Gaming tokens are likely to recover with Hong Kong’s web3 plans

- A Hong Kong legislator told the media that gaming tokens do not need to be regulated.

- As long as games do not involve securities or futures, Hong Kong is open to web3 development, the legislator said.

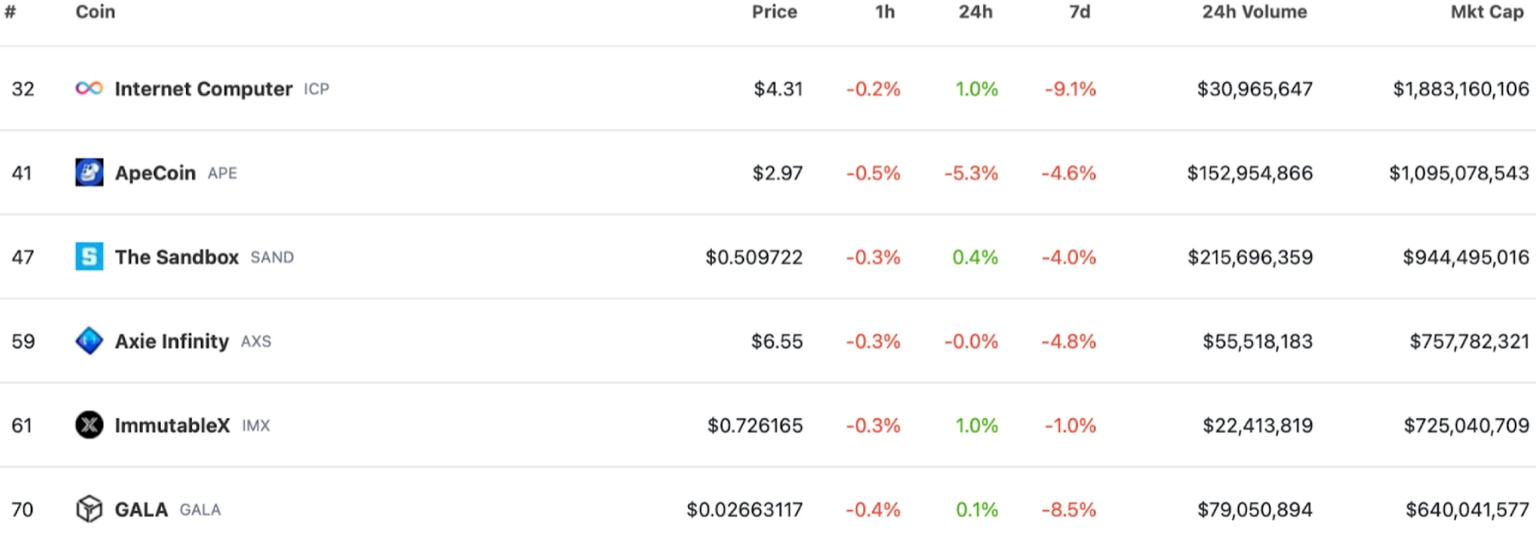

- Gaming tokens Internet Computer, ApeCoin, The Sandbox, Immutable X and Gala started their recovery on Wednesday.

Prices of some gaming tokens are on the rise on Wednesday after a Hong Kong lawmaker with links with the web3 ecosystem said these assets are not likely to face regulation in the city as long as they do not involve the trading of securities or futures.

Gaming tokens begin recovery amidst crypto market crackdown by US regulators

The US Securities & Exchange Commission’s (SEC) crackdown on cryptocurrencies resulted in a bloodbath. Bitcoin, Ethereum and other altcoins are recovering from the crackdown, while Hong Kong’s stance on cryptocurrencies promotes the development of the crypto ecosystem.

Colin Wu, a Chinese reporter, informed his 290K followers in a recent tweet that a Hong Kong legislator told the media that apart from exchanges and virtual asset management, gaming tokens may not need to be regulated.

A Hong Kong legislator told the media that apart from exchanges and virtual asset management, Hong Kong has not stated that it needs to be regulated; for example, game tokens, as long as they do not involve securities and futures, will not be regulated, and Hong Kong is… pic.twitter.com/WxpsBEZZrZ

— Wu Blockchain (@WuBlockchain) June 7, 2023

As long as web3 development does not involve securities and futures, Hong Kong is relatively open to such protocols and projects, according to the reporter.

The contrasting stance of US regulators and Hong Kong’s legislator signals a likely shift in development from the US to China in the long term.

Internet Computer, ApeCoin, The Sandbox, Immutable X and Gala begin recovery

Internet Computer (ICP), ApeCoin (APE), The Sandbox (SAND), Immutable X (IMX) and Gala (GALA) began their recovery on Wednesday.

The gaming tokens ICP, SAND, IMX and GALA wiped out losses from the past 24 hours. As Hong Kong’s stance on gaming and web3 tokens unravels, it could fuel further recovery in these gaming tokens in the short term.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.