Grayscale says it is 'operationally ready' for ETF as GBTC discount narrows

- Grayscale said it is prepared to convert its Grayscale Bitcoin Trust (GBTC) into an exchange-traded fund (ETF) after the SEC’s missed deadline.

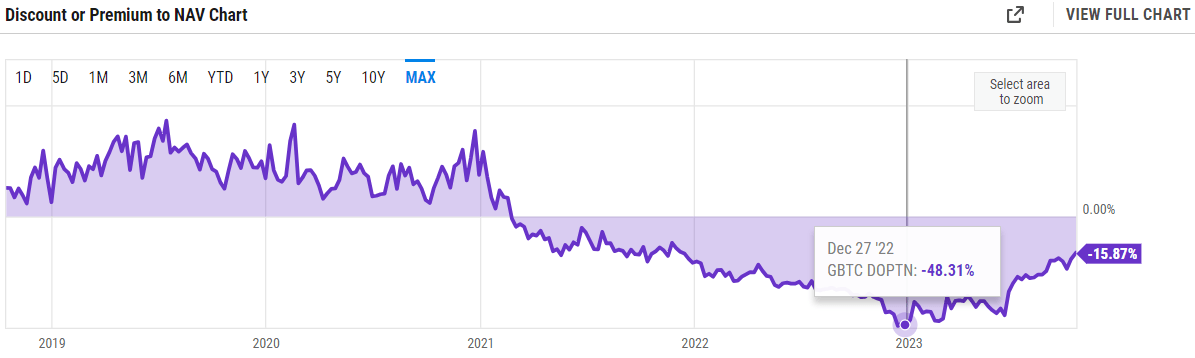

- GBTC discount to net asset value (NAV) has decreased from nearly 48% to 16%, reflecting increased demand.

- Arbitrage traders are shorting spot BTC against GBTC longs, as per analysts, after the discount narrowed.

Grayscale has expressed its readiness to convert its Grayscale Bitcoin Trust (GBTC) into an exchange-traded fund (ETF) after the US Securities & Exchange Commission (SEC) missed the deadline to appeal. The discount on GBTC shares against its net asset value (NAV) has significantly reduced from 48% to 16%.

Also Read: Bitcoin price surges as SEC misses appeal deadline for Grayscale GBTC conversion to spot BTC ETF

Grayscale moves closer to ETF

Following the court's deadline for the securities regulator to appeal Grayscale's conversion request, the latter issued a statement. The company noted its readiness to transform its Grayscale Bitcoin Trust fund (GBTC) into an ETF.

Grayscale's statement shared with Fox News said: "The Grayscale team remains operationally ready to convert GBTC to an ETF upon the SEC’s approval, and we look forward to sharing more information as soon as practicable."

This follows the SEC's decision to not appeal the court's approval of Grayscale's fund conversion application. Bloomberg analyst James Seyffart anticipates that dialogue between Grayscale and the SEC will commence this week, offering clarity on ETF approval.

While investors anticipate approval, the GBTC market cap is close to $3.5 billion based on Yahoo Finance data. Meanwhile, the next critical approval deadline for the SEC is upcoming on January 10 which pertains to an application previously submitted by ARK Invest and 21Shares.

Additionally, the SEC is evaluating multiple spot Bitcoin ETF proposals, including those from financial heavyweights like Fidelity and BlackRock.

Also Read: SEC will not appeal court ruling on Grayscale GBTC conversion to spot Bitcoin ETF

GBTC discount slips from 48%

Meanwhile, GBTC's discount against the net asset value (NAV) has reduced from almost 48% in December 2022 to 16% on Friday based on YCharts data. Crypto investor and influencer Scott Melkar noted, "The narrowing of the discount between the market price and NAV could be indicative of shifting market sentiment and potentially increased demand for GBTC shares."

GBTC discount to NAV

A fund’s discount to NAV essentially means that the market price of the fund's shares is trading at a lower price than the actual value of the assets held by the fund. In simpler terms, investors are buying something for less than its worth at a bargain price.

Melkar further explained, "The reduction of this discount to 16.59% may imply a more optimistic market view on GBTC, but it's worth noting that there is no guarantee that the discount will continue to narrow or even flip to a premium."

Amid the recent developments, arbitrage trading has spiked, as per investor Mike Alfred. He explained that as the discount on GBTC gets smaller in the next few weeks, these traders will likely buy back or cover their short Bitcoin positions to reduce the risk of their GBTC holdings. This could lead to increased demand for both Bitcoin and Bitcoin futures contracts.

A lot of GBTC arbitrage traders are shorting spot BTC as a hedge against their GBTC longs. As the GBTC discount gets closer to zero in the coming weeks, there will be a lot of short covering in spot and futures as people begin selling down their GBTC holdings. Be patient.

— Mike Alfred (@mikealfred) October 13, 2023

Author

Shraddha Sharma

FXStreet

With an educational background in Investment Banking and Finance, Shraddha has about four years of experience as a financial journalist, covering business, markets, and cryptocurrencies.