- Grayscale’s law firm filed a letter urging SEC to approve its BTC spot ETF after the August 29 win.

- The firm wants the commission to treat its Bitcoin Trust as an ETP investing in BTC futures contracts traded on CME.

- Grayscale says the Trust is ready to operate as an ETP upon Commission approval.

Grayscale Investment, one of the companies in the Bitcoin Spot Exchange-Traded Fund (ETF) race, has urged the US Securities and Exchange Commission (SEC) to approve its Bitcoin Trust (GBTC) conversion to an ETP, citing recent court victory. Grayscale CEO Michael Sonnenshein shared the development on social media platform X.

This afternoon, our legal team submitted a comment letter to $GBTC's 19b4 application on behalf of all @Grayscale investors.

— Sonnenshein (@Sonnenshein) September 5, 2023

We look forward to continuing to have a productive dialogue with with the SEC as we pursue next steps on GBTC's conversion.

I invite you to read the…

Also Read: Grayscale wins lawsuit against US SEC, Bitcoin price nears $28,000

Grayscale follows up the recent win with another letter to SEC

Grayscale Investment, through its legal representatives at Davis Polk, has asked the US SEC to approve its Bitcoin Trust conversion to an ETP. Noteworthy, an ETP is basically an ETF on Grayscale’s terms.

We would appreciate the opportunity to meet with the staff of the Securities and Exchange Commission as soon as practical to discuss the way forward in view of recent developments in the Trust’s ongoing effort to convert to an exchange-traded product (“ETP”).

After the SEC rejected Grayscale’s proposal to have the GBTC converted, the investment firm appealed in court and secured a victory on August 29, though the commission still has room to appeal. As the SEC continues modeling its entreaty, Grayscale’s lawyers have followed up with a letter in an attempt to expedite the process.

…we believe the Commission should conclude that there are no grounds for treating the Trust differently from ETPs that invest in bitcoin futures contracts traded on the Chicago Mercantile Exchange (“CME”).

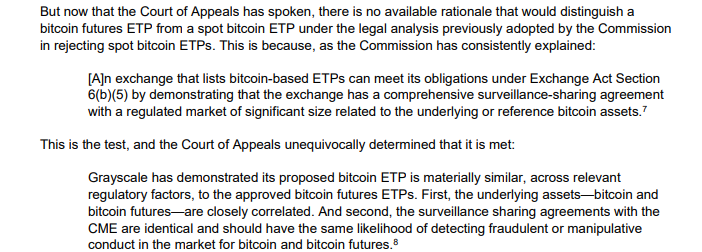

Notably, the SEC has filed fifteen orders rejecting spot BTC filings even after Bitcoin futures ETPs began trading on the CME. This is one of Grayscale’s bones of contention on the matter, with others being that Bitcoin and Bitcoin futures are closely correlated, and that the surveillance sharing agreements (SSA) with the CME are similar therefore share the same potential to detect malicious activities in the market.

Excerpt from Davis Polk letter to the SEC

With this, Grayscale calls out the commission for dragging the matter too long, and in so doing, harming the Trust’s existing investors as their shares now trade at a discount to net asset value.

Grayscale’s lawyers articulate, “the Trust is ready to operate as an ETP upon Commission approval,” urging the SEC to agree that the best use of resources now is for the Commission to issue an approval order.

While the SEC’s stance is that, applicants are yet to prove beyond reasonable doubt that they can protect investors from market manipulation, the euphoria around BTC spot ETFs is that investors would be exposed to the flagship crypto even without being actual owners.

Also Read: Grayscale Bitcoin Trust to readjust fees if SEC approves its spot BTC ETF applications

Crypto ETF FAQs

What is an ETF?

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Is Bitcoin futures ETF approved?

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Is Bitcoin spot ETF approved?

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.