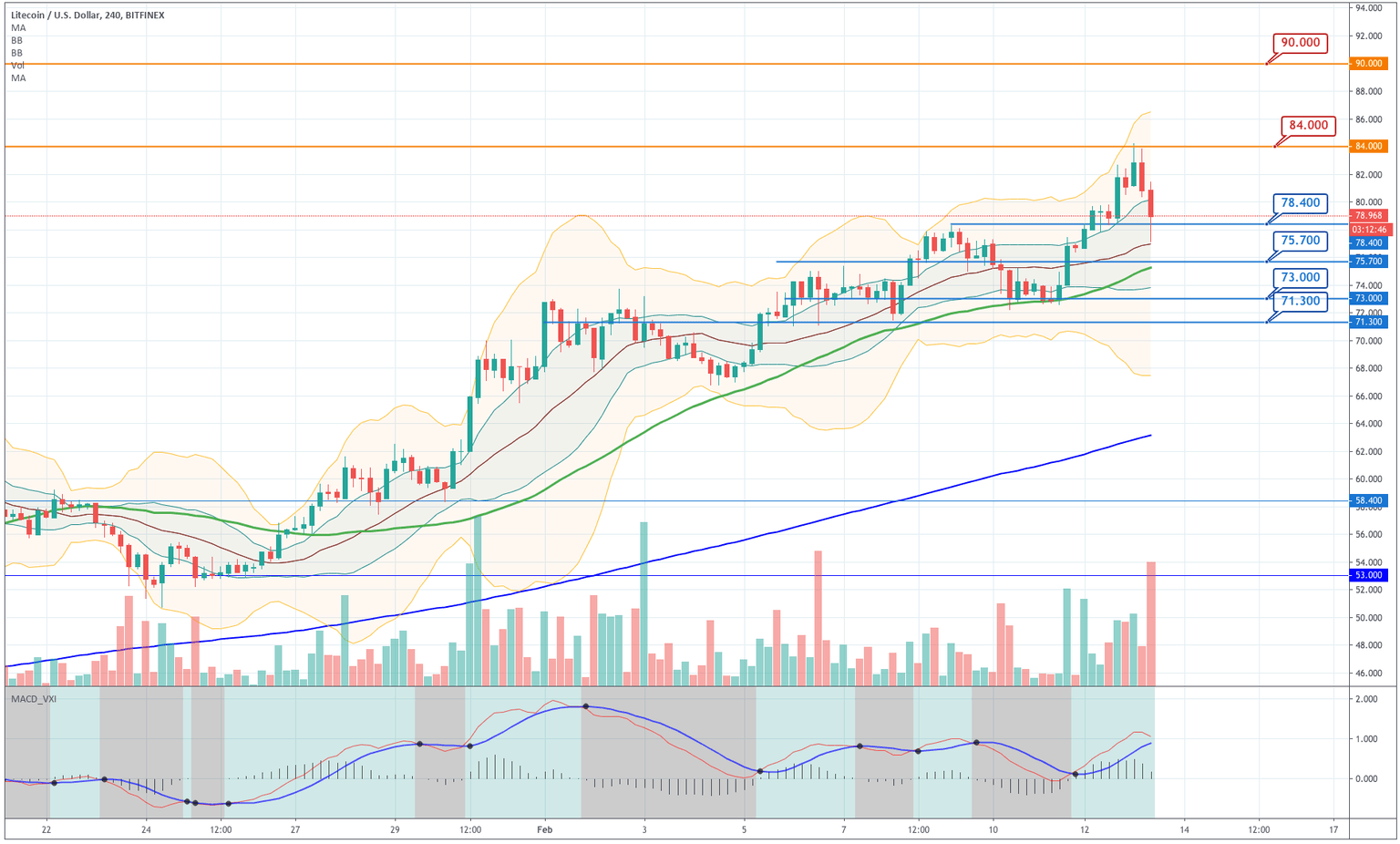

Litecoin

Litecoin had another leg up that move its price to $84, but it was rejected by sellers at that level and created an engulfing 4H candle. Now, after a selling spike, it is consolidating above $79. We can observe that the price is making higher highs and lows, and, also, is moving near its +1SD line. Thus, the upward trend is intact, and it is expected more upward movements after a consolidation period.

|

Support |

Pivot Point |

Resistance |

|

78 |

80.0 |

84 |

|

75.7 |

86 | |

|

73 |

90 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and