Grayscale ETH ETF stems bleeding as activity spikes on Ethereum

The Grayscale Ethereum Trust (ETHE) has posted its first day of zero outflows, ending a consecutive daily onslaught of outflows since its launch.

It comes as Ethereum and several of its layer-2 networks witnessed a surge in onchain activity.

On Aug. 12, United States-based spot Ether (ETH $2,638) exchange-traded fund (ETF) flows flipped positive for the fifth time since they launched on July 23, aided by ETHE posting its first day of zero outflows, according to Farside data.

ETHE posted its first day of zero outflows on Aug. 12. Source: Farside Investors

ETHE has hemorrhaged nearly $2.3 billion in Ether since its launch.

Before its conversion, ETHE held a total of $9 billion in ETH on its books, meaning the fund has shed more than 25% of its total holdings in the two and a half weeks the ETFs have been live.

In comparison, the Grayscale Bitcoin Trust (GBTC) took nearly four months before it saw its first day without outflows.

Grayscale’s first day of zero ETH ETF outflows came amid a sharp uptick of activity on Ethereum across decentralized exchanges (DEXs) and its layer-2 networks.

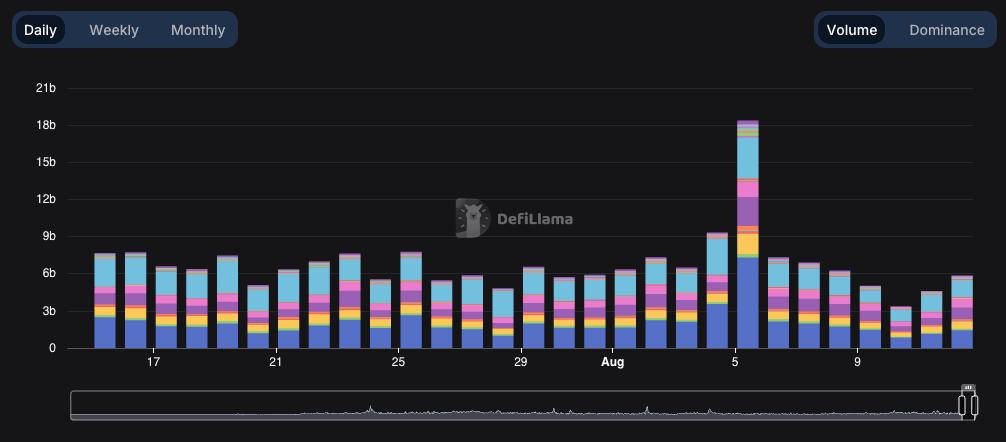

While trading volumes across Solana-based DEXs declined by 10% in the last 24 hours, trading volumes on Ethereum and Base rose 12% and 11%, respectively, within the same time frame, according to DefiLlama data.

Ethereum-based DEXs have witnessed a slight resurgence in the last 24 hours. Source: DefiLlama

Activity on Ethereum layer-2 networks has also been heating up, with a record number of new monthly L2-based addresses being created on the Ethereum-based DEX Uniswap.

Uniswap saw a total of 8.65 million new addresses created across layer-2 networks in July, nearly double that of the 4.93 million added in June, according to Dune Analytics data.

Uniswap saw 8.65 million new addresses created last month. Source: Dune Analytics

In an Aug. 9 post to X, Leon Waidmann noted that Base and Arbitrum touted 2.64 million and 1.37 million weekly active users, respectively.

Meanwhile, a total of 73 Ethereum layer-2 networks posted a cumulative 298 transactions per second of network activity on Aug. 12, just 34 TPS from the previous all-time high of 322 TPS reached on July 18, according to L2Beat data.

The total value locked across all Ethereum L2s now stands at $37.7 billion, while Ethereum touts $85 billion in TVL on its mainnet.

Dwindling outflows could be a bullish catalyst

Several analysts have looked to dwindling ETHE outflows as one of the primary bullish catalysts for the price of Ether in the coming months.

They suggested that ETH’s price could chart a similar course to Bitcoin (BTC $58,922) in the wake of its spot ETF approvals, which was also marred by heavy outflows from GBTC.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.