Google battles ChatGPT with Bard: Will this trigger rally in AI tokens?

- Google has released a ChatGPT rival AI “Bard” to early testers, after announcing a partnership with AI startup Anthropic.

- The technology giant’s move could trigger a rally in Artificial Intelligence-focused tokens in crypto.

- AGIX, an AI native token of SingularityNET has capitalized on the AI rally and tallied massive gains since the beginning of 2023.

Google is getting its ChatGPT competitor ready for action, the company said that its AI service Bard would be open to trusted testers and the service is being prepared for release within the following weeks.

The giant’s move has fueled a rally in Artificial Intelligence AI-focused cryptocurrencies.

Also read: Binance suspends USD transfers, CZ says the issue is being resolved

Google gears up for ChatGPT’s competitors launch in few weeks

Alphabet Inc.’s Google is working on its ChatGPT competitor and getting ready to launch “Bard.” The company’s new conversational AI service would be open to trusted testers before a rollout in coming weeks.

Google’s AI service aims to generate detailed answers when given simple prompts. Sundar Pichai, CEO of Google said,

We’ll combine external feedback with our own internal testing to make sure Bard’s responses meet a high bar for quality, safety, and groundedness in real-world information. We’re excited for this phase of testing to help us continue to learn and improve Bard’s quality and speed.

The company is currently faced with tough challenges in its flagship search business that drives most of its revenue. Alphabet reported that sales missed expectations after the launch of AI rivals like OpenAI’s ChatGPT.

Google’s move fuels bullish narrative in AI-focused cryptocurrencies

AGIX, an AI native token of SingularityNET capitalized on the AI-driven price rally and tallied huge gains since the beginning of 2023. The token climbed 170% from $0.17 to $0.46 since January.

AGIX price chart

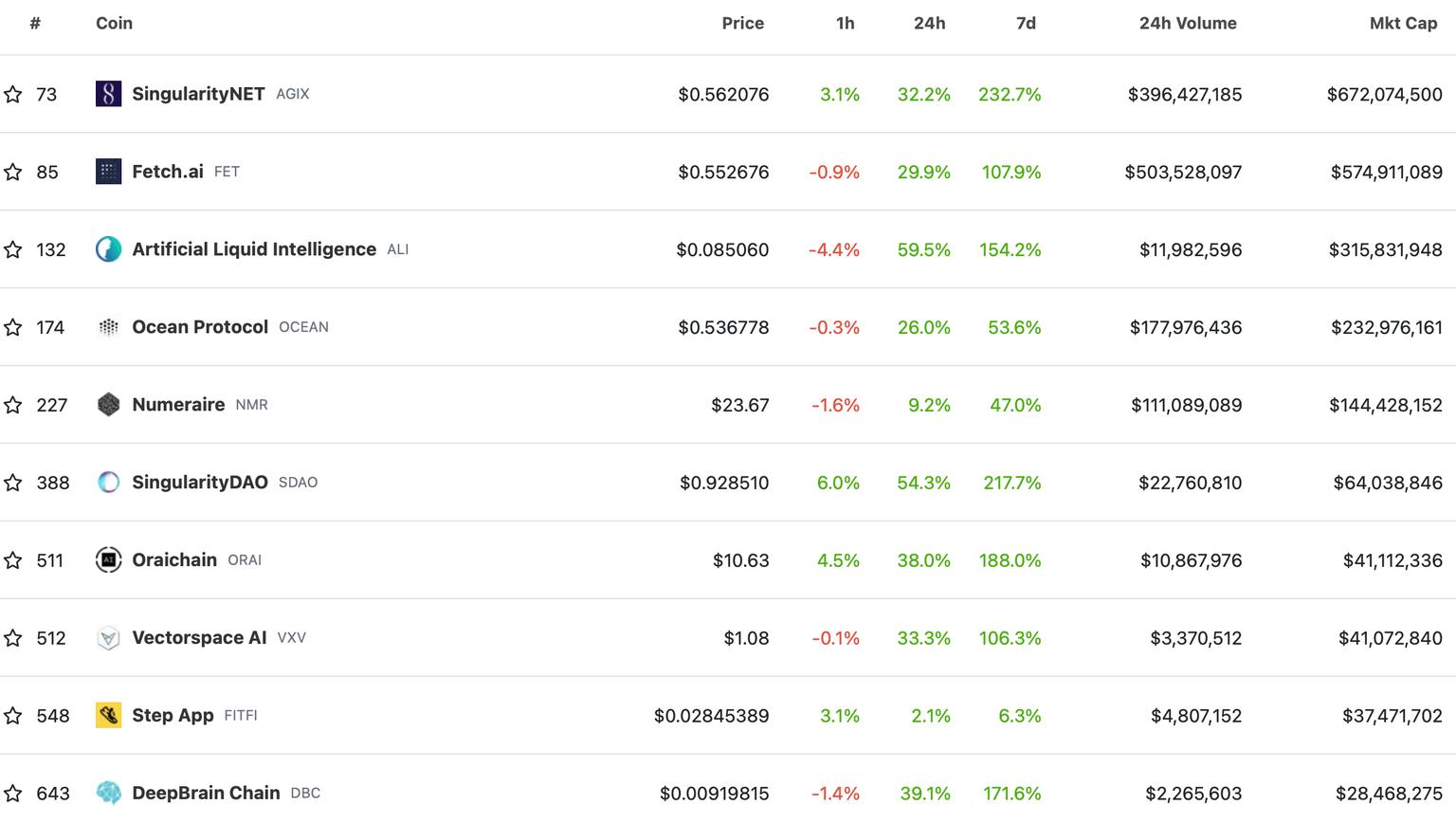

AGIX added nearly $500 million to its market capitalization since the beginning of 2023. Several other AI tokens have yielded double-digit gains overnight.

AI-based tokens

Fetch.ai’s FET, Artificial Liquid Intelligence’s ALI, Ocean Protocol OCEAN, SingularityDAO’s DAO have all yielded double-digit gains since February 6.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.