Grayscale Investments could be gearing up for a Bitcoin ETF with newly advertised jobs

- Grayscale is positioning itself for the possibility of a Bitcoin ETF with nine new related job positions.

- The SEC is considering several Bitcoin ETFs but maintains the volatility and market manipulation are obstacles.

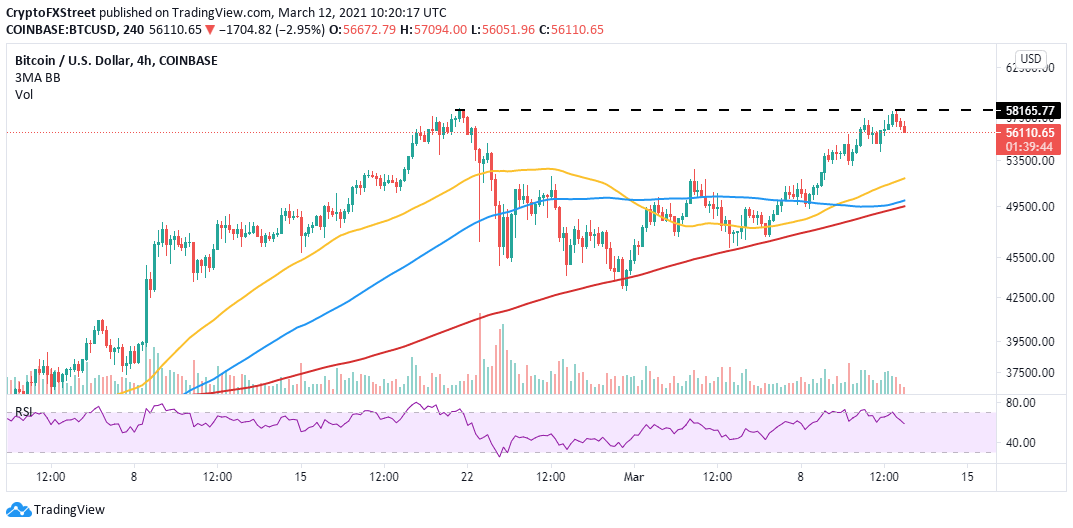

- Bitcoin has been rejected at $58,000 and is seeking support towards $54,000.

Grayscale Investments has become one of the most prominent institutions in the cryptocurrency industry. The company's latest job advertisement could give an insight into what to expect soon. The firm's LinkedIn profile has listed at least nine exchange (ETF)-traded fund-related job openings.

Grayscale new job listings point to a crypto ETF

It may be too early to speculate, but some of the job positions clearly suggest Grayscale is getting ready for an ETF-related product. The vacancies include an ETF compliance officer, an ETF authorized participant relationship manager, ETF market maker relationship manager, and ETF creation and redemption specialist. According to the Director of ETF research for CFRA Research, Todd Rosenbluth:

The race to launch the first Bitcoin ETF is heating up. "It's more of a question on when the SEC will approve a Bitcoin ETF, not if.

The Securities and Exchange Commission (SEC) is currently deliberating over several ETF proposals filed VanEck Associates Corp. and Bitwise Asset Management. However, the regulator is approaching the matter cautiously, citing market manipulation and volatility as key hindrances.

Currently, there are several crypto ETF products around the world, with two of them trading in Canada: The Purposed Bitcoin ETH (BTCC) and the Evolve Group's Bitcoin ETF (EBIT). Grayscale has filed for Bitcoin ETF before but does not have any active filings. Therefore, the new positions are likely to ensure that it is ahead of the game if the regulators make the first approval.

Meanwhile, the Grayscale Bitcoin Trust (GBTC) has been trading at a negative premium for the tenth day in a row. However, the on-chain chart by Glassnode reveals that the negative premium is reducing and could soon flip positive. The premium gives insight into an institutional interest in Bitcoin. As it flips positive, BTC price is expected to move higher.

Grayscale premium

Investors seek alternative from government bonds

Investors are bound to pursue other portfolio options to cushion themselves from the risky equity market. Government bonds have from time immemorial offered refuge to investors but lately been failing in this task.

So, will it be gold or Bitcoin? This is one of the questions market players are asking as they try to get creative. If Bitcoin stability or continues with the bull, there is a high chance most of this money will start flowing into the market.

Bitcoin deals with the latest rejection at $58,000

Bitcoin pumped to $58,000 but failed to make any significant progress above the record high. Despite the bearish calls, the bellwether cryptocurrency has been on an upward move from the beginning of March.

Meanwhile, BTC is trading at $56,120 amid the search for higher support. The Relative Strength Index shows that the least resistance path is downwards. On the downside, support at $54,000 could keep the uptrend intact.

BTC/USD 4-hour chart

Bitcoin remains the focal point of the cryptocurrency industry in the bull run. With a Bitcoin ETF likely to get approval, the bull cycle could be far from over. Analysts are already predicting the largest cryptocurrency may rise to $66,000 in the next few weeks, while others believe that BTC will hit $100,000 by the end of 2021.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren