Goldman Sachs invests $420 million in Bitcoin ETFs, what’s next for Solana, XRP ETF prospects

- Goldman Sachs filed a 13F disclosure of nearly $420 million investment in seven Bitcoin ETFs on Tuesday.

- Bloomberg ETF analyst discussed Solana ETF and how approval depends on the upcoming US Presidential election.

- Expert weighs in on XRP ETF that Ripple can use to sell the token to institutions on the XRP Ledger.

- Solana trades at $145 and XRP holds steady above key support at $0.57 on Wednesday.

Goldman Sachs, the seventh largest bank in the US, filed a 13F disclosure with the Securities & Exchange Commission (SEC) on August 13, disclosing nearly $420 million invested in seven Bitcoin Exchange Traded Funds (ETF). At a time when crypto traders are looking for developments in the Solana and XRP ETFs, the news brings confidence in institutional capital inflow to crypto investment products.

Senior Bloomberg ETF analyst Eric Balchunas recently commented on the future of Solana ETFs, and crypto expert Matt Rosendin weighed in on XRP ETF.

Solana and XRP trade at key support levels at the time of writing.

Goldman Sachs discloses nearly $420 million in seven Bitcoin ETFs

After the market close on Tuesday, Goldman Sachs disclosed nearly $420 million investment in seven Bitcoin ETFs. According to the SEC filing, the bank holds:

- $238.6 million iShares Bitcoin Trust (6,991,248 shares)

- $79.5 million Fidelity Bitcoin ETF (1,516,302 shares)

- $35.1 million Grayscale BTC (660,183 shares)

- $56.1 million Invesco Galaxy Bitcoin (940,443 shares)

- $8.3 million Bitwise Bitcoin ETF (253,961 shares)

- $749,469 WisdomTree Bitcoin (11,773 shares)

- $299,900 ARK 21Shares Bitcoin ETF (5,000 shares)

The bank’s position reflects a trend within institutions where the skepticism surrounding crypto investments has given way to acceptance among traditional firms.

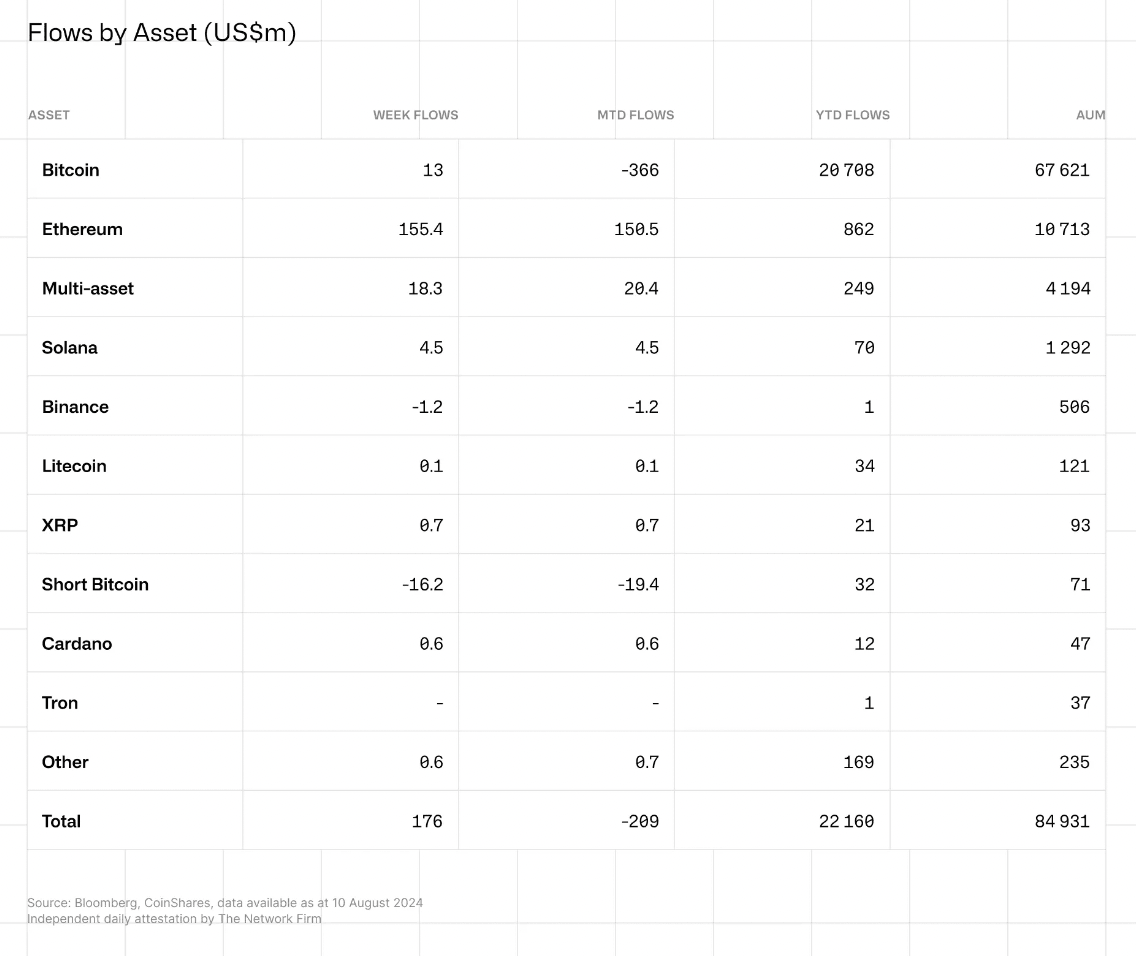

Data from CoinShares shows that Solana and XRP fund flows attracted $4.5 million and $0.7 million in institutional investment the week of August 12, respectively. The year-to-date flows to Solana and XRP are $70 million and $21 million, respectively.

CoinShares fund flows

Experts weigh in on the prospects of Solana and XRP ETFs

Nate Geraci, Senior ETF analyst at Bloomberg, says approval of the ETF (referring to Solana ETF) depends on the outcome of the US Presidential election. Geraci commented on the thoughts of leading ETF attorney Jeremy Senderowicz on X.

Very interesting comments from leading ETF attorney Jeremy Senderowicz...

— Nate Geraci (@NateGeraci) August 13, 2024

Says approval of ETF share class structure could hinge on upcoming election (something obviously discussed re: solana ETF, etc as well).

via @KathieOD_PI pic.twitter.com/b1wWRHP674

Matt Rosendin, founder of CapSign, says the solution of an XRP ETF is the payment remittance firm Ripple selling XRP tokens Over-The-Counter to institutional investors on the XRPLedger.

The solution, in my estimation, is an XRP ETF that Ripple can sell OTC with institutions on the XRPL. This requires Ripple to have an ATS license to conduct those secondary sales.

— Matt Rosendin (@MattRosendin) August 8, 2024

Brazil’s Securities and Exchange Commission (CVM) recently approved a Spot Solana ETF, fueling expectations of traders for a similar investment product in the US and UK.

Solana trades at $145, and XRP trades at $0.5768 at the time of writing.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.