While some observers say bitcoin (BTC, -3.06%) has bottomed out, analysts at JPMorgan remain bearish, identifying the impending unlocking of shares in the Grayscale Bitcoin Trust (GBTC) purchased in January as a source of downside risk to the cryptocurrency.

“Despite some improvement, our signals remain overall bearish,” JPMorgan strategists led by Nikolaos Panigirtzoglou wrote in a note Wednesday. “Selling of GBTC shares exiting the six-month lockup period during June and July has emerged as an additional headwind for bitcoin.”

Grayscale Bitcoin Trust, the world’s largest digital-assets fund manager, allows institutional investors to gain exposure to bitcoin through shares in the trust, which currently holds 654,600 BTC. That’s more than 3% of the cryptocurrency’s supply. Grayscale is a unit of Digital Currency Group, which also owns CoinDesk.

Accredited investors can buy GBTC shares directly at the net asset value (NAV) in daily private placements by depositing bitcoin or U.S. dollars. The shares can be sold in the secondary market only after a six-month lock-in period.

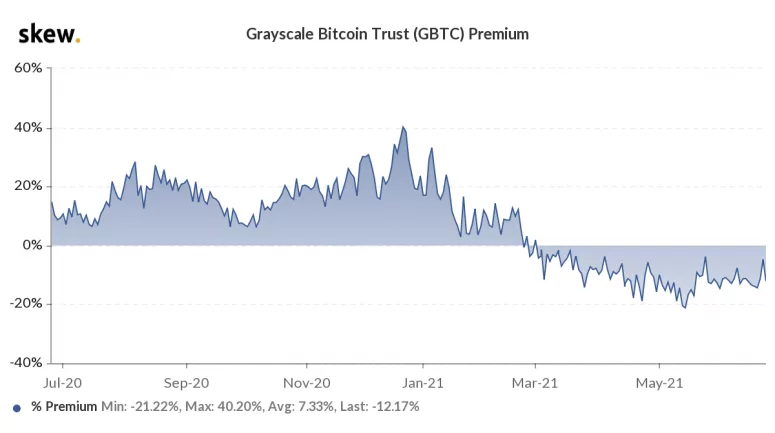

The trust’s popularity exploded at the end of the last year, when the premium on GBTC shares rose to a record-high 40% on Dec. 17. As such, investors rushed to carry trade or buy shares at NAV in a bid to sell them at a premium six months later. According to JPMorgan, the trust saw record inflows of $2 billion in December, followed by $1.7 billion in January.

The January tranche is scheduled for unlocking next month and is likely to release 140,000 bitcoin worth of shares, CoinShares’ chief strategy officer Meltem Demirors pointed out on Twitter.

After unlocking, investors have the option of liquidating their shareholdings in the secondary market. Analysts at JPMorgan foresee investors selling at least some of their shares, leading to “downward pressure on GBTC prices and on bitcoin markets more generally.”

What’s not clear is whether investors will reinvest proceeds back into Grayscale by rebuying bitcoin and transferring it over to the trust. If that happens, bitcoin will likely pick up a strong bid.

Until February, the shares consistently traded at a premium. That kept overall demand strong, with investors rotating money back into the trust after unlockings. “Most of the capital was likely from investors doing a “rinse-in repeat”, Ben Lilly, a crypto economist at Jarvis Labs, noted in a SubStack post dated April 22.

Grayscale's Bitcoin Trust (GBTC) Premium

Source: Skew

Now, however, the incentive to reinvest is relatively low. The so-called Grayscale carry trade has lost its shine ever since GBTC began trading at a discount in February. As of Wednesday, the shares traded at a discount of 12.17% to the net asset value, according to data source Skew.

Nevertheless, some analysts say the discount offers retail investors an opportunity to buy bitcoin on the cheap. “Investors looking for long-term passive bitcoin exposure are probably better off buying GBTC over spot bitcoin since you get paid to wait more via the discount than you pay in excess fees,” David Grider, a strategist at investment research firm FundStrat, wrote in an email in May.

Bitcoin is currently trading near $33,200, representing a 1.2% drop on the day. Prices dipped below $29,000 earlier this week only to make a quick recovery back to the multi-week trading range of $30,000 to $40,000.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.