GBTC hits lowest-ever $22M outflow, raising hopes for end to Bitcoin bleed

Grayscale’s spot Bitcoin (BTC $56,367) exchange-traded fund (ETF) has seen its third consecutive trading day of slowing net outflows, hitting a record low of $22.4 million as ETFs combined hit a two-week net inflow high.

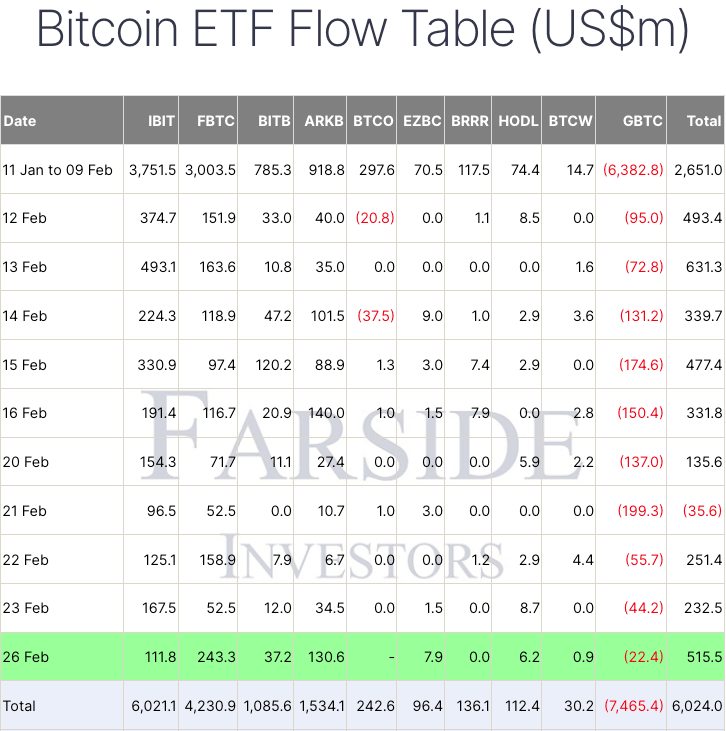

Farside Investor data for Feb. 26 shows the Grayscale Bitcoin Trust (GBTC) had three back-to-back days of slowing net outflows on Feb. 22, 23 and 26. It ended the trading week on Friday with a daily net outflow of $44.2 million, and outflows further halved on Feb. 26.

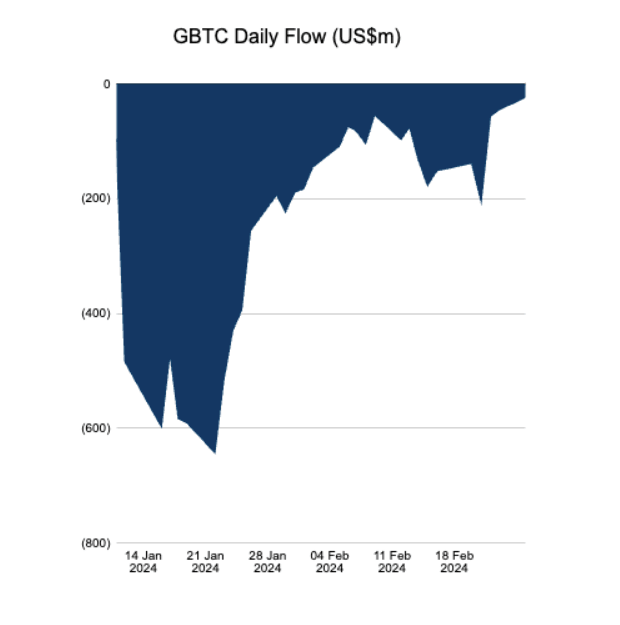

Daily net GBTC outflows since Jan. 11 peaked on Jan. 22 at $640.5 million. Source: Farside Investors

However, Grayscale has also marked 31 straight trading days of outflows since it converted to an ETF on Jan. 11, with $7.47 billion in total drained from the ETF.

Bitcoin technology firm Blockstream CEO Adam Back posted to X on Feb. 26 that he’s “waiting for the day GBTC flashes an inflow.”

Back added it “could happen” but would need “just enough premium” to incentivize traders to arbitrage the ETF.

Henrik Andersson, chief investment officer at asset manager Apollo Crypto, concurred in a separate X post, writing that the first time Grayscale’s fund posts a net inflow, it “will be a mega signal to the market.”

Meanwhile, Farside’s data for Feb. 26 shows the combined net inflows of all Bitcoin ETFs besides Invesco and Galaxy’s hit $515.5 million — the highest in two weeks.

The ETFs hit a combined net inflow of $631.3 million on Feb. 13 but have struggled to maintain the momentum since, even seeing a net outflow of $35.6 million on Feb. 21 due to a comparatively larger outflow day from GBTC and smaller inflows to other funds.

The ETFs have seen over $6 billion in net inflows since launching on Jan. 11. Source: Farside Investors

Fidelity’s ETF saw the bulk of the inflows on Feb. 26 at over $243 million, accounting for nearly half of the day’s net total. It is also FBTC’s second-highest inflow day ever behind Jan. 17.

The other half of the net inflow came from BlackRock’s ETF along with ARK Invest and 21Shares fund, which had respective inflows of nearly $112 million and over $130.5 million.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.