The New York Stock Exchange (NYSE) American LLC has proposed a rule change that will allow it to list and trade options for three Ether exchange-traded funds operated by crypto asset managers Grayscale and Bitwise.

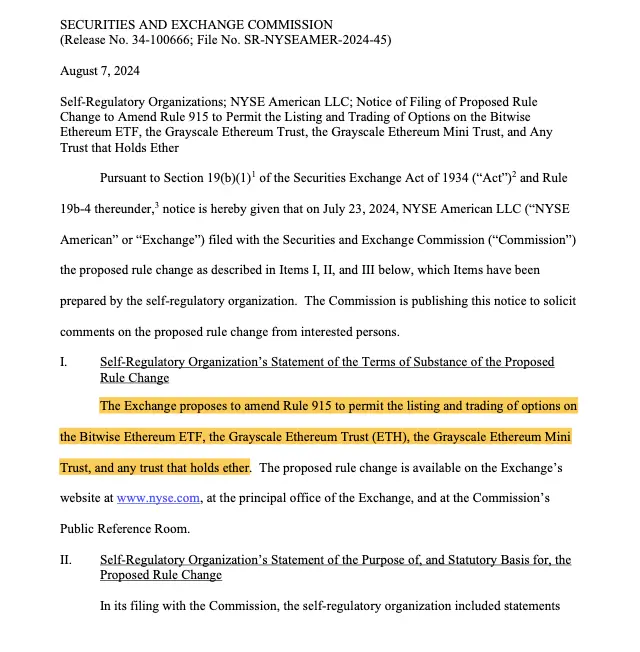

In an Aug. 7 filing to the Securities and Exchange Commission, the NYSE American asked the SEC to “permit the listing and trading of options” for the Bitwise Ethereum ETF (ETHW), the Grayscale Ethereum Trust (ETHE) and the Grayscale Ethereum Mini (ETH).

NYSE American has requested that options be listed for three ETH ETFs. Source: SEC

NYSE American said that allowing the trading of options on the three Ether (ETH $2,431) ETFs would benefit investors by providing a low-cost investment tool for gaining additional exposure to Ether.

Additionally, the filing said introducing options trading would offer investors a hedging mechanism to meet investment needs regarding ETH products and positions.

Comments on the proposal are expected to be submitted within the next 21 days.

Notably, NYSE American’s request for rule change would apply solely to Grayscale and Bitwise, the only spot Ether funds listed on its exchange.

NYSE American’s request comes just one day after the Nasdaq options exchange asked the SEC to allow options trading on the BlackRock iShares Ethereum Trust (ETHA).

Just like NYSE American’s proposed rule change, Nasdaq’s Aug. 6 request for ETH ETF options would apply exclusively to BlackRock’s fund, which is currently the only Ether ETF listed on the Nasdaq.

Stock exchanges shouldn’t hold their breath for ETH ETF options

Both NYSE American and Nasdaq may be waiting a while for the SEC to approve their request, as the regulator has still not yet authorized options trading on spot Bitcoin (BTC $57,261) ETFs, which launched in January and now command approximately $50 billion in assets under management.

In July, the SEC told the half dozen options exchanges — including Nasdaq — that had asked to list options on spot BTC ETFs that more time was needed to make a decision.

Options are widely used by hedge funds and financial planners alike to safeguard against sharp market movements — like the 28% drop in Ether’s spot price on Aug. 5.

They also form the basis of more exotic strategies, such as the “covered strangle” touted by 10x Research, an investment research firm.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Ethereum eyes a rally as on-chain data show bullish signs

Ethereum price retested its weekly support on Monday and, by Thursday, had risen by 4.50% to $2,454. Lookonchain data shows that Ethereum Spot ETFs saw inflows of 44,447 ETH, valued at $110.1 million, on Wednesday, while Santiment's data highlights increased activity in dormant wallets and recent capitulation events, indicating a potential upcoming rally.

Ethena launches USDe on Solana following app integrations across its ecosystem

Ethena (ENA) launched its dollar-denominated stablecoin USDe on the Solana network on Wednesday, allowing users to access it while transacting across applications in the SOL ecosystem. Meanwhile, ENA and SOL are down 6% and 1.3%, respectively, following the announcement.

Ripple traders shed XRP holdings at nearly $40 million losses, XRP holds steady above $0.50

Ripple made a comeback above key support at $0.50 after the recent correction in the crypto market. On-chain data shows traders losing interest in the altcoin after a massive sell-off event on August 5. Santiment data shows traders realized millions in losses.

Grayscale introduces decentralized AI token funds for TAO and SUI

Grayscale announced the launch of two new crypto investment funds for TAO and SUI tokens. Grayscale Bittensor Trust and Grayscale Sui Trust will focus solely on providing price exposure to TAO and SUI tokens. TAO and SUI could experience rallies following the launch of the new Trust funds.

Bitcoin: Can BTC rebound from the recent market challenge?

Bitcoin’s (BTC) price failed to close above $70,000 at the beginning of the week and dropped to $64,000 by Friday. Mt. Gox continues moving Bitcoin to exchanges for repayments to creditors while the Federal Open Market Committee (FOMC) decided to hold US interest rates steady.