Grayscale on selling spree as Bitcoin correlation to equities market deepens

- Grayscale Bitcoin trust falls by 20% in a week, overshadowing Bitcoin's 13% drop.

- The diminishing premium on Grayscale is a risk factor that might hinder BTC price recovery.

- Bitcoin correlation with the equities market spells doom amid the lagging technical levels.

- The consistent rise in the Purpose Bitcoin ETF holdings suggests that investor interest is intact.

Grayscale gigantic Bitcoin trust is falling at a rate faster than the recent drop in the price of the leading cryptocurrency. Grayscale Bitcoin trust has plunged roughly 20% in less than a week compared to a 13% dip in BTC. On the other hand, the cryptocurrency correlation with the equity market is hitting new levels. With the equities market on a downward spiral, Bitcoin may continue with the dip to $38,000.

Grayscale Bitcoin Trust sinking premium

Grayscale has for a long time maintained a huge premium on the underlying asset but currently sits at 0.7%. As the premium disappears, investors who had a high-risk appetite during the bull ran seem to be disembarking from the boat.

Simultaneously, investors could be selling in panic and may rejoin once stability returns. It is worth keeping in mind that the bellwether cryptocurrency plummeted from $58,000 to $45,000 in less than 48 hours this week. This is a huge drop considering the consistency BTC has had over the last several weeks. According to the CEO of Grayscale Investments, Michael Sonnenshein, the disappearing premium is:

"Certainly a risk, no question about it, but ultimately price discovery in GBTC every day is driven entirely by market forces."

Bitcoin growing correlation with the equities market

The crypto-to-equities market correlation is high at the moment. Additionally, this correlation has been lock-step in the last year, with Bitcoin standing out. The equity market allows investors to trade company shares on either regulated exchanges or over-the-counter markets.

A comprehensive look at these markets reveals losses across the board, especially for the futures market. Most of the leading futures are in the red, led by S&P 500 VIX, Small Cap 2000, Dow Jones and NASDAQ. If Bitcoin follows these stocks, we could see a drop to either $42,000 or $38,000.

The equities market chart

Bitcoin uptrend remains undented

The above critical indicators suggest that the bull run is in jeopardy. However, we must account for the positive counters, such as the perpetual funding rates. A previous article highlighted important data points to keep in mind while looking at the funding rates.

A funding rate of at least 0.1% signifies euphoria, indicating a sell-the-dip position. On the other hand, a rate around 0.01% hints at the market being in the buy-the-dip range. Skew's current data shows that the perpetual funding rate is normalizing, which means that Bitcoin is nearing the buy zone.

Perpetual funding rate

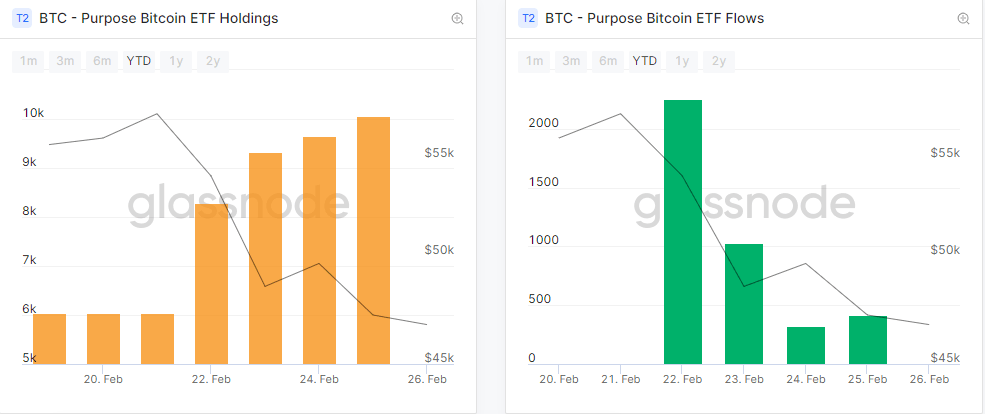

The Purpose Bitcoin exchange-traded fund (ETF) has been in the market for a few weeks. The product became the first approved ETF in North America by a company based in Canada. According to Glassnode data, the Purpose Bitcoin ETF holdings continue to rise consistently and stand at 10,064 BTC at the time of writing. Despite the increase, Bitcoin has been falling, implying that the fund has a minimal effect on the price action.

Purpose Bitcoin ETF

According to a prominent analyst, 'Dave the wave,' the retracement this week has not done any significant damage to Bitcoin's parabola. If Bitcoin confirms support above the 23.6% Fibonacci retracement level, another bull run could be confirmed.

No real damage done to the parabola yet... pic.twitter.com/DF4V5XMLcg

— dave the wave (@davthewave) February 26, 2021

The 4-hour chart shows Bitcoin doddering above $46,000. Support at $45,000 has been tested twice, making it a formidable buyer concentration zone. On the upside, the immediate resistance at $47,500 must come down for gains, leading to the 50 Simple Moving Average (SMA).

BTC/USD 4-hour chart

On the other hand, the Moving Average Convergence Divergence (MACD) illustrates that Bitcoin is not out of the woods yet. As the MACD line (blue) drops further below the signal line, overhead pressure is bound to increase. Therefore, recovery to $50,000 is unlikely to come easy, while sellers may push toward $42,000.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520-%25202021-02-26T135711.783-637499348795415454.png&w=1536&q=95)