- Gemini’s Cameron Winklevoss addressed the DCG and Genesis issues in an open letter.

- In the three-page letter, the American investor offered a “final deal” to concerned parties.

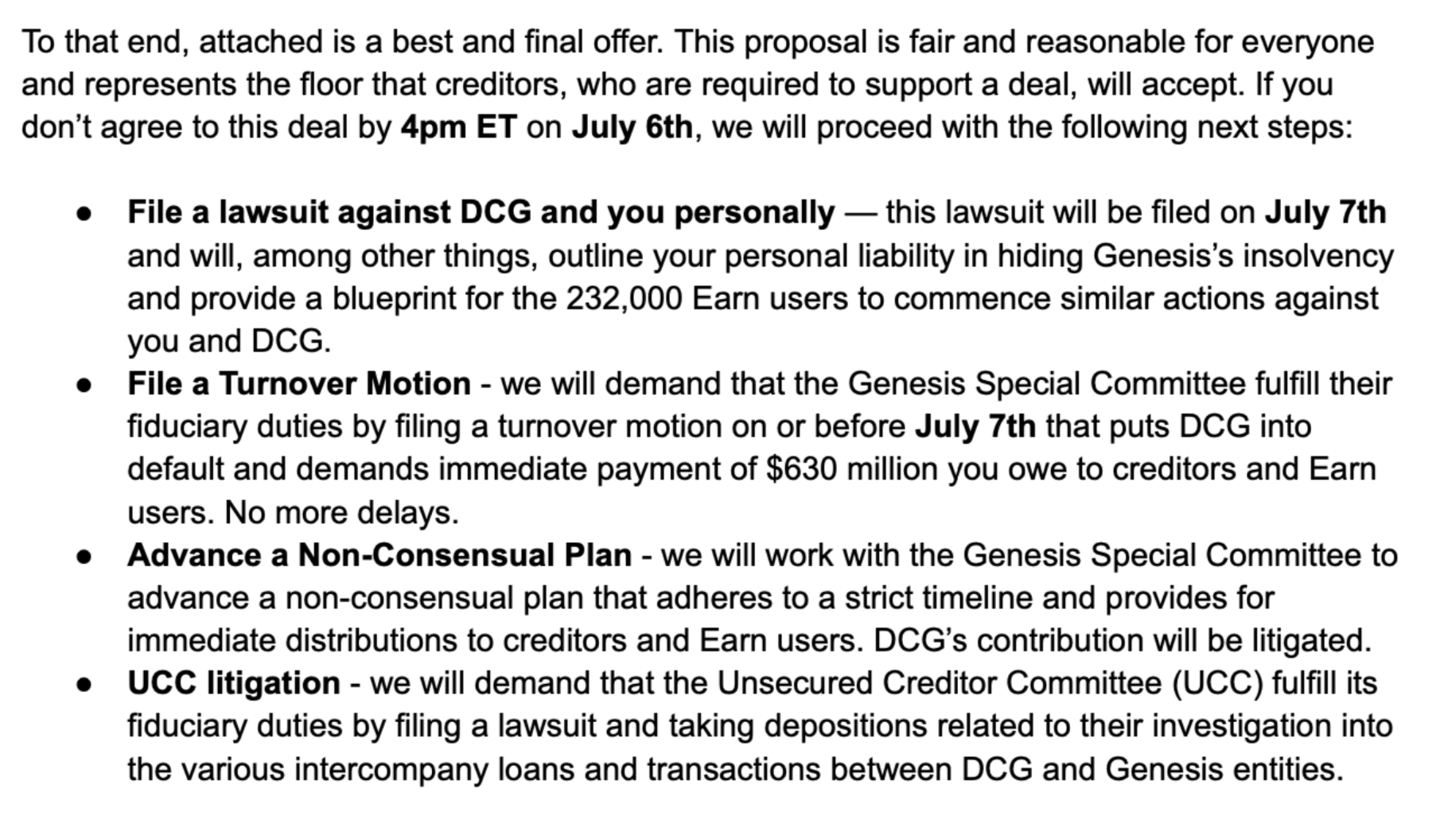

- A failure to accept the deal could lead to a lawsuit not just for DCG but also for its founder, Barry Silbert.

Cameron Winklevoss, the co-founder of the Gemini crypto exchange, tweeted, “An Open Letter to Barry Silbert.” The three-page letter addresses the delays caused by Digital Currency Group (DCG) and the now-bankrupt Genesis in finalizing the repayment for the affected individuals.

Earn Update: An Open Letter to @BarrySilbert pic.twitter.com/ErsYpcEjQD

— Cameron Winklevoss (@cameron) July 4, 2023

Also read: Will Bitcoin price face negative effects from Federal Reserve’s two rate hikes?

Winklevoss’ frustration and context

The collapse of Three Arrows Capital, followed by Sam Bankman-Fried’s FTX exchange, caused a huge blow to major institutions involved in the crypto industry. Digital Currency Group-owned lending platform Genesis was one such affected company.

Unable to honor withdrawals, Genesis halted withdrawals on November 16, 2022. On January 19, the institution filed for Chapter 11 bankruptcy protection.

Since then, there has been no plan of action from DCG to repay the affected Earn users, aka Genesis customers.

Barry Silbert faces the Final Offer

After Barry Silbert failed to respond to Cameron Winklevoss' initial open letter, the second one was much more direct. Winklevoss addresses how Barry Silbert has “engaged in fraudulent behavior” and that the founder’s previous letter addressing the board was a “Master Class in lack of self-awareness.”

He goes on to “break down” the game for Silbert and proposes a repayment structure to Earn users. The proposed package offers forbearance payments and loans denominated in US Dollars, Bitcoin and Ethereum. As seen in the image below, failing to comply, says Cameron Winklevoss, will lead to a lawsuit against DCG and Barry Silbert among other things.

Cameron Winklevoss’ Open Letter

Related Stories

Gemini files motion to dismiss SEC lawsuit as Genesis bankruptcy drags on

Genesis creditors won’t get full value of their claims, bankrupt crypto lender files updated plan

DCG to close down its institutional trading arm amidst a harsh crypto market

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Litecoin Price Prediction: LTC tries to retake $100 resistance as miners halt sell-off

Litecoin price grazed 105 mark on Monday, rebounding 22% from the one-month low of $87 recorded during last week’s market crash. On-chain data shows sell pressure among LTC miners has subsided. Is the bottom in?

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin price struggles around $95,000 after erasing gains from Friday’s relief rally over the weekend. Bitcoin’s weekly price chart posts the first major decline since President-elect Donald Trump’s win in November.

SEC Commissioner Hester Pierce sheds light on Ethereum ETF staking under new administration

In a Friday interview with Coinage, SEC Commissioner Hester Peirce discussed her optimism about upcoming regulatory changes as the agency transitions to new leadership under President Trump’s pick for new Chair, Paul Atkins.

Bitcoin dives 3% from its recent all-time high, is this the cycle top?

Bitcoin investors panicked after the Fed's hawkish rate cut decision, hitting the market with high selling pressure. Bitcoin's four-year market cycle pattern indicates that the recent correction could be temporary.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.